Focus On Jobs, Skilling, MSMEs, Middle Class

Nine Budget Priorities in pursuit of ‘Viksit Bharat’; Fiscal deficit: 4.9 per cent of GDP; Total expenditure: Rs48.21 lakh crore; Net tax receipt: Rs25.83 lakh crore

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Ministry of Finance in North Block to Rashtrapati Bhavan and Parliament House, along with the Ministers of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance to present the first Union Budget 2024-25 of Modi 3.0, in New Delhi on July 23, 2024.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Ministry of Finance in North Block to Rashtrapati Bhavan and Parliament House, along with the Ministers of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance to present the first Union Budget 2024-25 of Modi 3.0, in New Delhi on July 23, 2024.

FinTech BizNews Service

Mumbai, July 23, 2024: The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2024-25 in Parliament today. The highlights of the budget are as follows:

HIGHLIGHTS OF THE UNION BUDGET 2024-25

Part-A

Budget Estimates 2024-25:

-

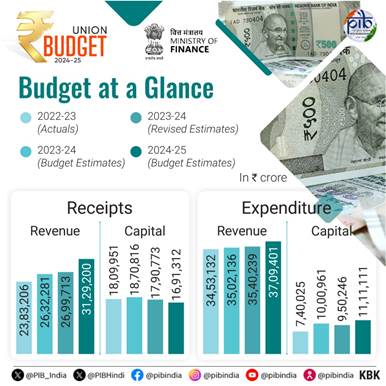

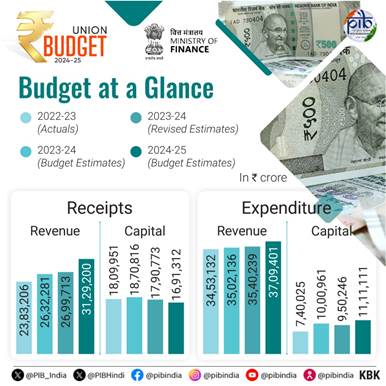

- Total receipts other than borrowings: Rs32.07 lakh crore.

- Total expenditure: Rs48.21 lakh crore.

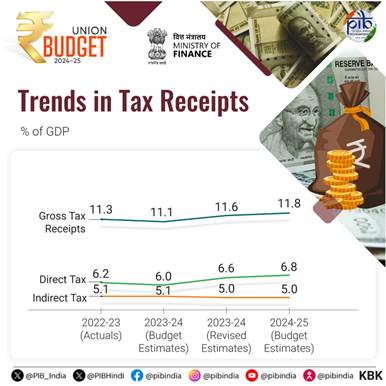

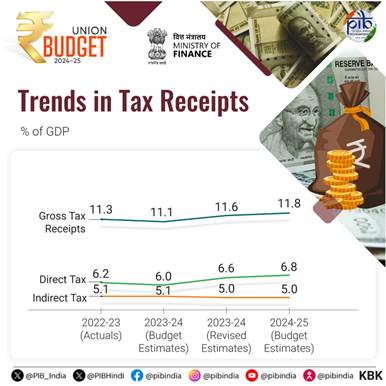

- Net tax receipt: Rs25.83 lakh crore.

- Fiscal deficit: 4.9 per cent of GDP.

- Government aims to reach a deficit below 4.5 per cent next year.

- Inflation continues to be low, stable and moving towards the 4% target; Core inflation (non-food, non-fuel) at 3.1%.

- The focus of budget is on EMPLOYMENT, SKILLING, MSMEs, and the MIDDLE CLASS.

Package of PM’s five schemes for Employment and Skilling

- Prime Minister’s Package of 5 Schemes and Initiatives for employment, skilling and other opportunities for 4.1 crore youth over a 5-year period.

- Scheme A - First Timers: One-month salary of up to Rs15,000 to be provided in 3 installments to first-time employees, as registered in the EPFO.

- Scheme B - Job Creation in manufacturing: Incentive to be provided at specified scale directly, both employee and employer, with respect to their EPFO contribution in the first 4 years of employment.

- Scheme C - Support to employers: Government to reimburse up to Rs3,000 per month for 2 years towards EPFO contribution of employers, for each additional employee.

- New centrally sponsored scheme for Skilling

- 20 lakh youth to be skilled over a 5-year period.

