Kotak Institutional Equities report on Banking sector: Several variables at play, resulting in high forecasting error; Understanding the path of NIM over the next few quarters

FinTech BizNews Service

Mumbai, July 11, 2025: Kotak Institutional Equities has come out with a special research report on Banking sector:

Our recent conversations with investors highlight a recurring theme on the path of NIM for FY2026. While we have highlighted that the variables affecting NIM are harder to forecast for the short term, it is more likely to see a gradual recovery rather than an immediate one. The timing of rate actions suggests faster compression and early recovery for public than private banks.

Several variables at play, resulting in high forecasting error

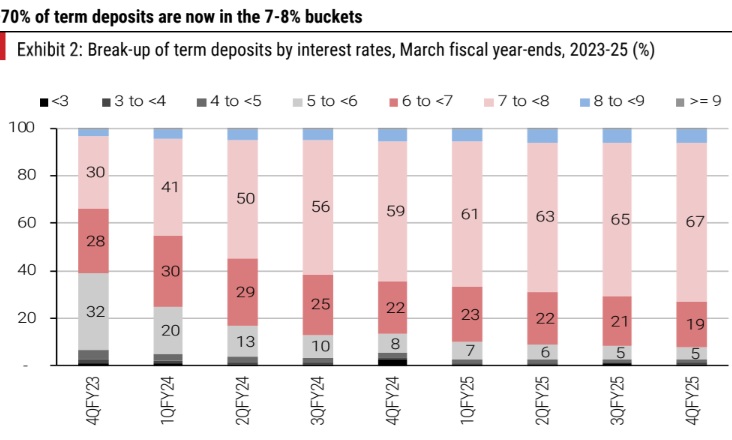

We believe that forecasting NIM, specifically for the short term, is likely to have a high error margin. Hence, we do see the rationale behind lenders not giving us any specific direction on the quantum of decline and timing of normalization. On the deposits side, we have to factor in the (1) flow between term and low-cost CASA, (2) quantum of deposits maturing at various interest rates and mobilizing deposits following the recent interest rates and (3) composition of savings accounts across various interest rates. On the loan side, we need to factor in (1) the timing of the reset of interest rates, (2) the composition of loans, the interest rate benchmarked on these loans and the frequency of the reset of interest rates and (3) spread changes on existing loans and fresh loans disbursed.

Repricing of deposits to be longer; savings rate cut implications uncertain

We have built in a marginally better-than-a-simplistic model to understand the dynamics of these changes, with an objective to have a better understanding of the direction rather than being precise about it. Our current thesis is leaning toward a gradual recovery in NIM rather than an immediate recovery, even from 3QFY26. The key challenge would be repricing of term deposits, which is likely to be more gradual, pushing out the NIM expansion. The near-term support from cuts in savings interest rates would be insufficient to reduce the NIM impact.

Lenders have two choices—allow NIM to drift with the cycle given the structure of assets and liability repricing, or smooth out the NIM volatility. Lenders need to assess if changing the interest rates differently (term deposits in a rising cycle and a combination of savings interest rates and term deposits) at various parts of the rate cycle would have any implication in their behavior as depositors. We acknowledge that savings interest rate product has a different purpose, but changes taken in this cycle need to have a more durable approach.

The challenge to choose between a cyclical headwind and long-term business

From a valuation perspective, we face a challenge in placing the right weightage between a cyclical headwind that is less worrisome than an asset quality challenge versus the stability and longevity of returns that these banks are delivering today with fewer asset quality issues. The key worry is the level at which NIM resets lower by 3QFY26 before NIM (1) starts improving and (2) peaks in this cycle, considering that the level of competition is higher and the quality of deposits is likely to be fairly inferior (lower CASA ratio) in this leg of the cycle. We are likely to see lenders looking at other metrics such as operating efficiency and leverage to drive return ratios closer to long-term averages.

Slower deposit repricing makes it harder to build NIM improvement

The RBI disclosure on yield on loans and cost of deposits, both on an incremental basis as well as on an outstanding basis. When the rates are moving higher, it becomes relatively easier for lenders to manage their NIM and growth expectations. Lenders can raise deposits through term and wholesale, if required, and it would still have a better outlook for NIM or NII growth. However, the challenge is usually when the rate cycle starts to soften as lenders have multiple challenges to solve. The rate cycle should ideally be a lot more gradual and phased out, giving time for lenders to reprice their liabilities. However, past history has shown that the situations are usually less than ideal as rates tend to fall sharply to reflect abrupt changes in the macro environment.

