Develop a consumer protection assessment matrix for REs

FinTech BizNews Service

Mumbai, May 31, 2024: The Reserve Bank institutionalized Internal Ombudsman (IO) mechanism for banks in 2018, non-bank system participants in 2019, select NBFCs in 2021, and CICs in 2022, with a view to strengthen the internal grievance redress system.

Major Developments

Opening/Reorganisation of Offices of RBI Ombudsman (ORBIOs)

The Reserve Bank reviewed the geographic presence of the ORBIOs and made them available in different regions keeping in view the volume of origination of complaints. Accordingly, a new ORBIO was operationalised at Shimla and additional ORBIOs have been operationalised at Chennai and Kolkata. All Ombudsman offices operate under the overarching ‘One Nation One Ombudsman’ principle, as per the RBI’s ANNUAL REPORT 2023-24 released on 30 May, 2024.

Customer Centric Measures

The Reserve Bank undertook 130 customer centric initiatives during 2021-22 to 2023-24 to improve customer service and satisfaction.

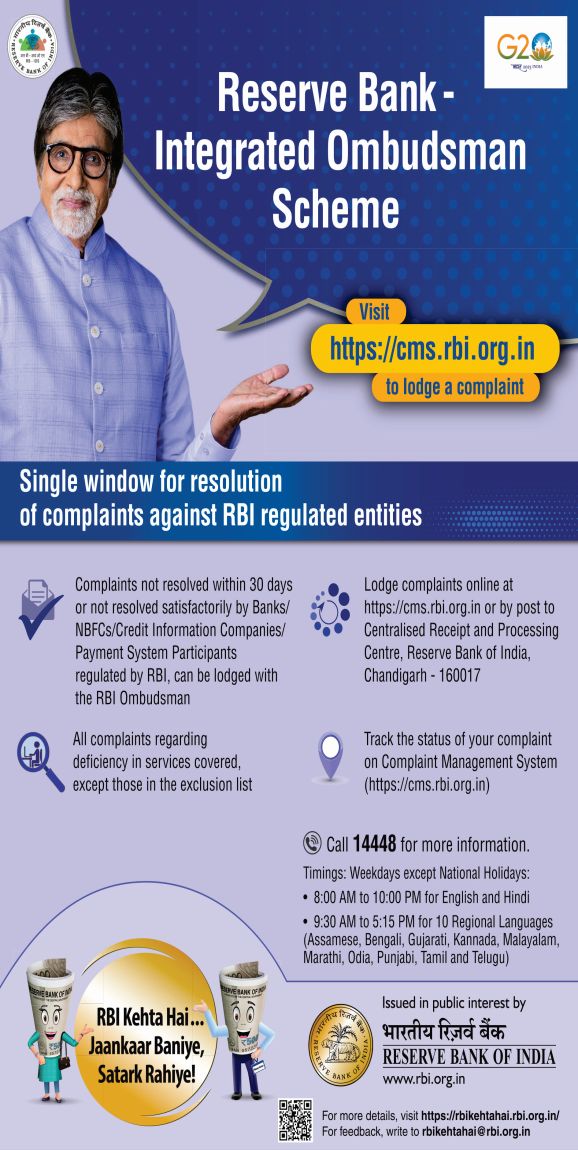

The Reserve Bank of India had released the Annual Report of the Ombudsman Scheme for the period April 1, 2022 to March 31, 2023. This is the first full-year report after the launch of Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 in November 2021. The Annual Report covers the activities under the RB-IOS, 2021 as well as major developments during the year in consumer education and protection and the way forward.

7,03,544 complaints were received at the ORBIOs and the CRPC between April 1, 2022 and March 31, 2023, showing an increase of 68.24% over last year. Of these, 2,34,690 complaints were allocated to and handled by the 22 ORBIOs, whereas 4,68,270 complaints were closed by CRPC as non-complaints / non-maintainable complaints.

Agenda for 2024-25

During 2024-25, the Department proposes to focus on the following goals:

• Further improvement in the complaint management system to enhance support in lodging complaints and ensure greater consistency in decisions and outcomes (Utkarsh 2.0);

• Develop a consumer protection assessment matrix for REs (Utkarsh 2.0);

• Strengthen internal grievance redress framework to encourage banks to take proactive measures to improve customer service;

• Conduct of survey to assess the reasons for the low level of complaints in the rural/ semi urban areas; and

• Review and rollout of reoriented nationwide intensive awareness programme based on feedback received from REs and ORBIOs.