Following a pandemic-led contraction during 2020-21, remittances to India in the post pandemic period recorded a significant surge.

FinTech BizNews Service

Mumbai, March 24, 2025: The Reserve Bank released the March 2025 issue of its monthly Bulletin. The Bulletin includes four speeches, five articles and current statistics.

The article titled "Changing Dynamics of India’s Remittances" , written by Dhirendra Gajbhiye, Sujata Kundu, Alisha George, Omkar Vinherkar, Yusra Anees, Jithin Baby,

analyses the results of the sixth round of India’s remittances survey conducted for 2023-24. It captures various dimensions of inward remittances to India – country-wise source of remittances, state-wise destination of remittances, transaction-wise size of remittances, prevalent mode of transmission, cost of sending remittances and share of remittances transmitted through the digital modes vis-à-vis cash.

Highlights:

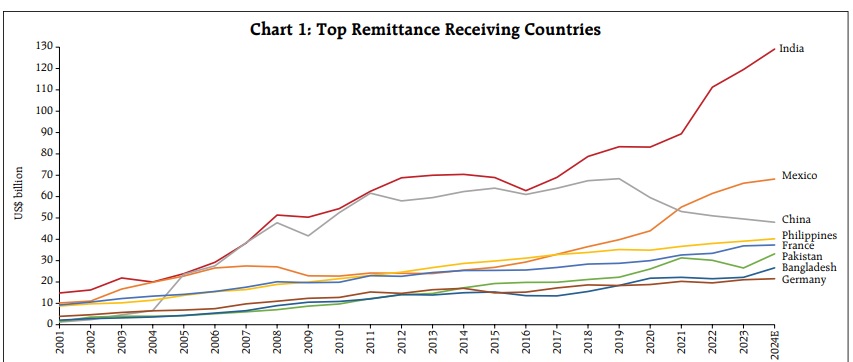

India’s inward remittances have more than doubled during 2010-11 to 2023-24 and have been a stable source of external financing during this period. Following a pandemic-led contraction during 2020-21, remittances to India in the post pandemic period recorded a significant surge.

The survey results indicate that the share of inward remittances from advanced economies has risen, surpassing the share of Gulf economies in 2023-24, reflecting a shift in migration pattern towards skilled Indian diaspora.

Maharashtra, followed by Kerala and Tamil Nadu, continue to be the dominant recipient of remittances.

The cost of sending remittances to India has moderated significantly, driven by digitalisation, but remains higher than the SDG target of 3 per cent.

Additionally, on an average, 73.5 per cent of total remittances received by the money transfer operators in 2023-24 were through digital mode.

Furthermore, fintech companies offer affordable cross-border remittance services, fostering competition among different remittance service providers.