Sales Growth For Non-BFSI Sector Is Much More Somber At 5.2% In Q1 FY25; Financial performance of corporates in Q1 FY25:

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, 17 August, 2024: Corporate performance of a sample of close to 3,000 companies is presented as follows:

Corporate performance

Q1-FY25 India Inc.’s performance in Q1 FY25 was somber, with the sequential moderation in profit growth becoming much more pronounced. Sales growth continued to trail in single digits, even though it is higher than last year. Seasonal patterns and elections were the major drivers of corporate performance, having an overall dampening impact on demand. - On the positive side, green shoots were visible in rural demand with FMCG, 2-wheeler and tractor sales picking up. A normal monsoon will further aid this recovery. - Traction was also seen in industries such as textiles, chemicals and paper products. - On the other hand, crude oil, cement and iron and steel industries were a major drag on the overall performance.

Financial performance of corporates in Q1 FY25

Corporate performance of a sample of close to 3,000 companies is presented.

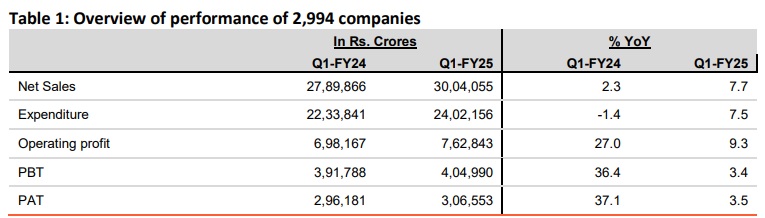

There is an improvement in sales growth to 7.7% in Q1 FY25 compared with a growth of 2.3% in Q1 FY24. While there has been a steady improvement in sales growth, it continues to grow in single digits, which is less than ideal. There has been an increase in the expenditure of companies led by an increase in the cost of raw materials for some industries. This also got reflected in a sharp moderation in profitability. After increasing by over 30% in Q1 FY24, growth in both PBT and PAT decelerated sharply to low single[1]digits in Q1 FY25. A significant part of this can be attributed to an unfavorable base effect.

To get a clearer picture of the performance of India Inc., we analyze the financial performance of companies excluding the BFSI segment. This is important as banks and financial institutions have benefitted from an uptick in their business upcycle and have hence registered robust performance on all financial metrics.

A summary of the financial results for the Ex. BFSI segment is also presented. Sales growth for the non-BFSI sector is much more somber at 5.2% in Q1 FY25. However, this marks a significant improvement from a decline of 2.5% in Q1 FY24 and hence to an extent the base effect propped up the number. The continued drag on sales growth is alarming as it signals weak domestic demand. Notably, there is a decline in profit growth for this segment which can be attributed to the pickup in expenditure growth. This can be attributed to an unfavorable base due to a correction and subsequent stabilization in global commodity prices.

Interest costs for companies remained almost steady in Q1 FY25 on a YoY basis. However, the sharp drop in profitability resulted in a marginal decline in interest coverage ratio (ICR) for the Ex. BFSI segment. It must be noted that the ICR is a measure of the debt servicing capability of a company and indicates if the company is making enough profits to meet its interest liabilities. It is calculated as a ratio of profit before interest and tax (PBIT) and the interest cost. In Q1 FY25, the ICR declined marginally to 5.76 from 5.97 in Q1 FY24. Despite the moderation, the ICR remains at comfortable levels.

Sector-wise movement in interest cover

There has been a decline in ICR for a majority of sectors in Q1 FY25 when compared with Q1 FY24. This is despite the fact that the weighted average lending rates (WALR) by banks were virtually unchanged in both the periods. Hence the decline in ICR can perhaps be explained by lower profits.

Some important observations are:

· Out of a total of 33 sectors, 17 witnessed a moderation in ICR in Q1 FY25 compared with the same period last year.

· Amongst the top 10 most heavily indebted sectors, namely, power, crude oil, telecom, iron and steel, auto, non-ferrous metals, logistics, healthcare, chemicals and real estate, 6 noted an improvement in ICR. This includes telecom, a sector which has been marred by high debt levels due to legacy issues.

· Despite the improvement, the ICR for the telecom sector remains below 1, which is a cause for concern.

· Sectors such as automobiles and healthcare witnessed a sharp improvement in their respective ICR backed by a robust performance in both sales and profits.

