Brief: The Reserve Bank recently released the November 2023 issue of its monthly Bulletin. The Bulletin includes four articles, out of which one article is titled 'Reading the Market's Mind: Decoding Monetary Policy Expectations from Financial Data.'This article uses the Overnight Index Swaps (OIS) rate to decode the near-term market expectations of changes in the monetary policy rate during 2016 to 2023.

By Joice John,

Bhimappa A. Talwar,

Priyanka Sachdeva and

Indranil Bhattacharyya

Mumbai, November 223, 2023: In a forward-looking monetary policy framework, central banks closely monitor market expectations on the evolving economic outlook as well as on future policy actions. This paper explores the methodology of extracting market expectations on the policy rate from the 2-month Overnight Index Swaps (OIS) rate and finds it effective in decoding near term market expectations. During 2016-2023, monetary policy surprises have been rare suggesting that the RBI’s communication strategy has been successful in anchoring market expectations. Our findings indicate that such policy surprises have an instantaneous impact on interest rates of longer maturities across money and bond markets on the policy day.

Introduction

In a forward-looking and market-based monetary policy framework, expectations about the future in addition to current economic conditions largely influence the decision making of economic agents viz., the public, market participants and all stakeholders. Since expectations on the economic outlook govern saving and investment decisions in the economy that generate business cycles, monetary authorities – in their stabilisation role – closely monitor market expectations on evolving economic activity as well as on future policy actions.

One of the key indicators for monetary policy formulation is the market expectation on the central bank’s policy rate, which reveals useful information about the market’s assessment of current economic developments and its perceptions about the future. Expectations of the future policy rate – including its timing and pace of change – are an important driver of financial asset prices and cost of credit to the wider economy, thus playing a significant role in monetary policy transmission. It is in this context that forward guidance has gained prominence in the communication strategy of central banks to anchor market expectations on future policy rates (Woodford, 2005). Prescient decoding of market expectations on the policy rate can avoid undue financial market volatility that ensues when expectations significantly differ from central bank actions. Unexpected movement in the federal funds rate (FFR) is found to be a key driver of treasury yields (Kuttner, 2001) and stock prices (Bernanke and Kuttner, 2005). Policy rate expectations can also be a key input for the central bank’s projection of growth and inflation.

Cross-Country Practices

The related literature and cross-country practices suggest that financial market instruments (futures and swaps), surveys and empirical models are the commonly used methods for extracting market expectations. While survey-based measures are directly measurable, subjective, and available with a lag, interest rate expectations embedded in the price of financial instruments are based on financial transactions, information on which are available at a regular frequency. Moreover, high frequency data availability – on a daily or even intra-day basis – for financial indicators enable a more robust identification of monetary policy surprises that are relatively less influenced by other economic news. In contrast, survey or model-based measures are generally available at a lower frequency. Moreover, survey-based measures are highly subjective and suffer from sampling bias while model-based measures rely on certain restrictive assumptions that make them less reliable, particularly during periods of high uncertainty. Nevertheless, it is prudent to use different methods and not be reliant on any single method for drawing policy inputs.

Amongst financial market instruments, the closest possible direct measure of expected future policy rates is the interest rate futures, which incorporate expectations of interest rates and are closely linked to the policy rate over the short to medium term horizon. The fed fund futures (FFFs) have been widely used as a measure of monetary policy expectations in the US (Krueger and Kuttner, 1996). For countries without similar interest rate hedging instruments, expectation is measured from the price of the instrument that moves along with the policy rate, e.g., Treasury Bills, unsecured interbank loan, and forward rate agreements (FRAs) (Joyce et al., 2008). Nevertheless, measuring expectations from such instruments is rendered complex because of additional factors that contribute to pricing, such as credit risk, liquidity risk, and term premium.

In view of the above, the search for an alternative measure led to the identification of the overnight indexed swap (OIS) rates as a measure of monetary policy expectations that is more generally comparable across different countries (Lloyd, 2018; 2021). An OIS is an interest rate derivative contract in which two entities agree to swap/exchange a fixed vis-à-vis a floating interest rate payment based on a notional principal amount. As against futures which are standardised instrument traded on exchanges, the OIS is traded over the counter (OTC). While the futures settle against the short-term rate (i.e., overnight rate) on a specific future date, the OIS settles against the path of short-term rate prevailing from the inception of the contract till its maturity. Financial agents primarily use OIS contracts to manage their interest rate exposures through hedging and appropriate arbitrage opportunities. As a risk management tool, OIS inter alia provides various benefits such as (i) reduction in credit risk; (ii) flexibility to move to interest rate basis of choice; (iii) converting fixed rate liability into floating or vice versa; and (iv) managing duration of investment portfolio. Subsequent research has proliferated the use of OIS to measure market expectations on the policy rate.

