The draft scale-based enforcement framework for action against various types of REs is under finalization

FinTech BizNews Service

Mumbai, May 31, 2024: Enforcement Department (EFD) was set up with a view to separate enforcement action from supervisory process and to put in place a structured, rule-based approach to identify and process violations by the REs of the applicable policies and enforce the same consistently across the Reserve Bank. The objective of enforcement is to ensure compliance by the REs with the rules and regulations, within the overarching principles of financial stability, public interest and consumer protection.

Agenda for 2023-24

The Department had set out the following goal for 2023-24:

• Endeavour to implement a scale-based approach to enforcement.

Implementation Status

A scale-based approach would be put in place for enforcement action against various types of REs [banks, NBFCs, HFCs, ARCs, Factors, CICs, Payment System Operators (PSOs)] based on their size, complexity, interconnectedness, range of activities and also the seriousness of violations. The draft scale-based enforcement framework is under finalization, according to RBI’s ANNUAL REPORT 2023-24, released on 30 May, 2024.

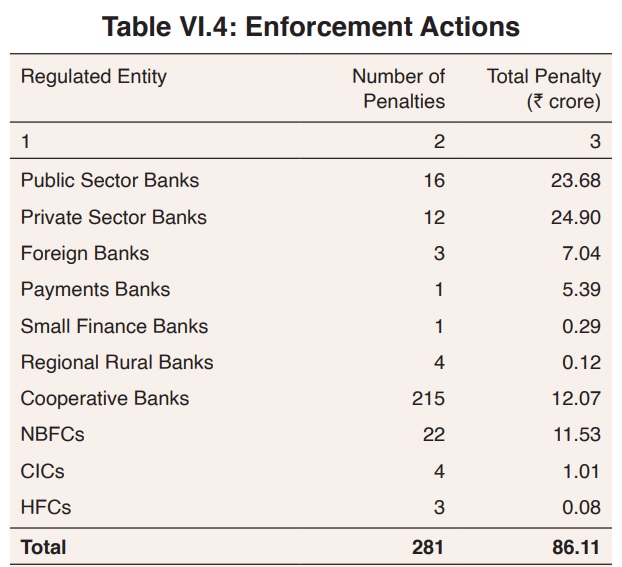

During 2023-24, the Department undertook enforcement action against REs and imposed 281 penalties aggregating Rs86.1 crore for contraventions/non-compliance with provisions of statutes and certain directions issued by the Reserve Bank from time to time.