Net Savings Expected To Hit Rs22 Tn In FY25; Currency in circulation expanded steadily in FY25 with banknotes in circulation rising by 6% in value and 5.6% in volume

FinTech BizNews Service

Mumbai, May 29, 2025: The latest RBI Annual Report indicates that household sector showed strong financial resilience, with net savings rising to 5.1% of GNDI in FY24 and expected to hit Rs22 lakh crore (6.5% of GDP) in FY25. This growing capital pool remains crucial for funding government and corporate deficits and supporting macroeconomic stability, according to a special research report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

RBI’s balance sheet expanded by 8.19% in FY25 less than nominal GDP growth of 9.9%. Despite contractions in traditional income streams such as domestic interest and LAF earnings, strategic management of foreign exchange operations and efforts to mitigate rupee volatility materially enhanced surplus generation. A Rs44,861.7 crore provision to the Contingency Fund kept Realized Equity healthy at 7.5% of the balance sheet, enabling record Rs2.69 lakh crore surplus transfers to the government and enhancing the fiscal space. Further, total gold holdings was 879.58 metric tonnes, reflecting an increase of 57.48 metric tonnes of gold during FY25. The share of gold in NFA increased to 12.0 per cent as at end-March 2025 from 8.3 per cent as at end-March 2024 due appreciation in gold prices.

Currency in circulation expanded steadily in FY25 with banknotes in circulation rising by 6% in value and 5.6% in volume.

Rs500 notes dominated both value and volume. Withdrawal of Rs2000 notes progressed well, reclaiming 98.2% of circulation.

Increased issuance of durable Rs10 coins alongside reduced Rs10 notes marks a cost-effective currency shift.

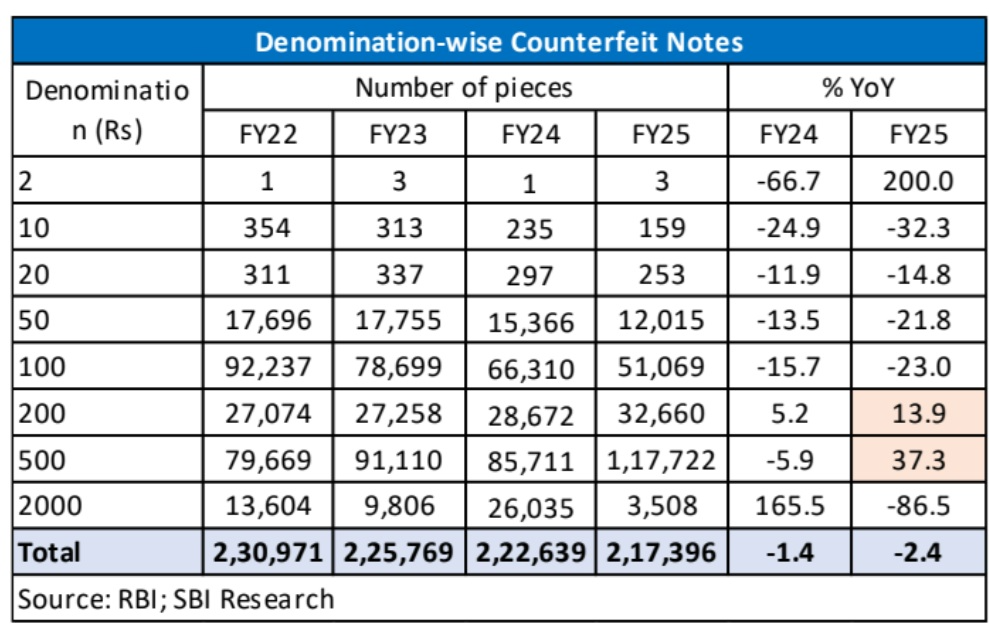

Counterfeit note detections fell overall by 2.4% to 2.17 lakh pieces but rose for Rs200 and Rs500 denominations, necessitating ongoing advancements in anti-counterfeiting technologies and enforcement mechanisms.

In the digital domain, the RBI’s retail digital currency (eRs-R) pilot encompassing 17 banks and 60 million users witnessed the value of eRs in circulation soaring by an impressive 334% in FY25. The introduction of offline functionality and programmable features, coupled with the inclusion of non-bank wallet providers, augments financial inclusion and signals a transformative evolution in India’s payments ecosystem.

