The findings have established the existence of a fraudulent scheme, orchestrated by Anil Ambani and administered by the Key Managerial Personnel (KMPs) of Reliance Home Finance Ltd (RHFL), to siphon off funds from the public listed company (RHFL) by structuring them as ‘loans’ to credit unworthy conduit borrowers

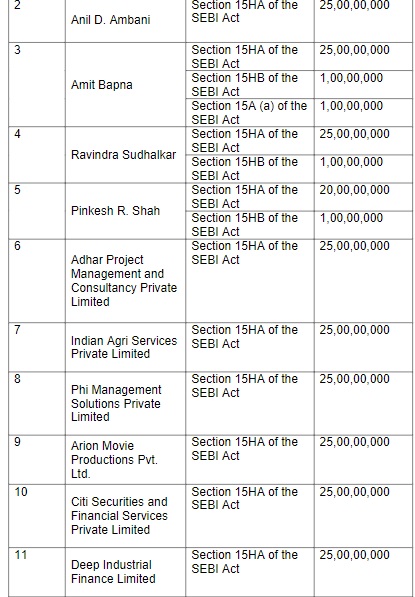

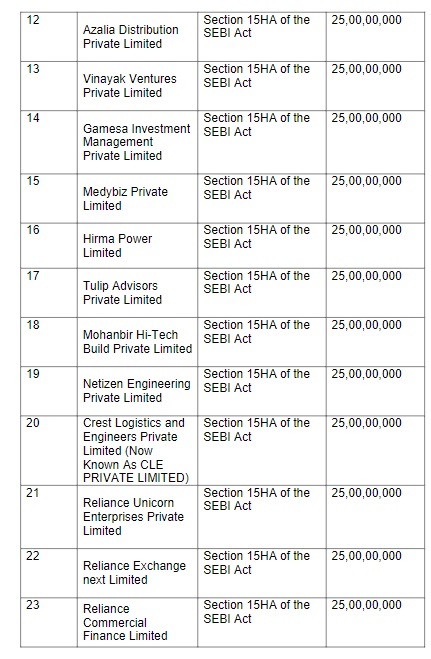

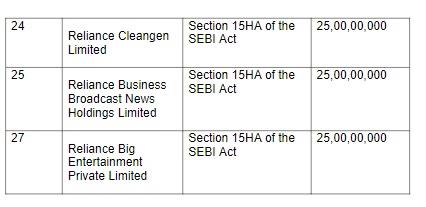

Number of Noticees with the amount of fine in Rs

FinTech BizNews Service

Mumbai, August 23, 2024: SEBI has restrained Anil Ambani from being associated with the securities market including as a director or Key Managerial Personnel in any listed company, holding/ associate company of any listed company, or in any intermediary registered with SEBI, for a period of 5 years, from the date of coming into force of this direction.

Ananth Narayan G., Whole Time Member, Securities And Exchange Board Of India, has given the following directions as part of Final Order in the matter of Reliance Home Finance.

DIRECTIONS

The findings have established the existence of a fraudulent scheme, orchestrated by Noticee No. 2 and administered by the KMPs of RHFL, to siphon off funds from the public listed company (RHFL) by structuring them as ‘loans’ to credit unworthy conduit borrowers, and in turn, to onward borrowers, all of whom have been found to be ‘promoter linked entities’ i.e. entities associated/ linked with Noticee 2 (Anil Ambani).

As per the material available on record for Board Meeting dated February11,2019, I note that upon being presented with the data pertaining to disproportionate lending to GPCL borrowers by RHFL (55% to GPC Loans as compared to 45% for housing loans), Board of Directors of RHFL expressed concern on composition of lending portfolio. Further, Board of RHFL interalia directed the management to provide no further lending to corporates, auditors to check the documentation of loans, whether due diligence was done and verifying the adequacy of security. Further, RHFL Board constituted a sub-committee (where NoticeeNo.3 was also a member) to review such exposures to corporate loans on bi-monthly basis. I note that Board of RHFL had issued strong and equivocal directions with respect to GPC Loans so as to protect the interests of the company.