- 1,000 Industrial Training Institutes to be upgraded in hub and spoke arrangements.

- New Scheme for Internship in 500 Top Companies to 1 crore youth in 5 years

Nine Budget Priorities in pursuit of ‘Viksit Bharat’:

- Productivity and resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development and

- Next Generation Reforms

Priority 1: Productivity and resilience in Agriculture

- Allocation of Rs1.52 lakh crore for agriculture and allied sectors.

- New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops to be released for cultivation by farmers.

- 1 crore farmers across the country to be initiated into natural farming, with certification and branding in next 2 years.

- 10,000 need-based bio-input resource centres to be established for natural farming.

- Digital Public Infrastructure (DPI) for Agriculture to be implemented for coverage of farmers and their lands in 3 years.

Priority 2: Employment & Skilling

- As part of the Prime Minister’s package, 3 schemes for ‘Employment Linked Incentive’ to be implemented - Scheme A - First Timers; Scheme B - Job Creation in manufacturing; Scheme C - Support to employers.

- To facilitate higher participation of women in the workforce,

- working women hostels and crèches to be established with industrial collaboration

- women-specific skilling programmes to be organized

- market access for women SHG enterprises to be promoted

Skill Development

- New centrally sponsored scheme for Skilling under Prime Minister’s Package for 20 lakh youth over a 5-year period.

- Model Skill Loan Scheme to be revised to facilitate loans up to

Rs7.5 lakh. - Financial support for loans upto Rs10 lakh for higher education in domestic institutions to be provided to youth who have not been eligible for any benefit under government schemes and policies.

Priority 3: Inclusive Human Resource Development and Social Justice

Purvodaya

- Industrial node at Gaya to be developed along the Amritsar-Kolkata Industrial Corridor.

- Power projects, including new 2400 MW power plant at Pirpainti, to be taken up at a cost of Rs21,400 crore.

Andhra Pradesh Reorganization Act

-

- Special financial support through multilateral development agencies of Rs15,000 crore in the current financial year.

- Industrial node at Kopparthy along Vishakhapatnam-Chennai Industrial Corridor and at Orvakal along Hyderabad-Bengaluru Industrial Corridor.

Women-led development

- Total allocation of more than Rs3 lakh crore for schemes benefitting women and girls.

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

- Socio-economic development of tribal families in tribal-majority villages and aspirational districts, covering 63,000 villages benefitting 5 crore tribal people.

Bank branches in North-Eastern Region

- 100 branches of India Post Payment Bank to be set up in the North East region.

Priority 4: Manufacturing & Services

Credit Guarantee Scheme for MSMEs in the Manufacturing Sector

- A credit guarantee scheme without collateral or third-party guarantee in term loans to MSMEs for purchase of machinery and equipment.

Credit Support to MSMEs during Stress Period

- New mechanism to facilitate continuation of bank credit to MSMEs during their stress period.

Mudra Loans

- The limit of Mudra loans under ‘Tarun’ category to be enhanced to Rs20 lakh from Rs10 lakh for those who have successfully repaid previous loans.

Enhanced scope for mandatory onboarding in TReDS

- Turnover threshold of buyers for mandatory onboarding on the TReDS platform to be reduced from Rs500 crore to Rs250 crore..

MSME Units for Food Irradiation, Quality & Safety Testing

- Financial support to set up 50 multi-product food irradiation units in the MSME sector .

E-Commerce Export Hubs

- E-Commerce Export Hubs to be set up under public-private-partnership (PPP) mode for MSMEs and traditional artisans to sell their products in international markets.

Critical Mineral Mission

- Critical Mineral Mission to be set up for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets.

Offshore mining of minerals

- Auction of the first tranche of offshore blocks for mining, building on the exploration already carried out.

Digital Public Infrastructure (DPI) Applications

- Development of DPI applications in the areas of credit, e-commerce, education, health, law and justice, logistics, MSME, services delivery, and urban governance.

Priority 5: Urban Development

Transit Oriented Development

- Formulation of Transit Oriented Development plans and strategies to implement and finance 14 large cities above 30 lakh population.