· On the other hand, sectors such as crude oil and chemicals have been plagued by a decline in profitability, which is affecting their debt serviceability capacity. The marginal dip in ICR is not a major cause of concern per se as it is still high by historical standards. However, the main driver of the lower ICR in Q1 FY25 is a moderation in profits, which is worrisome. This is especially true since profit growth is likely to remain muted due to an unfavorable base. This is likely to be offset to some extent by stable input prices, an increase in selling prices and a possible rate cut by the RBI.

Sector-wise performance

In terms of sector-wise performance, out of the 33 sectors, 18 recorded sales growth higher than the aggregate level of 7.7%. Mirroring the trend seen on the aggregate level, 22 sectors witnessed an improvement in sales vis-à-vis last year. A part of this can be attributed to base effect, as sales growth had declined in Q1 FY24. Sectors noting the maximum traction in sales included, consumer durables, electricals, power, business services and retailing amongst others. For some of these sectors, seasonal demand was a major factor driving sales.

For net profits, a total of 20 sectors showed higher growth than the average of 3.5%. However, a majority of sectors witnessed stress in maintaining a matching the growth in profit achieved last year. There were only 15 sectors for which the growth in PAT was higher than last year. These included: Consumer durables, textiles, chemicals, healthcare amongst others.

Let’s have an overview of growth in sales and net profits of various sectors in Q1-FY25 on a YoY basis, divided into different ranges. Amongst the sectors which did well on both profit and sales metric, consumer durables and retailing stand out, due to increased demand during severe heatwave. On the other hand, sectors such as iron and steel and cement witnessed a slowdown amid general elections and slowdown in government spending.

Based on the company presentations, following observations are made:

· Consumer durables: the sector benefitted from severe heatwaves in the country which led to a robust growth in sales. Demand for ACs and refrigerators picked up due to the summer demand, while events like T20 world cup and IPL drove demand for TVs. Fans and small domestic appliances also witnessed a surge in demand. For the lighting segment, price erosion kept sales growth muted even as there was a strong pickup in volume growth. Further, real estate demand drove sales of switches & switchgears and conduit pipes & fittings segments during the quarter. On the other hand, demand from industrial and infrastructure sector was weak due to elections. Companies also hiked prices which translated into better profitability.

· Retailing: There was an improvement in sales in the segment led by a recovery in the apparel segment. Within apparel, new and emerging categories. Food categories witnessed growth due to high inflation in the segment.

· Capital goods: The sector witnessed steady order inflows, contributing to the sturdy performance of the sector. Profitability was aided by improvement in margin orders, revenue mix and steady input prices.

· Real estate: Growth in sales was robust. Industry players anticipate only temporary disruption from LTCG tax on real estate. Demand to be driven by higher income and lower interest rates.

· Drugs and Pharmaceuticals: Sales growth picked up due to improvement in sales in the US market led by generic business. This in turn was aided by the launch of new products. There is a general increase in expenses across the board which is impacting margins.

· Crude oil: The sector accounts for more than 30% of the total sales of the companies in the sample. After declining steeply in Q1 FY24, sales for this sector improved and rose by 1.9% in Q1 FY25. This was led by both higher oil prices (On a YoY basis, oil prices increased by 9% in Q1FY25) as well as strong volume growth attributable to robust domestic demand. However, profit growth for the sector declined sharply due to lower refining margins. LPG price cuts announced by the government also impacted profit growth.

· Banks

Banks and financial institutions have delivered another quarter of robust performance. PAT growth remained robust and grew in double-digits.

· IT

IT companies recorded another weak quarter led by the continued weakness in discretionary demand. However, there was some traction with companies indicating some traction in growth from the US, particularly in the BFSI segment. Focus remained on cost-efficiency and new age technologies such as AI/GenAI and cloud models. Forward guidance suggests a much-anticipated recovery in the sector with the positive impulse coming from lower interest rates in the US.