OIS Rates

In the Indian context, a recent study using Lloyd’s methodology (2018) found that OIS rates of select maturities provide credible measures of market expectations on the future path of the policy rate (Rituraj and Kumar, 2019). We build on this study on several counts. First, we use the 2-month OIS rate, given the bi-monthly policy cycle in India, to gauge only the near-term policy expectations (till the next policy) rather than the long term, focusing on the more recent period (2016-23). Second, while Rituraj and Kumar (op cit.) use the number of calendar days between the inception of the contract till its maturity for calculating the value of the floating leg, this paper estimates the floating leg based on the number of business days (accounting for the holidays in between), which may be more appropriate. Third, using an event study (ES) approach, we empirically evaluate the role of market expectation and policy surprises in determining the immediate impact of policy changes on the money and bond markets in India on the policy day, which helps in identifying how market participants adjust their expectations after a policy announcement.

Related Literature

The FFFs is a prime measure of monetary policy expectations in the US which is widely used in the literature (Krueger and Kuttner, 1996; Kuttner, 2001; Faust, Swanson and Wright, 2004; Sack, 2004; Piazzesi and Swanson, 2008; Hamilton and Okimoto, 2011). While comparing the performance of various market-based instruments in the US – including FFFs and Eurodollar futures – as predictors of the future monetary policy stance, it was found that the FFFs predict monetary policy better in horizons up to six months (Gurkaynak et al., 2007). The absence of similar instruments, however, motivated the search for comparable measures in many countries.

Using OIS rates as an alternative measure that can be used outside the US and which is more generally comparable across different countries, it was found that one to12-month US OIS rates provide measures of investors’ interest rate expectations that are comparable to that of FFFs (Lloyd, 2018; 2021). Additionally, 1 to 24-month US, euro-zone and Japanese OIS rates and one to 18-month UK OIS rates were found to accurately measure expectations on future short-term interest rates in these countries.

The use of OIS contracts as measures of investors’ interest rate expectations offers various advantages.1 First, counterparty risk is minimal in OIS contracts since it involves only an exchange of interest and not notional principal amounts, although such risks along with the risk premia are likely to increase in times of stress (Finlay and Olivan, 2012). Second, OIS contracts do not involve any initial cash flow and only the net payments are exchanged, thus minimising liquidity risk. Taking cognizance of these important features, several studies have used OIS rates to decipher market expectations on future monetary policy (Christensen and Rudebusch, 2012; Woodford, 2012; Kamber and Mohanty, 2018; Altavilla et al., 2019; Lloyd, 2021).

As mentioned before, it was found that OIS rates of 1-, 9- and 12-months tenors provide credible measures of market expectations on the future path of the policy rate in the Indian context during normal times (Rituraj and Kumar, op cit). Moreover, unanticipated changes in monetary policy during the global financial crisis (GFC) of 2008 and the taper tantrum of 2013 were found to have a substantial bearing on ‘excess returns’ in the OIS market, unlike normal times. In the same spirit, several recent studies have used excess return derived from OIS rates as a proxy for monetary policy surprises. After controlling for the surprise component of monetary policy changes as reflected in Indian OIS rates, a text-mining analysis of the monetary policy statements of the Reserve Bank of India (RBI) found significant improvement in policy communication since the advent of the inflation targeting regime (Mathur and Sengupta, 2019). Using the 1-month OIS rate to delineate the expected and unexpected components of monetary policy announcements, an ES analysis around announcement days found that Indian G-sec yields generally react to monetary policy surprises (Das et al., 2020).

Monetary policy surprises derived from OIS rates are found to significantly impact the stocks of banking, financial services, and the realty sectors (Prabu et al., 2020). Maturity-wise changes in OIS rates in a narrow window around the RBI’s monetary policy announcements are used to capture the unexpected (surprise) component of policy decisions, which are complemented with narrative analysis to investigate the reliability of OIS rates in inferring market expectations (Lakdawala and Sengupta, 2021). Using changes in OIS rates (1-month) as a proxy for monetary policy surprises alongside other short-term OIS rates and longer-term treasury securities, it was found that monetary policy surprises have a positive and statistically significant impact on yields of Indian government and corporate bonds (Ahmed et al., 2022).

