Targets Of Department Of Payment & Settlement Systems for 2025-26; The Reserve Bank proposes to conduct a Survey to assess the evolving trends, adoption patterns and user preferences in India’s digital payments ecosystem

FinTech BizNews Service

Mumbai, May 29, 2025: According to the Reserve Bank of India's Annual Report for 2024-25 released today, the Department Of Payment And Settlement Systems (DPSS) of RBI will focus on the following goals in 2025-26, :

● To assess the evolving trends, adoption patterns and user preferences in India’s digital payments ecosystem, the Reserve Bank proposes to conduct a ‘Survey on Usage of Digital Payments’. The findings are expected to provide key insights into the transaction behaviour and challenges faced by users, thereby facilitating evidence-based decision making towards enhancing financial inclusion and making payment systems more effective;

● To protect customers from digital payment frauds, the Reserve Bank constituted a committee to examine various aspects of setting up a Digital Payments Intelligence Platform (DPIP) to harness advanced technologies for the purpose.

Reserve Bank Innovation Hub (RBIH) has been assigned for building a prototype of DPIP in consultation with five to ten banks based on the contours of the report of the committee; towards framing of ‘Payments Vision Document 2028’ has started with inputs being sought from various stakeholders. The document would aim to build on the growth of payment systems in the last decade and provide further impetus to entities in the payments ecosystem for them to develop and deploy solutions in this space; and

● The G20 Roadmap for enhancing cross-border payments has set targets for achieving cheaper, faster, more transparent and more accessible cross border payments. The ‘Annual Progress Report on Meeting the Targets for Cross border Payments: 2024 Report on Key Performance Indicators’ published by Financial Stability Board (FSB) indicates that the primary challenge with speed of payments is experienced at the beneficiary leg (i.e., the time from the beneficiary bank receiving the payment until the funds are credited to the end-customer’s account). The Reserve Bank shall work towards identifying the frictions in processing of beneficiary leg of cross-border payments and framing suitable regulatory policy/ action in consultation with the relevant stakeholders in India.

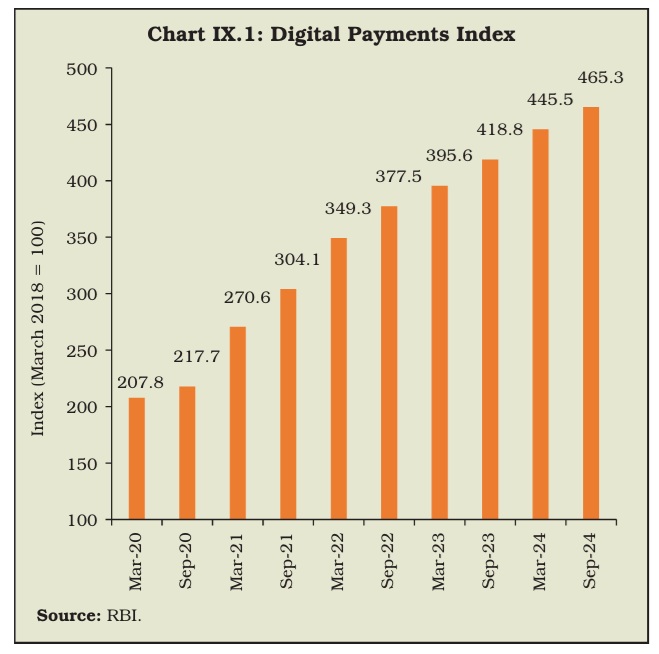

Digital Payments Index (DPI)

The Reserve Bank had constructed a composite DPI in 2021 to capture the extent of digitisation of payments across the country. The RBI-DPI index, computed semi-annually, demonstrates significant growth representing the rapid adoption and deepening of digital payments across the country in recent years.