However, the functionaries of the Company did not comply with the directions of the Board. As observed from the CAMs approved after February 11,2019, Noticee Nos.3&4’s name were conspicuously missing from such CAMs sent to NoticeeNo.2. However, as noted from the Minutes of Board Meeting and organogram,NoticeeNos.3–5 were authorized to issue instructions to the functionaries of RHFL, including the employees who had signed the CAMs put up after February11,2019. In the peculiar facts and circumstances of this case, by preponderance of probability, the only rational explanation is that certain KMPs under the instruction of NoticeeNo.2, who was not holding any position in governance of RHFL, systematically stripped the company’s assets/funds in blatant defiance of the RHFL Board’s direction. This being the case, it would be unfair and disproportionate to treat the company RHFL on the same footing as that of the aforesaid persons. The directions must therefore, in my view, take into account the aforesaid mitigating factor.

It is a matter of record that Noticee No. 5 had attended the RHFL Board’s meetings held on February 11, 2019 and March 28, 2019 wherein Board had inter alia expressed concerns on GPC lending and directed the same to be discontinued. The then statutory auditor PWC had also raised queries on the GPCL lending process and was continuously communicating with him.

Despite the concerns of the Board and PWC, I note that GPC loans continued to be extended till May 2019. Further, he, along with Noticee No. 4, was responsible for misrepresentation of financials of the Company and issuing certificate under Regulation 17(8) of LODR Regulations certifying that all the financial statements did not contain any materially untrue statement. However, as per the material available on record, I note that Noticee No. 5 did not approve the ‘loan’

applications of the GPCL borrowers. I also note that Noticee No. 5’s direct role in actual disbursal of ‘loans’ to GPCL borrowers is not supported by conclusive material on record. Therefore, unlike Noticee Nos. 3 & 4, the roleof Noticee No. 5 as a KMP in the fraudulent scheme is relatively different and the same needs to be considered while issuing directions against Noticee No. 5, in the interest of proportionality.

It is well established through various decisions of the Hon’ble Supreme Court, Hon’ble High Courts and Hon’ble SAT that the scope of the power under Section 11B of the SEBI Act is wide, under which directions can be passed to order refunds/ bring back monies/ disgorge illegal gains made by any person in violation of securities law.

I note that investigation in the matter has concluded thatthe Noticees were involved in perpetrating afraudulent scheme by disbursing GPC ‘loans’ resulting in erosion of the company’s finances due to such loans eventually being declared NPA. Though the Interim Order cum SCN explicitly alleges that promoter/ promoter linked entities were beneficiaries of the funds diverted from RHFL, the gains they made haven’t been quantified and persons haven’t been directed to show cause why a specific gain should not be refunded or disgorged.

I note that Investigation Report and Interim Order contain repeated references to promoter-linkedentities being the beneficiaries of the funds diverted from RHFL. Also, the Investigation Report and InterimOrder contain repeated references to GPC ‘loans’ given by RHFL being rendered NPA. From the aforesaid two sets of references, it may be inferred that NPAs of RHFL were equated with the benefits made by promoter linked entities for the purposes of Show Cause Notice issued to the Noticees. I am of the view that there is a need to quantify such receipts/gains and ascertain the real beneficiaries behind the web of companies. Therefore, in compliance with principles of natural justice, I find that illegal gains, if any, must be quantified. Noticees who have made the said gain must be identified, and an opportunity should be granted to Noticees’ to rebut the findings of SEBI on the

illegal gains/ benefitsmade by them, before any direction is passed with respect to such gains.

I note that Interim Order cum SCN called upon Noticee Nos. 3-5 to show cause as to why any other suitable directions including directions of recovery of remuneration as paid by RHFL during the period of investigation be not issued against them. In this regard, I note that the allegation in the Interim Order inter aliais that Noticee Nos. 3-5 are that they aided diversion and/ or misuse of funds of a listed company for the benefit of the other Reliance ADA group entities and exhibited gross misconduct and unprofessional behaviour on their part while approving the GPC loans leading to erosion of wealth of shareholders.

