Can India Remain Competitively Attractive To FPIs?; The State Bank of India’s Economic Research Department has come out with a research report titled "US Fed slays the rates by 50 bps but adopts a cautious, non-linear outlook"

FinTech BizNews Service

Mumbai, September 19, 2024: The State Bank of India’s Economic Research Department has come out with a research report titled “US Fed slays the rates by 50 bps but adopts a cautious, non-linear outlook.” The insightful report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Highlights from the report:

After setting the tone in Jackson hole, FOMC led by Governor Jerome Hayden Powell slashed the Federal funds rate by a rather brave 50 basis points (a big shot may be, but definitely not a Jumbo cut as painted elsewhere), reversing one of the steepest rate tweaking phases set in motion on March’17 2022 though the reading between the lines exposes the fault lines in Fed’s playbook.

The Federal Reserve (voted 11-to-1) to slash the benchmark interest rate by 50 bps to 4.75%-5.0% for the first time in four years. US Fed sees the benchmark interest rate falling by another 50 bps by the end of 2024 (two 25-bps cut each more likely), another full percentage point in 2025, and a final half-point reduction in 2026 to end in a 2.75%-3.0% range going by the latest FOMC dot-plot. In Jun’24, the last time the Fed released quarterly projections, the median U.S. central bank anticipated just one 25 bps reduction in all of 2024. At that time Fed projected median inflation for 2024 at 2.6%. Since then, inflation eased from what had been unexpectedly strong readings early in the year and now in Sep’24 policy it has projected 2.3% median inflation for 2024. The Fed said it decided to cut rates in light of progress toward its inflation goal and with the risks to both its mandates now "roughly in balance."

However, the Fed has increased the unemployment rate projection from 4.0% in June meeting to 4.4% in September meeting for 2024. The interesting part now would be Fed’s ability to navigate through the twin mandates; supporting maximum employment and returning inflation to its 2 percent objective. Despite the Fed bravely assuaging the markets’/ investors’/households’ psyche through a bolstered interpretation of recent indicators suggesting the economic activity continuing to expand at a solid pace, job gains having slowed, and the unemployment rate having moved up though remaining low as Inflation has made further progress toward the Committee's 2 percent objective the general perception seems to view the bold move as a litmus test by a Central Bank worried down to the hilt by the overall stratospheric hike in prices in the last four years, coupled with higher interest outgo on mortgages and other borrowings (Credit Card outstandings have grown to $1.14 billion as on June’24, up ~5.8% from a year ago). Coupled with this is the upwardly growing synchronization among joblessness of various ethnic groups (relatively well off Whites and Asians also showing elevation in joblessness along with Hispanics and people of color) and uncertain trajectory of non-core inflation clouding its vision.

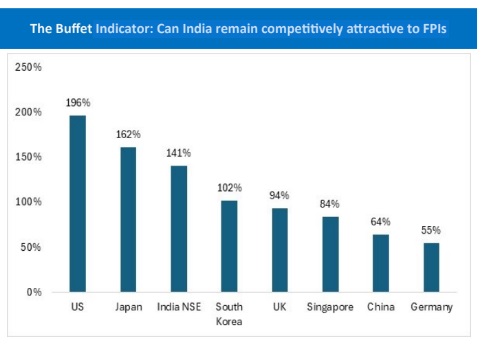

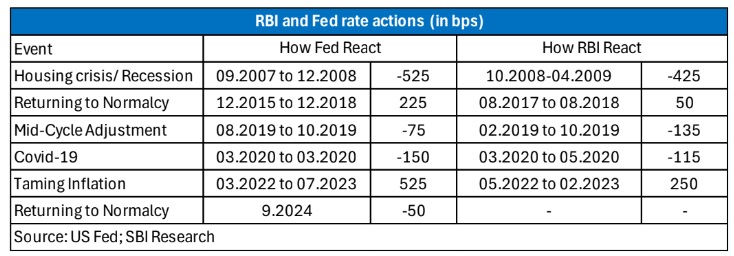

While the Fed rates bandwidth have an overarching effect on global sentiments, in particular on investments and capital flows on real time basis, from a purely Indian perspective we believe the action largely remains a minor one for the flows to Equity markets (chiefly due to sharp rise in Buffet indicator, the current M-cap to GDP ratio of ~141% (93% as on March’23) which places the Indian markets at a slightly overvalued pedestal. The bond markets may witness comparatively better inflows due to rate differentials trajectory continuing (and GoI sticking to lower fiscal deficit targets) as the RBI looks more set to depart from the ’Follow the Fed’ mentality for good, having created a robust and resilient Indian financial ecosystem, fueled largely by domestic demand-supply metrics. The USD/INR however may undergo some gravitational pull to sustain the country’s competitiveness on trade front, despite a weakening Dollar index.

The aggressive rate cut by Federal Reserve has important bearing on RBIs own decision on interest rates. Although this is not explicit, fall in dollar rates impact the domestic inflation through international prices. The recent minutes of the RBI MPC do indicate discussions on possible Fed rate actions. RBI may disassociate from the interest rate developments in the US and may take independent view on the domestic rates based on evolving conditions. Domestic conditions are paramount and with robust growth higher than potential output, case of pause exists. This is further supported by the fact that impact of weak dollar on international prices and its pass through on Indian economy may evolve in coming days. Additionally, the better liquidity position may provide the cushion to the Central Bank to let the festive season tide over. As such, we don’t anticipate any rate action by RBI in calendar 2024. An early 2025 rate cut (February) looks the best bet as off now. We still believe that liquidity challenges will remain for the banking sector with Government cash balances progressively moving out of the banking system with a move towards JIT mechanism.