India is expected to garner total inflows close to US$ 30bn in FY25

Jahnavi Prabhakar

Economist

Bank of Baroda

Mumbai, May 14, 2024: The inclusion of Indian government bonds in the Bloomberg and JP Morgan global bond indices has

excellent implications for Indian market and the economy as a whole, raising its standing amongst its

global peers. The optimism surrounding growing prospects of economy, coupled with lower inflation,

stable currency and stability in reforms remains favorable and reflects optimism towards India’s

growth potential. This serves as a strong background for potential investors and opens new sources of

investment avenues for domestic capital, given there is availability of funds. This is touted to be the

shining moment for Indian economy.

Indian economy remains a favored place for investment as has been reflected by strong FPI flows in

the past few months. After China and Brazil, India’s government bond market is the third largest

amongst emerging economies. The foreign ownership stands at a mere 2%, much lower when

compared to other emerging economies. Back in Sep’23, it was announced that starting from 28 Jun

2024, JP Morgan will include India in its Government Bond Index-Emerging markets. The GBI EM GD

(Global diversified Index) comprises of fund from across the globe with the AUM totaling to US$

213bn. India is assigned a weightage of total 10% in the index. With this weightage, India is expected

to garner total inflows close to US$ 30bn in FY25. There will be an investment in over 23 Indian

government bonds with the notional value to the tune of US$ 330bn. In addition to this, Indian

securities are also expected to be included in the Bloomberg EM local currency government Index.

The index could possibly include 34 Indian securities. This is likely to happen by Jan’25 with an initial

weightage of 10%. With this, India’s rupee will become the third largest currency, component wise

after China’s renminbi and South Korean won. Overall, we expect this will bring in combined (equity

and debt) FII flow to the tune of US$ 40-45bn.

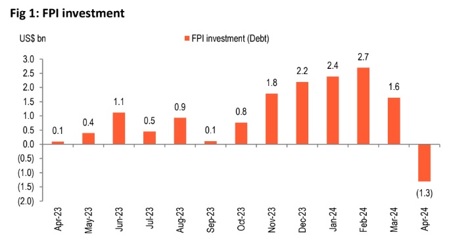

Global market trends and macro updates have influenced the global movement of FPI flows. The news

of inclusion of India in the government bond index has driven FII flows higher across segments

including, in the debt segment. There has been a steady increase starting from Oct’23, with FII

flows in the debt segment at US$ 0.8bn and climbing to US$ 2.7bn, highest level in over 5-years.

Secondly, the sector wise data under the sovereign segment (Fig 2) has noticed a gradual increase in

investment scaling as high as US$ 29bn in Mar’24, signaling greater demand and sharp uptick since

Oct’23 given the announcement of inclusion of India in the global bond indexes. This is based on the

following factors:

- India’s economy remains on strong footing with the economy expected to clock 7.6% in FY24

according to government estimates. For FY25, RBI expects the economy to register a growth

of 7%. Even other global agencies have forecasted India to grow at a healthy pace of 6.8%

(IMF) with the possible upward revision and 6.6% (World Bank) for FY25.

Strong optimism surrounding India’s growth story, signs of traction in domestic demand,

supported by benign oil prices. Additionally, robust capital markets coupled with returns and

conducive environment will attract more FII flows in to the country.

FPI inflows in the debt segment have started increasing from November

right up to March. In April the decline can be attributed to market expectations of the Fed deferring

the decision on rate cuts beyond June. This means that interest rates will remain high for longer in the US markets.

AUC under sovereign bonds had increased to an all-time high of $ 28.8 bn in March

2024. Until September 2023, it had remained range bound at $ 18-19 bn.

However, there has been some moderation lately and the reasons for this include: 1) Uncertainty over interest rate movement by global central banks. 2) Uneven growth in global economies with

divergence in global central banks actions. According to OCED, US is expected to witness slowdown,

with growth forecasted at 2.6% in CY24, followed by 1.8% growth projected in CY25. China’s economy is projected to grow at a much slower pace from 4.9% to 4.5% in CY24 and CY25 respectively. On the other hand, Japan is projected to rebound and register a growth of 0.5% and 1.1% for the same period.

Europe is likely to witness some recovery, with a growth of 4.9% (CY24) and 4.5% (CY25). 3) Escalated

geo-political tensions continues to remain a cause of concern with elevated risk of higher inflation.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.