Revisit to IBC a MUST to keep its competitive edge; Divestment needs a concrete roadmap for attracting capital & confidence of FIs

Dr. Soumya Kanti Ghosh,

Group Chief Economic Adviser,

State Bank of India

Mumbai, July 08, 2024: The Government should focus on adherence to fiscal prudence and continue on the fiscal consolidation path, but at the same time refrain from obsessing too much over the fiscal stance (with FD estimated around 4.9% in FY25 budget as per SBI projections) as it may come in the way of long-term sustainable growth path, by striking the right balance by limiting the consolidation to 20 bps (at max) this fiscal

❑ The estimated decline in both Gross, as also Net market borrowings of GoI, in FY25 (Rs 13.5 lakh crore and Rs 11.1 lakh crore respectively) should also come as an enabler for the GoI’s glide path for fiscal prudence/ consolidation

❑ Parity on taxation front for bank deposits (both Demand and Time) vis-à-vis other investment avenues is an immediate need given the shifting preference of select cohorts of investors to alternate asset classes whose returns have been trumping bank deposits. Basis, our analysis, the impact on revenue foregone for GoI of any such move would not be significant

❑ After a decade of transformative changes, the Indian banking system stands much healthier ready to scale up to meet emerging challenges as the country embarks on the Viksit Bharat sojourn. There is, thus, an imminent need to shift to focused reforms that specifically meet calibrated Decarbonization and ESG targets at industry level

❑ The fault lines in the IBC set-up needs to be critically analyzed (chiefly from a time bound resolution angle as average resolution period has zoomed up to 863 days now) in view of conflicting situations arising of late pertaining to litigation, dissenting creditors and poor infrastructure that can dilute the very spirit of this radical, yet largely successful approach to course correct the flow of resources to productive sectors while also addressing insolvency issues.

Credit to Agri & Allied activities increased 3.5 X by March’24, hitting Rs 20.7 lakh crore, against Rs 6 lakh crore in FY14, standing at 37% of the output in the agriculture and allied sectors (Rs 56.19 lakh crore at current prices in FY23)

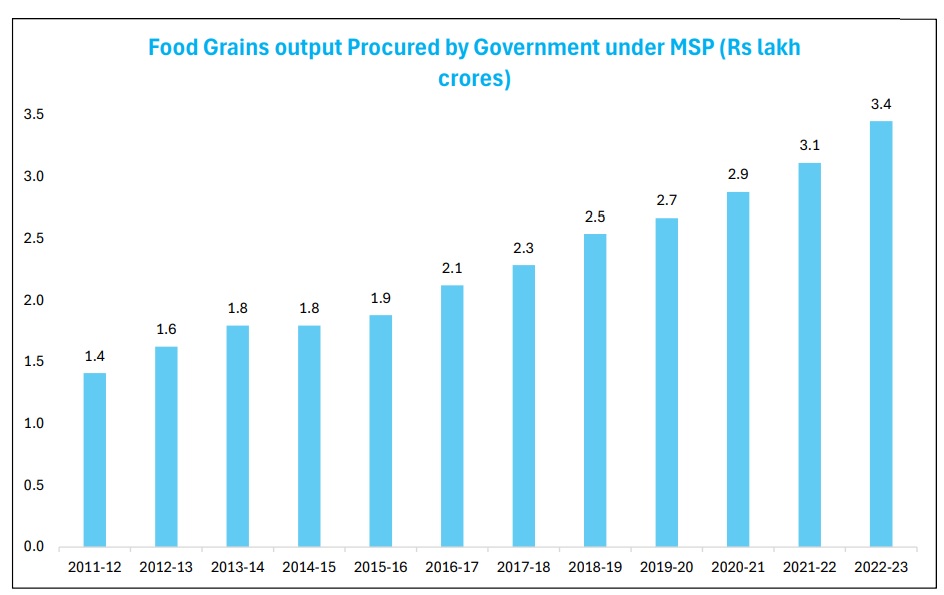

❑ While MSP has been instrumental in price discovery mechanism, benefitting 1.6 crore farmers, the issues innate to MSP mechanism viz. needless politics, disincentivizing private investment, neglect of non-MSP crops, reduction in export competitiveness & burden of trade disputes, alternative mechanism needs to be looked into vigorously, viz. obligation to private parties for buying crops at MSP (or above MSP), encouraging crop diversification, promoting high-value and climate-resilient crops to increase farmers' income opportunities as also strengthening agricultural marketing infrastructure through increase in public investment in agri infrastructure

❑ While the share of food grain in total Agri & Allied output is 17% (Livestock @31% tops the list), the share of food grains procured by the Govt. through MSP vide institutional mechanism works out to 6% of the total Agri & Allied output, though it has entailed an expenditure of Rs 3.4 lakh crore in FY23 (Rs 1.79 lakh crore in FY15). MSP of all the 22 crops has witnessed average increase of 100%+ during the last decade

❑ Analyzing eNAM prices, we understand prices of major crops are already above MSP even though prices of not so widely cultivated crops are a little under MSP…hence GoI could devise a plan to provide price support to the farmers, if only market prices fall lower than MSP (viz. Directly compensating the farmers the difference between selling price and MSP that would soften the fiscal cost of the GoI). Also, promising sectors with incremental value addition like livestock and horticulture should occupy a larger share of policy initiatives.

