female tax filers are around 15% of the individual tax filers; The quantum of ‘crorepati’ taxpayers rose 5x to 2.2 lakh in AY24 (against 0.4 lakh in AY14); How Tax Simplification has given a necessary fillip to ITR Filing

FinTech BizNews Service

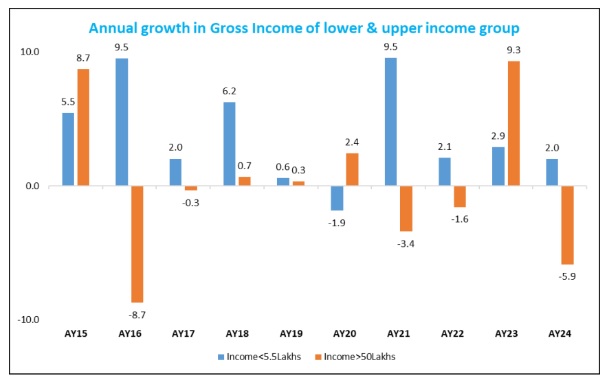

Mumbai, 27 October, 2024: A comparison of disparity in income during AY15 and AY24 shows that there is a clear rightward shift in the income distribution curve signifying people in lower income brackets are increasing their income to converge towards their share in population, as per a report authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

The report further states: “Our analysis shows that there has been a cumulative 74.2% decline in income disparity coverage for those earning up to Rs 5 lakhs.... This shows the continuous efforts of Govt are reaching the bottom of pyramid – that is leading to increase in income of ‘lower income group’ people.

❑ With an increasing alignment with progressive taxation regime, contribution of direct taxes to total tax revenue reached 56.7% in AY24 (54.6% in AY23), the highest in 14 years. The growth rate of Personal income tax (PIT) collections has been surging faster than Corporate tax collections since FY21, with PIT increasing by 6% against CIT’s 3% growth

❑ Maharashtra has the highest share in direct tax collection kitty (~39%), followed by Karnataka, Delhi, Tamil Nadu and Gujarat. Also, riding the new gilded age of economic boom, states of Maharashtra, Delhi, Karnataka, Tamil Nadu have higher per capita tax than national average. States like Andhra Pradesh, Uttarakhand, Haryana, Kerala and Gujarat have per capita tax lower than national level but higher per capita income

❑ Direct taxes to GDP ratio inched up to 6.64 % in AY24, highest since 2000-01, vindicating the results of improving tax compliance. Interestingly, Direct Tax

buoyancy grew to 1.86 in 2023-24 from 1.25 in the previous financial year while Cost of collection declined to 0.44 % in FY24 (0.51% in FY23)

❑ ITRs filed during AY24 witnessed a phenomenal jump, standing at ~8.6 crore (against ~7.3 crore in AY22). A total of 6.89 crore or 79% of these returns were filed on or before the due date, the concomitant result in the share of returns filed after due date (i.e., with fine) thus declining from a high of 60% in AY20 to merely 21% in AY24. We believe the total number of ITRs filing for AY25 could swell more than 9 crore by end March’25 (7.3 crore ITRs have been filed by the due date) while inculcating more discipline amongst the filers

❑ Granular analysis indicates the shifting of middle class in India from income range of Rs 1.5-5.0 lakh in AY14 to Rs 2.5-10.0 lakh in AY24...Even the quantum of ‘crorepati’ taxpayers rose 5x to 2.2 lakh in AY24 (against 0.4 lakh in AY14)

❑ Top-5 states (Maharashtra, Uttar Pradesh, Gujarat, Rajasthan and Tamil Nadu) accounted for ~48% of the total ITRs filed in AY24. These states also accounted for the maximum increase in incremental number of ITRs filings witnessed during the intermittent period (AY24-AY15), driven in part by better employment opportunities being created, as also the migration efflux inter/intra geographical pockets

❑ Gini coefficient, estimating ITR data of taxable income of individuals, reveals individual income inequality has decreased from AY13 ( FY12) to AY24 (FY23) from 0.489 to 0.460. The jump in Gini Co-efficient during last two AYs (from a declining trend witnessed earlier) could be more specific to increased participation of wide cohorts of retail investors (specifically lower income group) in F&O segments of Capital Markets, sans much understanding of the intricacies of the broader markets. However, based on our projections, we understand that Gini coefficient should further decrease to 0.441 in AY25.