III. OIS Market in India: Stylised Facts

As mentioned earlier, an OIS is an interest rate derivative contract in which two parties agree to swap/exchange a fixed interest rate payment (the OIS rate) vis-à-vis a floating interest rate payment over the tenor of the contract. In an OIS contract, the floating leg interest payment is derived by calculating the accrued interest payments from a strategy of investing the notional principal in a reference rate and repeating this on an overnight basis for the duration of the contract, reinvesting principal plus interest continuously. The floating rate is usually the overnight (unsecured) interbank rate and the reference rate for OIS contracts in India is the Mumbai Interbank Offered Rate (MIBOR). On the other hand, the OIS rate represents the contract’s fixed rate which contains market participants’ expectations about future overnight rates. The notional principal is used to calculate interest payments but is not exchanged; it is only the interest payments that are exchanged at pre-determined intervals over the tenor of the contract, i.e, if the fixed interest rate payment exceeds that of the floating rate, the agent who took on the former payments must pay the other at settlement. More simply, an investor who has taken a long position in an OIS contract will receive payments based on a fixed swap rate and make payments based on the overnight rate that is realised over the contract’s maturity.

III.1 Evolution

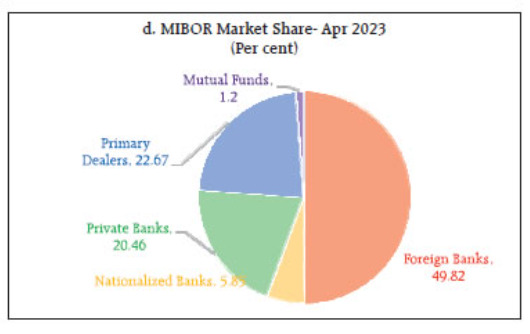

Interest rate derivatives (IRDs), which are traded either on organised exchanges or on OTC markets, were permitted in India in July 1999. Within IRD, interest rate swaps (IRS) – which involve swapping of interest rate payments based on notional principal – have the largest market share. Currently, the trading in IRS is dominated by MIBOR-OIS with the MIBOR as the floating interest rate, followed by the Mumbai Inter-bank Forward Offer Rate (MIFOR) counterpart. In the MIBOR segment, the daily average value of transactions, although lower than the levels prior to the GFC, have increased considerably since COVID-19, while the outstanding value of transactions has more than doubled since 2020-21. Across tenors, the trading is primarily concentrated in 1-year, 2-year, and 5-year maturity segments, with the short-term segment (up to 1 year) comprising more than 50 per cent of total trade. Market share is dominated by foreign banks followed by primary dealers and private sector banks. Despite their large interest rate exposure, the participation of nationalised banks in the IRS markets remains thin. In this regard, as the balance sheet of nationalised banks becomes more market linked, particularly in the wake of the adoption of external benchmarks lending rate (EBLR), their demand for hedging is expected to increase, thus contributing further to the development of the IRD market (Acharya, 2020). The share of nationalised banks has improved from 0.5 per cent in April 2020 to 5.9 per cent in April 2023.

III.2 OIS rates and Monetary Policy Expectations

The no-arbitrage condition requires that the fixed leg of an OIS contract should be equal to the expected overnight rates compounded daily for the period of the contract, plus a term premium. Therefore, if overnight rates are expected to increase (decrease) during the period of the contract, the OIS rate should consequently move up (down). This feature of the OIS is useful in identifying the “surprise” component of any policy announcement that can affect money market rates.

In the context of extracting market expectations, the positioning in the OIS market is based on expectations about the future direction of policy interest rates since overnight MIBOR is traded based on the inter-bank call money rate – the operating target of monetary policy. For instance, market participants expecting an increase in interest rate may choose an OIS contract where they pay the fixed rate and receive the actual (floating) rate over the period of the swap. In this sense, the OIS rates can be used to decipher market expectations of monetary policy. As mentioned before, the liquidity premia and counterparty risks are minimal in an OIS contract; therefore, if the excess return, i.e., the difference between the fixed and the floating leg is, on an average, zero, then the OIS can provide a robust measure of investors’ expectations of future overnight interest rates over the horizon of the contract.

