OMO gap in FY26 could hover around Rs 1.7 trillion. RBI could look into using CRR more as a regulatory intervention tool / countercyclical liquidity buffer rather than as a liquidity tool in future

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, March 4, 2025: Systemic Liquidity needs Flexible Targeting of Permanent Nature.... RBI doing a commendable job yet Rs

1 trillion Liquidity Support may be needed further by March end...Delicate mix of temporary and permanent

liquidity injection / withdrawal remains a work-in-progress calling for development of liquid term money

markets even as exchange rate volatility and capital outflows are ‘clear and present’ dangers.

Series of Forex market intervention to counter volatility in capital flows and Tax outflows, along with a nudge to JIT SPARSH transition and

movement in GoI cash balances simultaneously have impacted the systemic liquidity

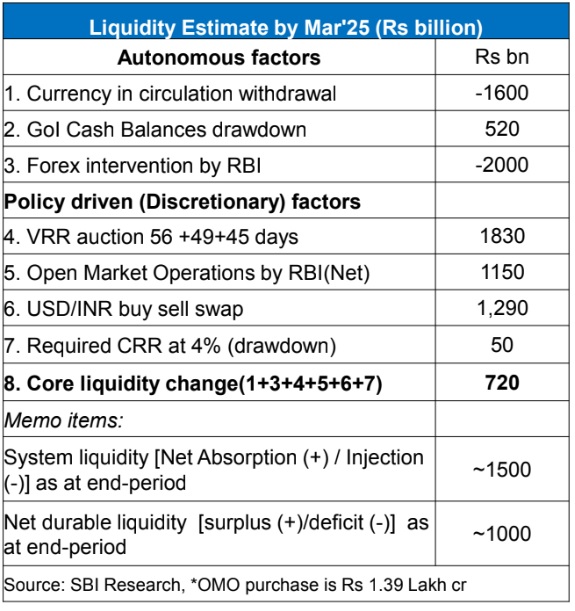

❑ RBI has resorted to several measures to inject liquidity into the system, several variable rate repo (VRR) auctions of varying tenors and a series

of daily VRR auctions since January 16, jumbo dollar-rupee swaps, unrestricted OMOs apart from a 25 bps repo cut

❑ While the liquidity situation has eased somewhat, with daily liquidity deficit reducing in March, we believe system liquidity will remain tight due to

year end tax outflows / credit off-take....Going by repo auction figures, it is evident that RBI is also using more than what GoI cash balances is

available for VRR auctions balances and thus the residual amount has been out of RBI’s liquidity from other (own) sources...

❑ Given that such daily VRR transactions is akin to frictional / transient liquidity injections but is somehow also substituting for permanent / durable

liquidity shortfall (shortfalls arising out of currency leakage and liquidity impact of RBI forex intervention) To negate such, RBI is selling in NDF

forwards and then carrying over short term buy sell swaps to replace the maturing forward sale position and also to counter the durable liquidity

drain from spot intervention

❑ This long swap deal of RBI should have a cascading impact on money market. Corporate bond yields and CD were elevated. The

spread between a repo rate and a Corporate Bond yield was as much as 125 basis point northwards over the repo rate, while buying

activity in secondary market had also been under pressure....the present swap will ensure transition to money market yields

❑ While the market players (through banks) are provided with liquidity injection and the Central Bank replenishes its reserves, corporate ALM

mismatches are also taken care of through hedging due to liquidity rich feature of such Fx swaps

❑ As the effective INR cost (7% with a downward bias inclusive of swap cost via forward premia and USD funding costs) is a tad lower than the

cost of issuance of CDs (keeping in mind the elevated demand due to March end credit push), which has seen a lot of heat as banks do not look

forward to roll over high-cost wholesale funding from non-retail sources received till last year, the ripple effect could be yield accretive for CD

markets in the short term FIIs have favored India more than other emerging markets in the last decade, the number of net positive inflows years far outweighing net negative years...However, the spell and intensity of present sell-off wherein FIIs have pulled out Rs 34,574 crore from the Indian equity markets in Feb’25 pushing total outflows to Rs 1.12 lakh crore in the first two months of 2025 and Rs 2.12 lakh crore in five months period (Oct’24 to Feb’25) despite Rs 3.3 lakh crore DIIs push

❑ To infuse liquidity, OMOs worth Rs 1.39 lakh crore have also been conducted so far with Rs 1.00 lakh crore in primary markets and Rs 0.38 lakh crore in secondary markets... however, the structural friction in money / capital markets has ensured the divergences have accentuated

❑ On a (not so!) surprising note, despite rate cut, SGS and corporate bonds spreads over G-Secs have widened from 30-35 bps (over G-Secs) to 45-50 bps.... This has spilled over to Corporate bond markets as well, hampering effective transmission of rate cut. We are of the opinion that there is a need to address this ‘spread widening’ and believe that open market operations may be considered in SGSs as well to smoothen/harmonize the spreads...also, states need to spread their issuances more evenly throughout the year (against bunching more in last quarter) to avoid paying higher cost in the last quarter

❑ With an unchanged ownership in G-sec in FY26, OMO gap in FY26 could hover around Rs 1.7 trillion. Thus, more liquidity measures could be required on a sustained basis.... RBI could look into using CRR more as a regulatory intervention tool / countercyclical liquidity buffer rather than as a liquidity tool in future

❑ The banks were holding ~Rs 1.5 trillion excess SLR because of LCR requirements and a large part stands offloaded to RBI through OMOs. However, this did not have any material impact on sovereign yields (or on spreads between T-bills/G-Sec and Corp. Bonds for that matter)... CD rates have climbed northwards since last year while Spread between repo and CP (weighted average rate) which was negative during FY21 has now increased to around 110 bps in FY25 and 145 bps in Feb 2025....

Similarly, spread between repo and 3 months CD which was negative during FY21 now increased to around 80 bps in FY25 and 119 bps in Feb 2025

❑ Separately, there is now inadvertent cash leakage since In Mahakumbh, the withdrawal has been largely by retail depositors whereas the accretion of fresh deposits has been with non-retail participants and hence a significant part of the currency may not come back to systemic deposits, at least by March end

❑ System liquidity is still at a deficit of Rs 1.6 trillion (end-Feb) while average deficit is higher at Rs 1.95 trillion. We believe around Rs 1 trillion more will be needed by March still to keep the systemic liquidity just in equilibrium mode