The share of advances-related frauds, both in terms of number and amount, increased across all bank groups

FinTech BizNews Service

Mumbai, 29 December 2025: Today, in compliance with Section 36 (2) of the Banking Regulation Act, 1949, the Reserve Bank of India released the Report on Trend and Progress of Banking in India 2024-25. This Report presents the performance of the banking sector, including commercial banks, co-operative banks and non-banking financial institutions, during 2024-25 and 2025-26 so far.

Frauds in the Banking Sector

Frauds present multiple challenges by exposing financial institutions to reputational, operational and business risks, while also weakening customer trust.

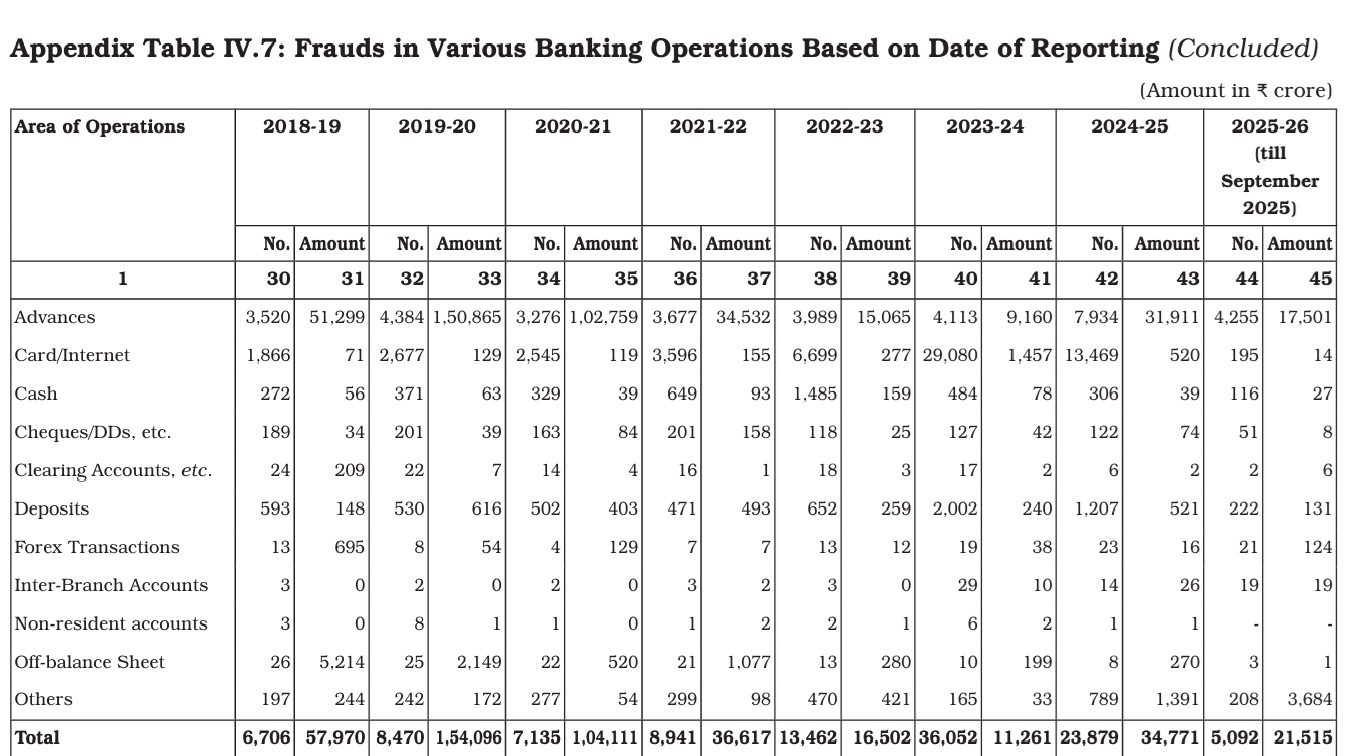

The banking system frauds in the first half of the current FY (2025-26) amounted to Rs21,515, recording y/y increase of 30%. The number of banking frauds drastically came down to 5092 from 18,386 a year ago.

During 2024-25, based on date of reporting by banks, the total number of frauds decreased. However, the amount involved in frauds increased. This was mainly due to re-examination and reporting afresh of 122 fraud cases amounting to Rs18,336 crore after ensuring compliance with the judgement of the Hon’ble Supreme Court of India dated March 27, 2023.

Based on the date of occurrence of frauds, during 2024-25, the share of card / internet frauds in the total stood at 66.8 per cent in terms of number of cases. In terms of amount, the share of advances-related frauds was 33.1 per cent.

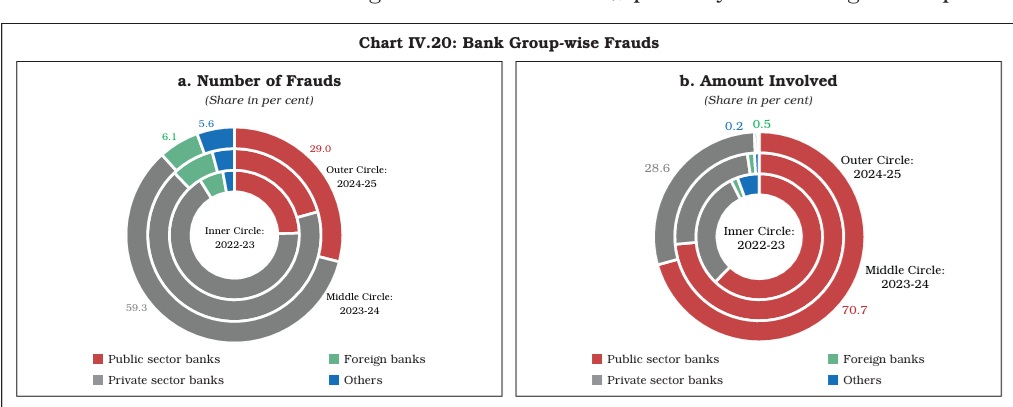

In 2024-25, PVBs accounted for 59.3 per cent of the total number of frauds reported, while PSBs accounted for 70.7 per cent of the amount involved. Within PVBs, card/internet-related frauds accounted for the largest share by number, while frauds related to advances constituted the largest share by value in 2024-25. In contrast, PSBs reported the highest share of frauds related to advances, both in terms of number of cases and the amount involved. The share of card/internet frauds declined across all bank groups in both number and amount involved during 2024–25. The share of advances-related frauds, both in terms of number and amount, increased across all bank groups (except for PSBs in terms of amount), primarily due to a significant portion of reclassified frauds being associated with advances.

Amounts involved are as reported and do not reflect the amount of loss incurred. Depending on recoveries, the loss incurred gets reduced. Further, the entire amount involved in loan accounts is not necessarily diverted.

Frauds As on September 30, 2025

As on September 30, 2025, 942 frauds amounting to Rs1,28,031 crore were withdrawn by banks and financial institutions due to non-compliance with the principles of natural justice as per the judgment of the Hon’ble Supreme Court of India dated March 27, 2023.

Data pertaining to 2024-25 includes fraud classification in 122 cases amounting to Rs18,336 crore, pertaining to previous financial years, reported afresh during the financial year 2024-25 after re-examination and ensuring compliance with the judgement of the Hon’ble Supreme Court of India, dated March 27, 2023.