Urban Housing

- Investment of Rs10 lakh crore, including the central assistance of Rs2.2 lakh crore in next 5 years, under PM Awas Yojana Urban 2.0 proposed to address the , housing needs of 1 crore urban poor and middle-class families.

Street Markets

- New scheme to support the development of 100 weekly ‘haats’ or street food hubs every year for the next 5 years in select cities.

Priority 6: Energy Security

Energy Transition

- Policy document on ‘Energy Transition Pathways’ to balance the imperatives of employment, growth and environmental sustainability to be brought out.

Pumped Storage Policy

- Policy for promoting pumped storage projects for electricity storage to be brought out.

Research and development of small and modular nuclear reactors

- Government to partner with private sector for R&D of Bharat Small Modular Reactor and newer technologies for nuclear energy, and to set up Bharat Small Reactors.

Advanced Ultra Super Critical Thermal Power Plants

- Joint venture proposed between NTPC and BHEL to set up a full scale 800 MW commercial plant using Advanced Ultra Super Critical (AUSC) technology.

Roadmap for ‘hard to abate’ industries

- Appropriate regulations for transition of ‘hard to abate’ industries from the current ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode to be put in place.

Priority 7: Infrastructure

Infrastructure investment by Central Government

- Rs11,11,111 crore (3.4 % of GDP) to be provided for capital expenditure.

Infrastructure investment by state governments

- Provision of Rs1.5 lakh crore for long-term interest free loans to support states in infrastructure investment.

Pradhan Mantri Gram SadakYojana (PMGSY)

- Launch of phase IV of PMGSY to provide all-weather connectivity to 25,000 rural habitations.

Irrigation and Flood Mitigation

- Financial support of Rs11,500 crore to projects such as the Kosi-Mechi intra-state link and other schemes in Bihar.

- Government to provide assistance to Assam, Himachal Pradesh, Uttarakhand and Sikkim for floods, landslides and other related projects.

Tourism

- Comprehensive development of Vishnupad Temple Corridor, Mahabodhi Temple Corridor and Rajgir.

- Assistance for development of temples, monuments, craftsmanship, wildlife sanctuaries, natural landscapes and pristine beaches of Odisha.

Priority 8: Innovation, Research & Development

- Anusandhan National Research Fund for basic research and prototype development to be operationalised.

- Financing pool of Rs1 lakh crore for spurring private sector-driven research and innovation at commercial scale.

Space Economy

- Venture capital fund of Rs1,000 crore to be set up for expanding the space economy by 5 times in the next 10 years.

Priority 9: Next Generation Reforms

Rural Land Related Actions

- Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands

- Digitization of cadastral maps

- Survey of map sub-divisions as per current ownership

- Establishment of land registry

- Linking to the farmers registry

Urban Land Related Actions

- Land records in urban areas to be digitized with GIS mapping.

Services to Labour

- Integration of e-shram portal with other portals to facilitate such one-stop solution.

- Open architecture databases for the rapidly changing labour market, skill requirements and available job roles.

- Mechanism to connect job-aspirants with potential employers and skill providers.

NPS Vatsalya

- NPS-Vatsalya as a plan for contribution by parents and guardians for minors.

PART B

Indirect Taxes

GST

- Buoyed by GST’s success, tax structure to be simplified and rationalised to expand GST to remaining sectors.

Sector specific customs duty proposals

Medicines and Medical Equipment

- Three cancer drugs namely TrastuzumabDeruxtecan, Osimertinib and Durvalumab fully exempted from custom duty.

- Changes in Basic Customs Duty (BCD) on x-ray tubes & flat panel detectors for use in medical x-ray machines under the Phased Manufacturing Programme.

Mobile Phone and Related Parts

- BCD on mobile phone, mobile Printed Circuit Board Assembly (PCBA) and mobile charger reduced to 15 per cent.

Precious Metals

- Customs duties on gold and silver reduced to 6 per cent and that on platinum to 6.4 per cent.

Other Metals

- BCD removed on ferro nickel and blister copper.

- BCD removed on ferrous scrap and nickel cathode.

- Concessional BCD of 2.5 per cent on copper scrap.

Electronics

- BCD removed, subject to conditions, on oxygen free copper for manufacture of resistors.

Chemicals and Petrochemicals

- BCD on ammonium nitrate increased from 7.5 to 10 per cent.