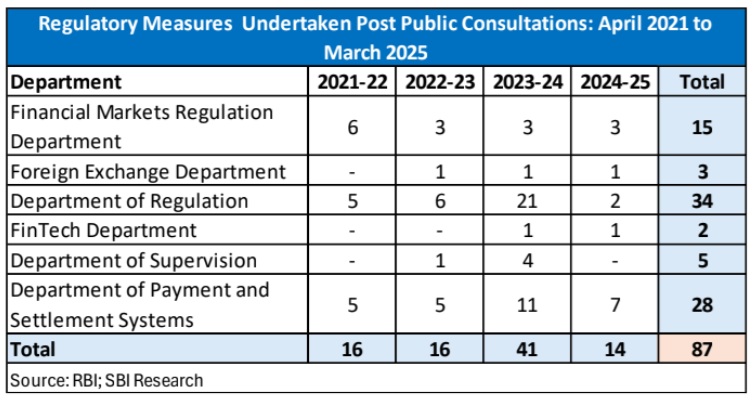

The RBI’s regulatory framework continues to evolve through a consultative process, exemplified by 87 public consultations over the past four years. Customer-centric reforms have been vigorously pursued, with 173 measures implemented over the past four years, including 43 in FY25 alone. These initiatives are pivotal in elevating service quality, strengthening grievance redressal, and fostering greater financial inclusion, thereby reinforcing public trust in the regulated financial sector.