However, I note that there is no allegation with respect to the legality of their appointment to the positions held by them in the Company or that they benefitted from the diversion of funds of the listed company. I note that salary/ remuneration of a person is a compensation for the work done by him in the professional capacity for which he is duly appointed by the Company and it cannot be considered as profit made by that person. I note that Hon’ble SAT delved on the issue of disgorgement of salary in the matter of NSE v. SEBI22 and held as follows:

“We also note that the direction to disgorge 25% of the salary is patently erroneous. The power under Sections 11 and 11B for disgorgement cannot be extended to recover money from salary. Salary is a periodical payment for one’s labour. As per Black’s Law Dictionary Eight Edition salary means compensation for services. Salary is given to a person as a remuneration for the work that he does in an organization. Salary is not a profit nor can it be termed as an unfair gain for the work which the person has done in the organization. If the person is not in service/employed, the question of 22SAT Order dated Janaury 23, 2023 (SAT Appeal No. 333/2019, leading matter in a bunch of appeals)

disgorgement from the salary does not arise. Recovery from salary can only be done when the person is in service/employed. Disgorgement under Sections 11 and 11B can only be made for illegal or unethical acts through such transactions or activity which is in contravention to the provisions of the SEBI Act or the provisions made thereunder. In the absence of any illegal or any unethical acts and in the absence of any finding of unlawful gain being made by them the direction to disgorge 25% of the salary is wholly illegal and cannot be sustained. Directions under Sections 11 and 11B are equitable in nature. Disgorgement has been held to be an equitable direction. In our opinion, direction for disgorgement from salary amounts to penal recovery. It becomes punitive and not equitable.”

In view of the above and absence of any findings made in the Interim Order cum SCN regarding illegal gains made by Noticee Nos. 3-5, I am of the view that it is not a fit case for issuance of directions for recovery of remuneration against these Noticees. However, the Noticees conduct warrants remedial and punitive directions with respect to their association with the securities market, intermediaries and listed companies considering the serious damages that they have done to the integrity of the securities market.

Considering the egregious nature of the fraud perpetrated in this case, I am of the view that the maximum possible penalty must be imposed on all Noticees except against Noticee Nos. 1and 5for the reasons cited.

In view of the findings and having regard to the facts and circumstances of the case, I, in exercise of the powers conferred upon me under Sections 11(1), 11(4), 11(4A), 11B(1) and11B(2) read with Section 15A(a), 15HA and 15HB and Section 19 of the SEBI Act, 1992and Rule 5 of the SEBI (Procedure for Holding Inquiry and Imposing Penalties) Rules, 1995,direct as under:

(i)Noticee No.1 is restrained from accessing the securities market and prohibited from buying, selling or otherwise dealing in securities, directly or indirectly, or being associated with the securities market in any manner, whatsoever, for a period of 6 months, from the date of coming in to force of this order.

(ii)NoticeeNos.2, 25 and 27 are restrained from accessing the securities market and prohibited from buying, selling or otherwise dealing in securities, directly or indirectly, for a period of 5years, from the date of coming into force of this order.

(iii) Noticee No.2 is restrained from being associated with the securities market including as a director or Key Managerial Personnel in any listed company, holding/associate company of any listed company, or in any intermediary registered with SEBI, for a period of 5 years, from the date of coming into force of this direction.

(iv)NoticeeNos.3to5 are restrained from being associated with the securities market including as a director or Key Managerial Personnel in any listed company, or any intermediary registered with SEBI, for a period of 5years, from the date of coming into force of this direction.

(v)The present proceedings initiated against Noticee No.26 (Reliance Broadcast Network Limited) and NoticeeNo.28 (Reliance Capital Limited) shall be decided by separate orders.

(vi)Noticees are hereby imposed with the penalties as specified.

This Order shall come into force with immediate effect.

SEBI shall determine the quantum of illegal gains/ benefit made by way of the fraudulent scheme as established in this Order and action may be initiated in accordance with law.

A copy of this Order shall be served on the Noticees. A copy of this Order shall be forwarded to the Stock Exchanges, Depositories, Registrar and Share Transfer Agents and Banks to ensure necessary compliance.