· Automobile and ancillaries

Auto sector witnessed another good quarter, despite an unfavorable base. While there was moderation in both sales and profit growth due to an elevated base, the sector posted another remarkable quarter of double-digit growth. Aiding 6 margin growth were lower commodity prices and cost optimization efforts. Demand for PVs was muted due to heatwaves and elections. However, rural demand is stronger than urban demand. Sales of EVs were impacted negatively due to the expiration of FAME subsidy in Mar’24. Within automobiles, demand for tractors saw an improvement, marking a significant departure from the last few quarters. This was attributed to an improved monsoon outlook, better terms of trade on the back of higher output prices, and increase in MSPs and benign input inflation. Two-wheeler sales also exhibited strong momentum, with rural outperforming urban. Margins benefitted from higher selling prices as well as a reduction in input prices.

· Insurance

There was a steady growth in the insurance sector due to increased demand for insurance policies. Given the high economic growth and low insurance penetration in the country, the sector is expected to do well in the coming quarters as well.

· FMCG

Major players indicated a pickup in rural demand. The trend of premiumization continued. Demand for certain categories witnessed an improvement. These included staples, snacks, dairy, personal wash, fragrances and homecare. Some industry players noted a decline in discretionary spending due to heatwaves. Increased competition from local and regional players remains an ongoing challenge for the sector. Some sequential uptick in prices of key inputs such as sugar, potato, edible oils, leaf tobacco & other agri commodities. Apart from this, higher ocean freight charges and supply chain disruptions weighed on margins.

· Power

Led by a surge in demand due to the heatwave, power companies noted a sharp improvement in sales. However, profitability for the sector continued to decline in Q1 FY25 as well.

· Paints: Demand scenario was muted due to impact of heatwave and elections. Apart from these price cuts and adverse product mix (higher demand for economy products) also impacted sales and profits. However, demand from the rural segment and the auto sector was resilient. Material price inflation impacted margins.

· Fertilizers: Domestic demand for NPK fertilizers was robust. Early onset of monsoon also aided sales growth. Some recovery was visible in global agrochemical demand, which bodes well for the outlook of the sector. However, sales of DAP was muted led by a decline in NBS subsidy. Prices of inputs such as ammonia and phosphatic impacted margins.

· Infrastructure

Despite a slowdown in government spending due to the general elections, the infrastructure sector performed well on both sales and profit metrics. This was aided by a robust increase in both order inflows and order books from both domestic as well as international markets. In international markets, the Middle East drove growth.

· Telecom: Steady growth in subscribers contributed to improved sales for the sector. There was an increase in average revenue per user (ARPU) during the quarter which also led to a pickup in profitability. With the tariff hikes announced recently, this is likely to improve further in Q2.

· Hospitality: Performance was steady despite fewer weddings and severe heatwaves.

· Cement: For the cement sector, Q1 FY25 was a challenging quarter. This is because demand was muted due to lower government spending during the elections and heatwaves in the country. Furthermore, there was a further moderation in cement prices. This was offset partially by lower to stable raw material prices.

· Iron and steel: There was a decline in sales for the sector due to lower prices of steel, heatwave, elections and seasonality. Even so, demand from the auto sector was stable. 7 External demand was subdued in key markets such as Europe and the US. Raw material costs were range-bound but falling domestic prices and competition from cheap imports from China impacted profitability.

· Paper products: While the sector noted a sharp decline in both sales and PAT, the outlook is expected to be better. Industry players noted some signs of demand recovery ahead of the festive season, even as cheap Chinese supplies continue to have a negative impact on the sector. Higher freight costs and increase in wood prices impacted profitability.

Concluding remarks

Q1 FY25 was marked by a slowdown in profit growth for India Inc. despite stable interest costs as well as lower input costs. - An unfavourable base can explain the dismal performance. - However, muted sales which continue to grow in single digits is a cause of concern. - Heatwaves and general elections impacted sales of many sectors, such as cement and iron and steel. - On the other hand, sectors such as consumer durables benefitted from the severe heatwaves and recorded their best ever quarterly sales. - FMCG companies noted a sequential pickup in sales and remain optimistic on the future outlook given the satisfactory progress of monsoon.

Overall, the sequential slowdown in profits is a cause of concern as it is used in the calculation of GVA. Notably, RBI has revised its GDP forecast for Q1 FY25 lower on the back of a moderation in corporate profitability. Going ahead, an unfavourable base and an increase in input costs will weigh on corporate profitability. However, support will come from pickup in demand due to festive season, moderation in inflation and pickup in rural demand. Interest costs too are expected to decline once the RBI cuts rate.