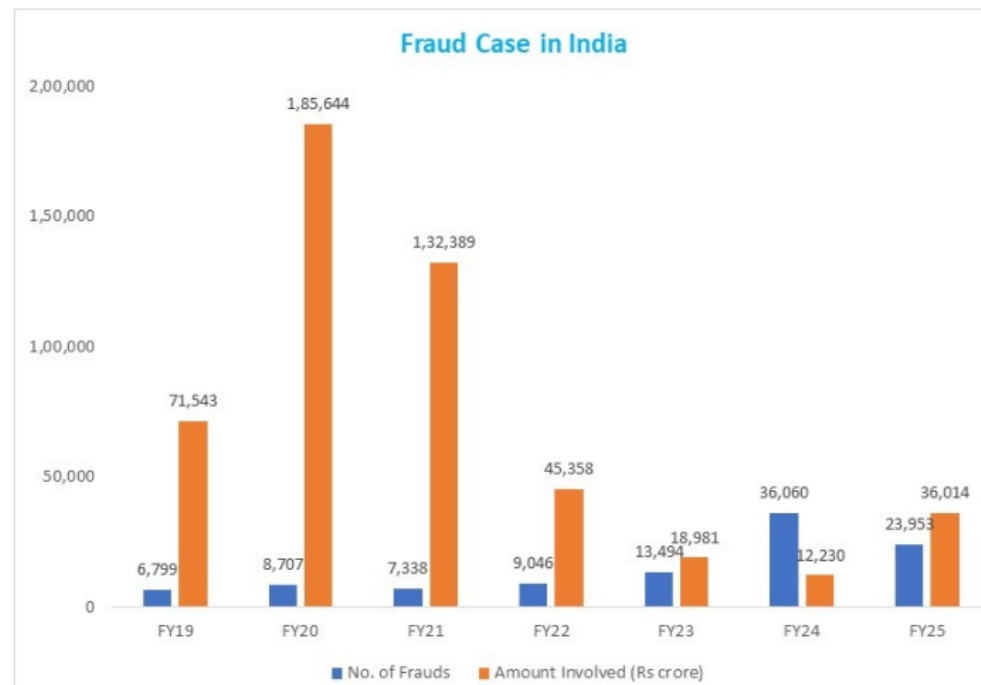

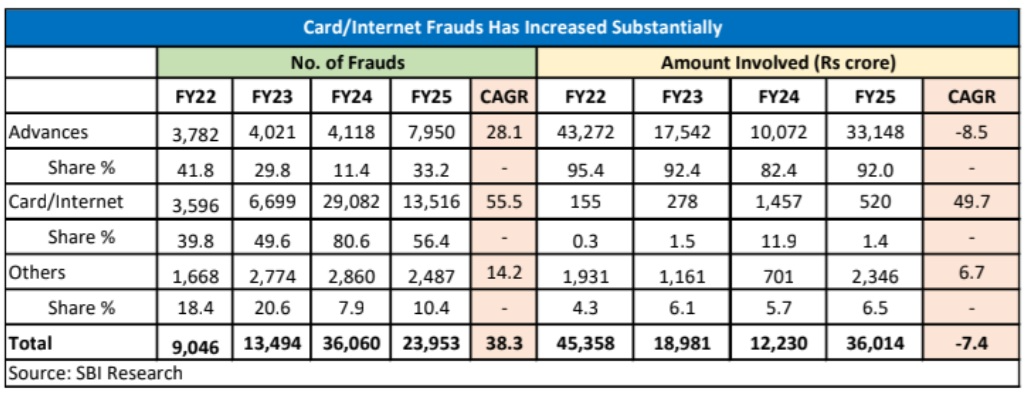

RISE IN ADVANCES RELATED FRAUDS

NUMBER OF FRAUDS HAVE DECLINED, DUE TO DECLINE IN CARD/INTERNET FRAUDS, AMOUNT IN-

CREASED DUE TO THE RISE IN ADVANCES RELATED FRAUDS

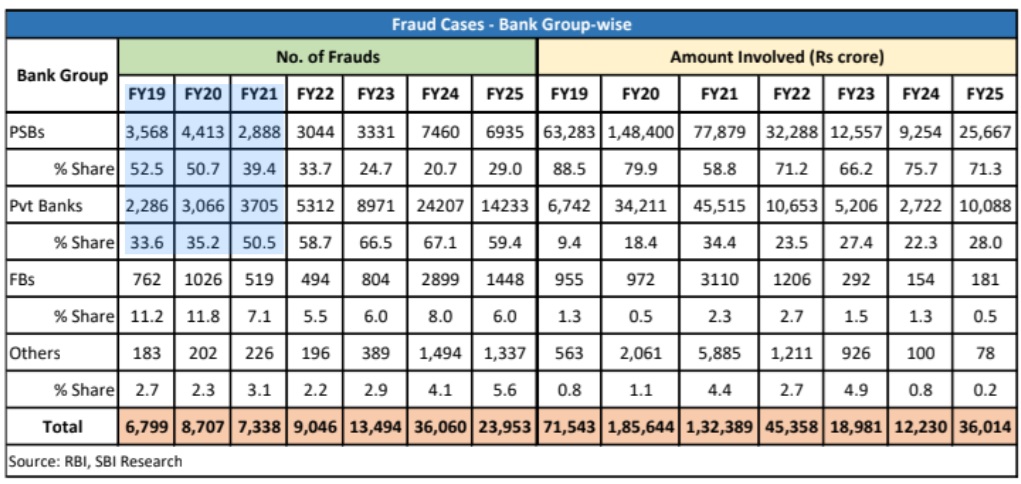

The number of cases on frauds reported by banks has declined to 23,953 in FY25 from 36,060 in FY24. However, in terms of amount, frauds has been increased 3-times to Rs 36,014 crore in FY25 from Rs12,230 crore in FY24. Private sector banks reported maximum number of frauds, public sector banks continued to contribute maximum to the fraud amount.

The increase in the amount involved in the total frauds reported during 2024-25 over 2023-24 was mainly due to removal of fraud classification in 122 cases amounting to Rs18,674 crore reported during previous financial years and reporting afresh during the current financial year after re-examination and ensuring compliance with the judgement of the Hon’ble Supreme Court dated March 27, 2023.

Advances fraud rose from Rs 10,072 crore in FY24 to Rs 33,148 crore in FY25. While, the number of frauds in ‘card/internet’ has declined significantly to 13,516 (Rs 1457 crore) in FY25 from 29,082 (Rs 520 crore) in FY24.

Card/internet frauds contributed maximum to the number of frauds reported by private sector banks.

While the incidence of fraud cases declined, but fraud amounts tripled to Rs 36,014 crore, mainly due to surging advances-related fraud. In contrast card and internet frauds volume diminished significantly from 29,802 in FY24 to 13,516 in FY25.

In summary, India’s financial system stands at crossroads— resilient and transformative.