Deposit repricing involves multiple variables and behaves differently across phases of the interest rate cycle. In a rising rate environment, lenders enjoy several advantages. The marginal cost of deposits tends to be lower than the average cost, allowing lenders to pursue growth more confidently by offering higher rates on incremental deposits. However, the reverse scenario is far more complex. In a declining rate cycle, cutting deposit rates becomes difficult, as the risk of losing deposits to competitors increases significantly. Another key distinction between rising and falling rate cycles lies in the role of low-cost deposits. During rising rates, lenders can grow even with a reduced CASA contribution. In contrast, when rates decline, maintaining growth becomes more challenging without a strong CASA base. These dynamics highlight the asymmetry in deposit pricing behavior and the strategic complexities lenders face in managing deposit costs across different phases of the interest rate cycle.

We observe that lenders have chosen to cut savings interest rates in this cycle, but we seek a deeper understanding of this behavior. Notably, they did not raise rates across all savings buckets—only in the higher-ticket segment. Ideally, we would prefer a more consistent approach, where rising interest rates also lead to adjustments in savings rates. This would help depositors form clearer expectations, knowing that savings rates are somewhat aligned with broader interest rate movements. A more transparent and uniform rate-setting behavior could strengthen depositor confidence and improve the predictability of deposit flows.

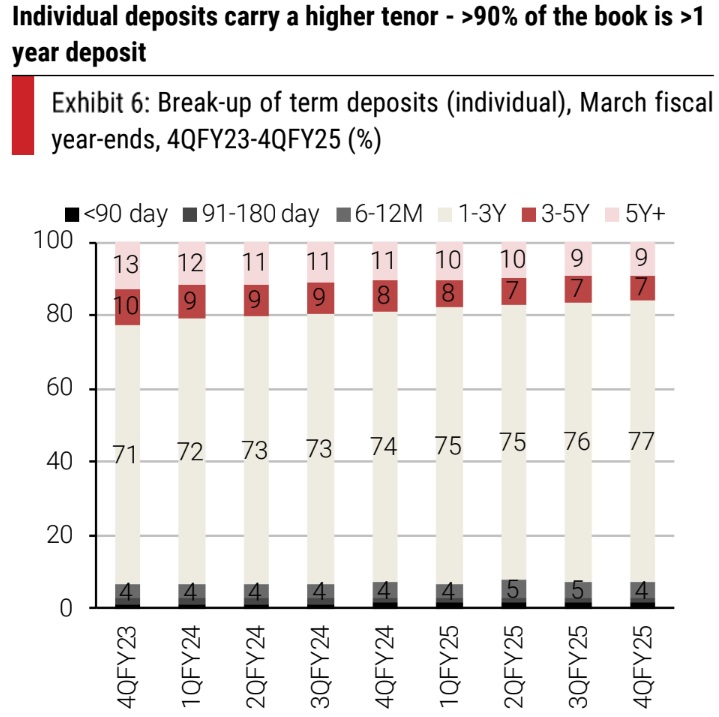

Lenders have been shortening deposit durations in recent years, likely driven more by interest rate dynamics than depositor behavior. Slightly lower rates on longer tenures (1-3 years) make it harder for depositors to commit, given the uncertainty around the rate cycle’s duration. This suggests lenders may be aiming to reduce NIM cycle volatility, but such moves are also reshaping depositor behavior in lasting ways we should monitor. For now, depositors remain comfortable with banks despite the availability of safer alternatives. However, maintaining a wide gap between savings and term deposit rates—or introducing excessive rate volatility—could trigger behavioral shifts we must be cautious of. These shifts may not only affect deposit stickiness but also challenge the traditional banking model, if depositors begin favoring more stable or flexible options. Understanding these evolving preferences is key to anticipating future trends in deposit mobilization and retention.

Loans repricing extends beyond EBLR-linked loans

On the asset side, we have investments and loans subject to repricing. The decline in investment yields is often linked to treasury gains that lender may book in a given year, making it relatively difficult to model. However, we note that the duration of this book is fairly high, given the quantum of loans within the portfolio.

Changes in lending yields are influenced by multiple factors. Primarily, interest rates are benchmarked to various loan types—EBLR, fixed rate, floating rate, MCLR and others. Repricing is not uniform even for loans with similar reference rates. For instance, public banks have transmitted rate changes faster than private banks for EBLR-linked loans. Meanwhile, MCLR-linked loans, which include a higher share of mid and large corporate exposures, tend to reprice over longer intervals. These loans also face significant takeover risks, if arbitrage opportunities are compelling. Varying spreads across loan products further complicate projections of lending yield changes. Finally, risk-taking could undergo a change as well. This would imply that lenders can offset some of the risk by improving or reducing the spreads, which too has a bearing on lending yields.