Cumulative rate cuts of ~125-150 bps estimated in FY26 in the best-case scenario with inflation to breach 3% consistently for next 3 months barring any food price shock/heatwave

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, May 5, 2025: The benign inflationary patterns suggest an aggressive rate cut trajectory by India’s Central Bank with key Policy rate likely to breach the Neutral rate by March’26 though the transmission of rate cuts on Deposits may not be even... Cumulative rate cuts of 125-150 bps estimated in FY26 in the best case scenario with inflation to breach 3% consistently for next 3 months barring any food price shock/heatwave .... Jumbo rate cuts of 50 bps could be a better signalling mechanism... Credit-Deposit wedge may aggravate as deposit rates bow down with lacklustre growth while OMOs and a buoyant dividend transfer to ensure no negative surprises on liquidity front and better yield management ...yields to move closer to 6% with a downward bias.

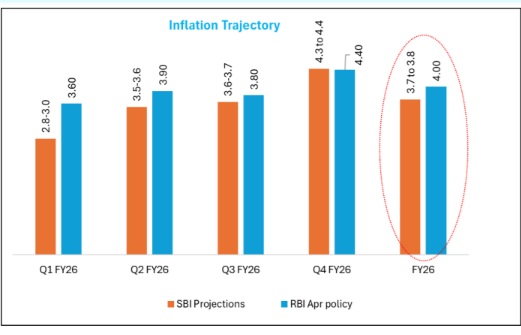

The sharp moderation in CPI inflation, hitting a 67-month low of 3.34% in Mar’25 due to sharp correction in food inflation bodes

well for lowering the average CPI headline forecast for FY26 below 4% now (with below 3% in Q1FY26).... Nominal GDP

growth is expected to be in the range of 9-9.5% for FY26 (Budget: 10%), signifying a Goldilocks period to slash the policy rates

given the low growth and low inflation

❑ With multi-year low inflation in March and benign inflation expectations going forward, we expect rate cuts of 75 basis points

in June and August (H1) and another 50 bps cut in H2 i.e. cumulative cuts of 125 bps going forward while 25 bps rate

cut has already been initiated in Feb’25 (that could put the terminal Rate at ~5.0%-5.25% by March 2026). However, we feel,

jumbo cuts of 50 bps, could be more effective than secular 25 bps tranches spread over the horizon

❑ In response to the 50-bps cut in the policy repo rate since February 2025, banks have reduced their repo-linked EBLRs by a

similar magnitude. While the MCLR, which has a longer reset period and is referenced to the cost of funds, may get adjusted

with some lag. Larger transmission to deposits rates is expected in the coming quarters

❑ Based on the available estimates of natural rate, the neutral nominal policy rates works out at 5.65%.... The current trajectory

of the domestic inflation is well within the band of 2-6% with average inflation based on available data placed at 4.7%. Thus,

there is 70 bps distance before target convergence despite the tolerance.... The potential output growth is estimated at 7%

and based on the advance estimates GDP growth of 6.3% and worst GDP growth at 6%, the output gap is in the range -100 to

-70 bps.... Assuming further convergence of domestic inflation to target, the possibility of cumulative rate cut of 125-150 bps is

also possible by March 2026...implying repo rate declining below neutral rate

❑ Given the dual mandate, the Fed may hold rates in next two cycles.... A pause signal is unequivocal based on recent

statements

❑ We expect the USD/INR pair to stabilize in the range ₹85-87 for 2025.... The domestic impact of tariffs on dollar will be

visible in 2025 which will support rupee...Further, DXY is expected to fall as US domestic economy will adjust to tariff

impact

Accelerated and Unabated series of OMOs showcase RBI’s willingness to go the Extra Mile even as massive OMOs by RBI

fortify the ecosystem though appearing counter intuitive to collective market wisdom at times.... RBI conducts OMO auction for

an overall quantum without security specific limits and retains flexibility to provide allotment to a maximum number of

participants. Typically, amount accepted is always spread among the securities so that any/one aggressive bidder may not

corner the liquidity window

❑ Auctions have also been held in some liquid, on the run papers - probably an attempt to provide liquidity to Banks who do not

run a large, longer duration HTM portfolio

❑ The present move, through OMOs scheduled for another Rs 1.25 lakh cr in May’25, looks aligned to keep liquidity in surplus to

the tune of ~Rs. 2 lakh crore+ as announced by the Governor in the last policy meet, more so factoring in the recent volatility in

the markets and outlook on anchoring durable growth while negating any impact of exogenous shocks’ pass through... Also

the maturing Short Forwards position, initiated to cushion the rupee from undue volatility against a masquerading Greenback

early this year and relentless sell-off by FIIs, now necessitates RBI to put in place countermeasures

❑ OMOs are also expected to build moats around yields.... Yields may remain capped due to replenishment demand from banks

that have offloaded securities in recent OMOs, balancing any spillover from heightened conflict post Pahalgam terror attack

❑ With close to ~Rs. 4 lakh crore of OMO done and another Rs. 1.25 lakh crore (or more!) pending, G-Sec holding by banks as a

% of SLR portfolio is on the decline. Moreover, larger holding by the regulator, at times, tends to affect secondary market

liquidity...RBI dividend could top Rs 2 lakh crores

❑ With rapid transmission of rate cuts desired, deposit rates would come under immediate downward pressure, ensuring

deposits mobilisation remain a Herculean challenge for Banks.... While Credit growth is expected to moderate at 11-12% for

FY26, Deposits may stop shy of double digit growth during the FY accentuating a wedge between Credit-Deposits momentum,

squeezing the NIM of banks adversely

❑ Assuming the % share of ownership is same as that of Sep’24, with slight increase in FPI’s share, the minimum gap to be filled

comes to ~Rs 1.7 lakh Crores in FY26.... OMOs in SDLs may be considered going forward to bring more balance to the

market and align RBI holding to the proportion of outstanding G-Secs and SDLs... Also, the huge number of outstanding SDL

securities (~5000 against ~100-Plus for Central Government) may be rationalized through Buy back