❑ Declining Income Inequality mirroring upward transition of lower income people along with their income is evident....43.6% Individual ITR filers, belonging to income group of less than Rs 4 lakhs in AY15 (FY14), have left the lowest income group and shifted upwards...also, 26.1% of the gross income of lowest income group of lower than Rs 4 lakhs has shifted upwards in the intermittent period

❑ Working on Income disparity curves of AY15 /FY 14 and AY24 /FY23 (comparison of disparity in income) shows that there is a clear rightward shift in the income distribution curve signifying people in lower income brackets are increasing their income to converge towards their share in population

❑ We believe that Govt’s measure of simple average (ratio of total income of taxpayers to total number of taxpayers) as given in IT data, is not able to capture granular contribution of each income bracket in increase of total income. We have, thus, calculated the weighted mean income of Individuals. The modified metric provides picture of granular increase of income within income brackets, thus captures their contribution better.

❑ Direct tax file base is increasing in hitherto untapped states....States such as Maharashtra, Delhi, Gujarat and Karnataka, which have been traditional leaders in income tax base are nearing saturation in ITR filing while UP, Bihar, AP, Punjab and Rajasthan are gaining share in incremental growth of filers

❑ Female Labour force participation is on the rise (from 23.3 in 2017-18 to 41.7 in 2023-24), with Jharkhand, Odisha, Uttarakhand, Bihar and

Gujarat fanning the maximum movement

❑ As Income Tax Department has solicited comments from public to modify the IT act, after a hiatus of 6 decades, woven around four pillars of

simplifying the act, reduction of litigations, compliance reduction and removing redundant / obsolete provisions, we opine that greater reforms

can be initiated on banking front that has a direct connect with all adults / households and suggest introducing uniform taxation by

considering a proposal for taxing at the flat rate of for individuals over a particular threshold income, senior citizens (60 to 80 age)

and for super seniors (80+ age) for income above Rs 10 lakhs as also revisiting the TDS threshold suitably

Direct taxes to GDP ratio is two decade high and cost of collection is lowest since 2001

❑ Direct taxes to GDP ratio is 6.64 % in FY24, which is highest since 2000-01,when consolidated time series by

CBDT is available

❑ Direct Tax buoyancy grew to 1.86 in 2023-24 from 1.25 in the previous financial year

❑ Cost of collection (expenditure on tax collection as proportion to total tax collection) declined to 0.44 % in FY24

from 0.51 % in FY23

5 States contributing more than 70% in total direct taxes collection

❑ Maharashtra having highest direct tax collection (38.9%), followed by Karnataka, Delhi, Tamil Nadu and Gujarat

❑ States like Maharashtra, Delhi, Karnataka, Tamil Nadu, have per capita tax higher than national level

❑ States like Rajasthan, Punjab, Bihar, West Bengal, Odisha, MP and UP have per capita direct tax lower than national level and low per capita income

❑ However, states like Andhra Pradesh, Uttarakhand, Haryana, Kerala and Gujarat have per capita tax lower than national level and high per capita income

Female ITR filers – methodology

❑ We have endeavored to estimate female tax filers based on the female labour force participation rate

❑ First female LFPR of 15+ is calculated for each state using the female population estimate for 2024

❑ Further, as agri income is exempted from income tax we considered only non-agri female workers considering the % share of

females in non-agri activities from the PLFS report

❑ Next, we took the individual tax filers for each state (94% of overall tax filers) as a proportion of total labour force for that

state. This proportion is taken as the proxy for formalization in that state and is then used to calculate the female tax filers

from the non-agri female labour force

Since the PLFS gives labour force participation rate for agri, forestry and fishing but only agri income is exempted

from income tax, we have considered a range of female ITR filers

❑ Our estimates show that female tax filers are around 15% of the individual tax filers

❑ Certain states as Kerala, Tamil Nadu, Punjab and West Bengal have higher share of female tax filers