Digital frauds particularly using UPI has accelerated. UPI, India’s most preferred digital payment mode, has been targeted by fraudsters using compromised mobile numbers, fraudulent QR codes designed to steal money or credentials

FinTech BizNews Service

Mumbai, 6 February 2026: The Monetary Policy Committee (MPC) held its 59th meeting from February 4 to 6, 2026, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Shri Indranil Bhattacharyya attended the meeting.

The RBI Governor today made a Statement on Developmental and Regulatory Policies. This Statement sets out various developmental and regulatory policy measures relating to (i) Regulations; (ii) Payments System; (iii) Financial Inclusion; (iv) Financial Markets; and (v) Capacity Building.

Discussion Paper on “Exploring safeguards in digital payments to curb frauds”

Over the past decade, digital payments in India have expanded at an unprecedented pace, reflecting a structural shift in the way individuals and businesses conduct financial transactions. However, it has been accompanied with growing sophistication of fraudulent activities targeting innocent customers. In alignment with the objective of promoting digital payments in a safe and secure manner, it is proposed to issue a Discussion Paper exploring the introduction of calibrated safeguards in digital payments such as introduction of lagged credits, additional authentication for specific class of users like senior citizens, etc. The proposed measures are intended to mitigate frauds and strengthen customer protection.

Review of framework of Limiting Customer Liability in digital transactions

The extant instructions on limiting the liability of customers in unauthorised electronic banking transactions were issued in 2017, which deal with scenarios and timelines for zero / limited liability of a customer. In view of the rapid adoption of technology in the banking sector and payments systems, since issuance of these instructions, the existing instructions have been reviewed. Accordingly, the draft revised instructions, including a framework for compensation in case of small value fraudulent transactions, shall be issued shortly for public consultation.

Empowering customers

The RBI Governor further stated in the Statement: “For customer protection, we will issue three draft guidelines: one, relating to mis-selling; two, regarding recovery of loans and engagement of recovery agents; and three, on limiting liability of customers in un-authorised electronic banking transactions. It is also proposed to introduce a framework to compensate customers up to an amount of Rs25000/- for loss incurred in small-value fraudulent transactions.

We will also publish a discussion paper on possible measures to enhance the safety of digital payments. Such measures may include lagged credits and additional authentication for specific class of users like senior citizens.”

RBI’s Initiatives Laudable

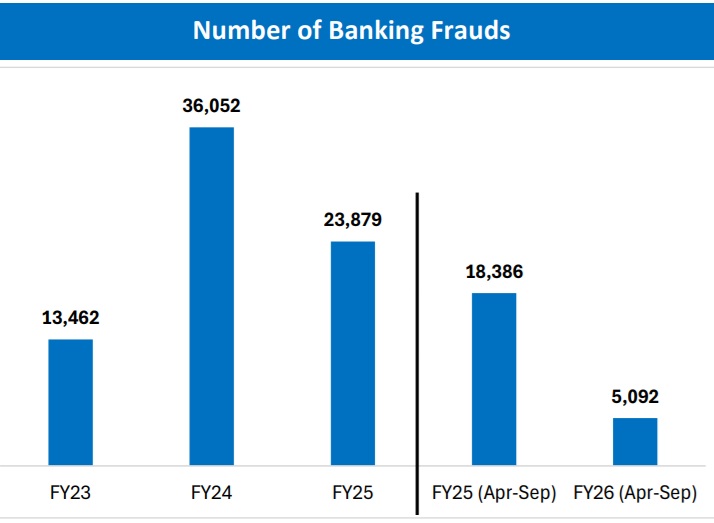

As per the SBI research report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India; the number of banking frauds has increased from 13,494 in FY23 to 23,879 in FY25. (The number 23,879 represents a 76.96% increase over 13,494.)

Against this backdrop the RBI’s initiatives to protect customers through various measures (like introduction of lagged credits, additional authentication for specific class of users like senior citizens) including the monetary compensation of Rs 25,000 for small-value fraudulent transactions is laudable.

• “Digital frauds particularly using UPI has accelerated. UPI, India’s most preferred digital payment mode, has been targeted by fraudsters using compromised mobile numbers, fraudulent QR codes designed to steal money or credentials. Thus, the cyber risk of digital payment has evolved requiring revision in framework for compensation in case of small value fraudulent transactions and other related issues,” adds the SBI research report.