Plastics

- BCD on PVC flex banners increased from 10 to 25 per cent.

Telecommunication Equipment

- BCD increased from 10 to 15 per cent on PCBA of specified telecom equipment.

Trade facilitation

- For promotion of domestic aviation and boat & ship MRO, time period for export of goods imported for repairs extended from six months to one year.

- Time-limit for re-import of goods for repairs under warranty extended from three to five years.

Critical Minerals

- 25 critical minerals fully exempted from customs duties.

- BCD on two critical minerals reduced.

Solar Energy

- Capital goods for use in manufacture of solar cells and panels exempted from customs duty.

Marine products

- BCD on certain broodstock, polychaete worms, shrimp and fish feed reduced to 5 per cent.

- Various inputs for manufacture of shrimp and fish feed exempted from customs duty.

Leather and Textile

- BCD reduced on real down filling material from duck or goose.

- BCD reduced, subject to conditions, on methylene diphenyl diisocyanate (MDI) for manufacture of spandex yarn from 7.5 to 5 per cent.

Direct Taxes

- Efforts to simplify taxes, improve tax payer services, provide tax certainty and reduce litigation to be continued.

- Enhance revenues for funding development and welfare schemes of government.

- 58 per cent of corporate tax from simplified tax regime in FY23, more than two-thirds taxpayers availed simplified tax regime for personal income tax in FY 24.

Simplification for Charities and of TDS

- Two tax exemption regimes for charities to be merged into one.

- 5 per cent TDS rate on many payments merged into 2 per cent TDS rate.

- 20 per cent TDS rate on repurchase of units by mutual funds or UTI withdrawn.

- TDS rate on e-commerce operators reduced from one to 0.1 per cent.

- Delay for payment of TDS up to due date of filing statement decriminalized.

Simplification of Reassessment

- Assessment can be reopened beyond three years upto five years from the end of Assessment Year only if the escaped income is ₹ 50 lakh or more.

- In search cases, time limit reduced from ten to six years before the year of search.

Simplification and Rationalisation of Capital Gains

- Short term gains on certain financial assets to attract a tax rate of 20 per cent.

- Long term gains on all financial and non-financial assets to attract a tax rate of 12.5 per cent.

- Exemption limit of capital gains on certain financial assets increased to ₹ 1.25 lakh per year.

Tax Payer Services

- All remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders to be digitalized over the next two years.

Litigation and Appeals

- ‘Vivad Se Vishwas Scheme, 2024’ for resolution of income tax disputes pending in appeal.

- Monetary limits for filing direct taxes, excise and service tax related appeals in Tax Tribunals, High Courts and Supreme Court increased to ₹60 lakh, ₹2 crore and ₹5 crore respectively.

- Safe harbour rules expanded to reduce litigation and provide certainty in international taxation.

Employment and Investment

- Angel tax for all classes of investors abolished to bolster start-up eco-system,.

- Simpler tax regime for foreign shipping companies operating domestic cruises to promote cruise tourism in India.

- Safe harbour rates for foreign mining companies selling raw diamonds in the country.

- Corporate tax rate on foreign companies reduced from 40 to 35 per cent.

Deepening tax base

- Security Transactions Tax on futures and options of securities increased to 0.02 per cent and 0.1 per cent respectively.

- Income received on buy back of shares in the hands of recipient to be taxed.

Social Security Benefits.

- Deduction of expenditure by employers towards NPS to be increased from 10 to 14 per cent of the employee’s salary.

- Non-reporting of small movable foreign assets up to ₹20 lakh de-penalised.

Other major proposal in Finance Bill

- Equalization levy of 2 per cent withdrawn.

Changes in Personal Income Tax under new tax regime

- Standard deduction for salaried employees increased from ₹50,000 to ₹75,000.

- Deduction on family pension for pensioners enhanced from ₹15,000/- to ₹25,000/-

- Revised tax rate structure:

0-3 lakh rupees | Nil |

3-7 lakh rupees | 5 per cent |

7-10 lakh rupees | 10 per cent |

10-12 lakh rupees | 15 per cent |

12-15 lakh rupees | 20 per cent |

Above 15 lakh rupees | 30 per cent |

- Salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.