This publication will act as a valuable source of information on UCBs for researchers, analysts, policymakers, bankers, and the public at large.

FinTech BizNews Service

Mumbai, April 24, 2025: The Reserve Bank of India has released the 11th volume of the annual publication titled ‘Primary (Urban) Co-operative Banks’ Outlook 2023-24’. It can be accessed at https://data.rbi.org.in/#/dbie/reports/Publication/Time-Series%20Publications/Primary%20%28Urban%29%20Co-operative%20Banks'%20Outlook

The publication has been brought out by the ‘Department of Supervision’ of the Reserve Bank of India.

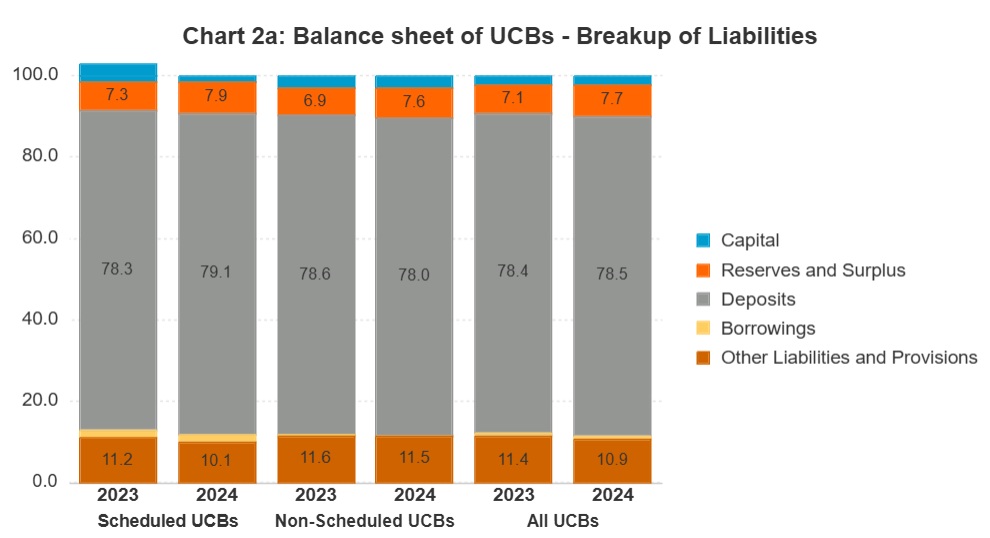

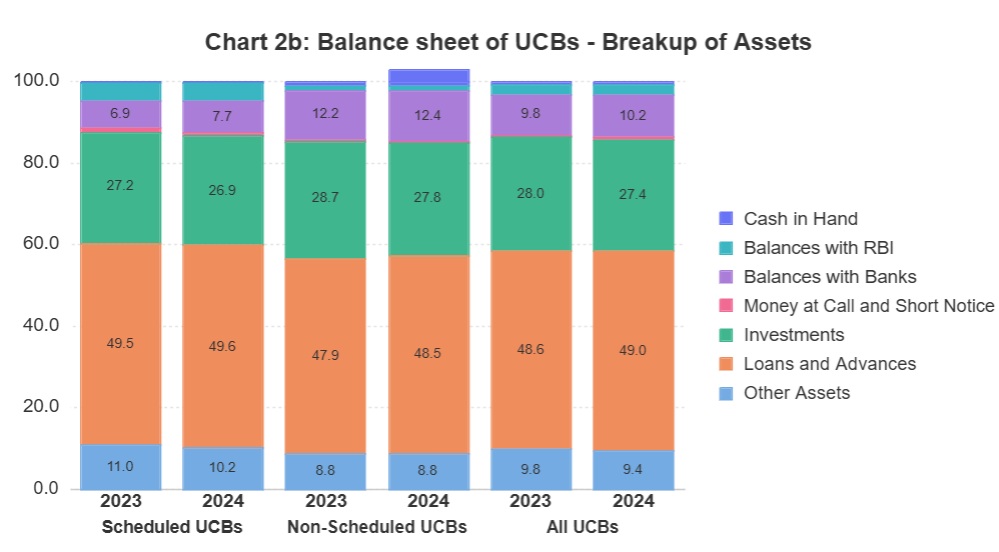

The publication covers the financial accounts of Scheduled and Non-Scheduled Primary (Urban) Co-operative Banks for the financial year 2023-24. The publication provides aggregate information on major items of balance sheet, profit and loss account, non-performing assets, financial ratios, state-wise distribution of offices and details of priority sector advances. Besides, the publication also provides bank-wise information of Scheduled Primary (Urban) Co-operative Banks on balance sheet items, select financial ratios on Capital Adequacy, Profitability, and Employee Productivity. The publication is being brought out in only electronic form on an annual basis on the Reserve Bank’s website through the link https://data.rbi.org.in/#/dbie/reports/Publication/Time-Series%20Publications/Primary%20%28Urban%29%20Co-operative%20Banks'%20Outlook of Database on Indian Economy (DBIE). There will be no hard copies of the publication available for the reference in the matter.

The Department of Supervision collects regulatory and supervisory data from all Primary Urban Cooperative Banks as a part of its supervisory assessment framework. Since 2013, a summary position of key financial and performance variables has been disseminated, such as major balance sheet indicators with broad components of liabilities and assets along some key ratios; income, expenditure and profit & loss account; Non-performing assets ratios for loans and investments, provisioning; Capital Adequacy ratios, etc.

The report also gives details of branches/offices. This volume has been brought out by the Department of Supervision under the guidance of Dr. Vijay Singh Shekhawat, Chief General Manager. The staff team for this publication was headed by Dr. Yogesh Kumar Gupta and Dr. Jugnu Ansari, General Managers with able support from Mr. Rajib Sarkar, Assistant General Manager, Mr. Prasanna Agrawal, Manager, Mr. Shubham Goel, Manager and Ms. Ayushi Chauhan, Manager. This publication will act as a valuable source of information on UCBs for researchers, analysts, policymakers, bankers, and the public at large.