The agri and allied sector, under some state of slack even though undergoing a mélange of PHY-GITAL transformation, needs a few unconventional yet rewarding Big Bang approaches

• A Livelihood Credit Card (LCC) encompassing a multi-purpose loan covering a rural household’s entire activities for ease of doing KCC (with an initial pilot launch of one million) should further reinvigorate rural demand

• Changing the dynamics of KCC ‘review & renewal’ mechanism with repayment of ‘interest alone’ being the criteria for renewal while simultaneously deepening use of technology by Banks

• Forming a comprehensive omnibus Credit Guarantee Fund Trust-Agri & Allied Sectors (CGFT-AAS) which will act as a credit accelerator and ensure coverage of all fresh Agri loans including AVCF with a capital outlay of Rs 11,320 crore over 5 years, should boost fresh agri credit multiple times AND creating an institutional framework for enhancing demand for milk in Mid-Day meals for children could provide additional income stream for 1.58 cr farmers

❑ The hitherto fragmented and disheartened shift towards creating a vibrant and holistic Agri Value Chain needs an immediate revisit, including removing frictions in financing channels given the favourable trend being witnessed in the rural economy, growing horizontally with urban ecosphere. The value unlocking as also value creation should encompass end-to-end activities; farming, aggregating, grading/sorting, warehousing, value additions through processing and retailing, in particular on postproduction stage(s). The low hanging fruits can easily be captured with a little effort in this regard

❑ The departure from announcing farm loans waivers, post-pandemic, that have had a seriously distorting impact on credit culture (not limited to agri sector alone but spreading like a bush fire to other related strata) could be reignited in the light of recent Telengana government’s decision to waive farm loans that could have a fiscal cost of Rs 31,000 crore, soon finding takers by many as an immediately gratifying populist measure that ultimately serves as a Self Goal, the fiscal Harakiri gravely thwarting the competitiveness of the state(s) in the medium run.

❑ PLI scheme has been a game changer towards augmenting incremental manufacturing capacity, drawing fresh investments to the tune of Rs 1 lakh crore, with incremental sales of Rs 8.61 lakh crore (with exports share being 40%) and facilitating employment generation of 8.78 lakh

• Given the fact that MSMEs contribute around 45% of exports and around 40% in manufacturing GVA, a separate PLI scheme for MSMEs should boost the sectoral contribution further and facilitate employment generation with representation from across Textile, Garments, Handicraft, Food Processing, Leather, Electronics, Auto Components, Bulk Drugs etc.

❑ Given the complete change sweeping the PSBs under successive EASE reforms and policy support, the roadmap ahead could be dotted with reduction of ownership stake in PSU banks, greater HR autonomy, further investments in digital and IT infrastructure and aligning PSL framework to nation's priorities. Also, the divestment targets need to be more realistic and start now sans hesitations/ deliberations given the maturity of Indian Banking system and need to scale up in collaboration with global peers, reducing the stake in IDBI Bank a good fit case for such reality check

❑ Given the critical importance of rare earth metals in particular, and minerals in general, India needs to develop a mineral strategy for the entire value chain from exploration to recycling, implying building capacity at each stage of the value chain

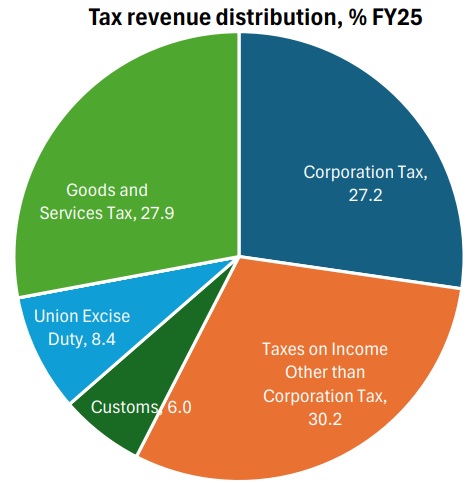

❑ The Personal Income Tax, making the most of the revenue mop-up kitty, needs to be aligned with the Corporate tax rate while endeavoring to bring all payers under the New Tax Regime in a calibrated manner. GST 2.0 reforms can be pursued by pulling more items within the ambit of GST like electricity and ATF first