The OIS rates start moderating (firming up) towards the expected policy rate over the tenure of the contract. For instance, the 2-month OIS rate – tenor similar to the frequency of the monetary policy cycle – gradually eases over the ensuing two months if the market expects a reduction in the policy repo rate in the upcoming monetary policy meeting and vice versa. For India, the 2-month OIS rates seem to capture well the policy easing cycle during February 2019 to May 2020 and the tightening cycle commencing May 2022. In contrast, OIS rates of longer maturity reflect expectations on the future path of the policy rate (multiple policy cycles) along with the term premia. This is in accordance with the expectation hypothesis of the term structure – interest rates are expected to move in a way that equalises the expected return on short and long-term investment strategies for comparable investment horizons.

Having estimated the unanticipated changes in policy actions from excess returns, we next evaluate their instantaneous impact on long-term money and bond market rates. For this purpose, we first look at select policy announcement days that had a surprise element (the five instances mentioned earlier) along with those policy days in which rate changes were announced during the last three years.

changes in longer-term rates have moved broadly in tandem with the changes in excess return. There were, however, some policy days in which other measures were announced simultaneously along with the policy rate, especially in the aftermath of the COVID-19 pandemic. In the wake of these developments, a perfect identification of the impact of a monetary policy surprise on long term interest rates might not be possible as the impact of several other measures would get reflected in the markets’ reaction. In most instances, however, monetary policy related announcement was the sole event on that day; therefore, we adopted an ES methodology in a regression framework in conformity with the recent literature (Ahmed et al., 2022; Bauer and Swenson, 2023).

To assess the impact, changes in interest rate/yields on these instruments on all the monetary policy announcement days during August 2016 to February 2023 are regressed (i) on changes in the policy rate (Model 1) and (ii) on the anticipated and surprise components (Model 2). While most studies based on tick-by-tick data of the US and the euro area use a small window (30-minutes) around the policy announcements to capture the immediate announcement effect (Altavilla et al., 2019; Bauer and Swenson, 2023), our analysis is conducted on daily data due to unavailability of intra-day data for some indicators. In line with the recent literature, it is also assumed that the monetary policy announcement is the major event on the policy days having the most pronounced impact on the market (Kapp and Kristiansen, 2021).

Since most of the deals in the call money market are traded in the morning hours before the policy announcement and does not fully reflect repo rate changes on the policy day, the changes in the overnight rate – the weighted average call rate (WACR) – is computed as the difference between the call rate a day after the policy announcement (t+1) and a day prior to the announcement (t-1). Given intra-day data availability on government securities, the changes in yields are computed as the difference between the opening and closing rates on the policy announcement day to exclude the impact of overnight changes in global factors viz., US treasury yields, and crude oil prices, which have a significant bearing on G-sec yields. As per available data, changes in T-bill and corporate bond yields are computed on close-close basis i.e., difference between rate prevailing at the end of the monetary policy day (t) and the closing rate of the previous working day

As expected, the instantaneous impact of policy rate changes progressively moderates across the term structure. As expected, the extent of instantaneous pass-through is almost unity in the case of the WACR but is more subdued for longer maturities. In the overnight money market, the policy rate changes, irrespective of whether these are anticipated or not, are almost fully passed on immediately. The anticipated policy changes have no significant instantaneous impact on G-sec and corporate bond yields as market participants already incorporate them in their expectations. In these segments, however, policy surprises are found to have a strong and significant contemporaneous impact across maturities – more so in corporate bonds than G-sec – as market participants immediately adjust their expectations after the surprise announcement. The findings are consistent with some recent studies that suggests policy surprises having a positive and statistically significant impact on G-sec and corporate bond yields in the Indian context (Das et al., 2020; Ahmed et al., 2022).

V. Conclusion

This paper adopts Lloyd’s methodology for extracting market expectations on RBI’s next policy announcement and identifying the surprise element of policy changes from the 2-month OIS rate. Since the formal adoption of FIT (October 2016) and up to 2022-23, policy surprises have been rare and under exceptional circumstances, suggesting that the RBI’s communication have been effective in guiding market expectations. The empirical analysis indicates that policy rate changes have an instantaneous and full impact at the shorter end of the term structure but are muted at the longer end. The anticipated changes in policy rate are found to have no immediate impact on longer term interest rates as those are already factored in by the markets. In contrast, monetary policy surprises have a positive and significant immediate impact across market segments and maturities. Therefore, major central banks abjure from surprising the market through effective communication strategies in normal times, large exogenous shocks can require central banks to take proactive monetary and liquidity actions to maintain domestic macroeconomic stability which can have an element of surprise for the market. As such, policy surprises are used sparingly under exceptional circumstances. Overall, our findings suggest the potency of the 2-month OIS rate in capturing near term market expectations on the policy rate.