The next few days could become volatile, depending on whether inflation surprises or Bessent affirms a gradual approach to implementing Trump’s tariffs.

Radhika Rao,

Executive Director and Senior Economist,

DBS Bank

Mumbai, January 14, 2025: This week’s featured insight is our Asset Risks Dashboard, which track conditions and gauge risk sentiments across four key asset classes (Equities, Interest Rates, Credit, and FX).

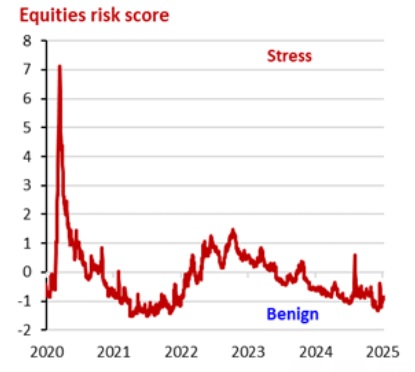

Today we focus on Equities. The equities risk score remains benign, rising only slightly from its December 2024 low. Near record-high US equity valuations and a low VIX reflect expectations of favourable business policies under a second Trump presidency, such as lower corporate taxes and deregulation, that are anticipated to sustain robust US economic growth. However, the risk score could edge up should the US economy unexpectedly enters a recession and/or further unknown risks emerge.

India markets: Inflation moderates, rupee eyes global pain points (Radhika Rao)

India’s December CPI inflation moderated to 5.2% yoy (DBSf: 5.2%, consensus 5.3%) from 5.5% the month before. Food and beverages inflation rose by a slower 7.7% yoy vs 8.2% in November, on a broad-based sequential decline in perishables (vegetables), cereals and pulses, while edible oils and eggs registered MoM increases. Core (ex-food and fuel) stabilised at 3.6%, backing our view that demand conditions are subdued, posing limited risk of second round effects, alongside muted manufacturing costs. Ongoing disinflation in key food categories and expectations of a strong kharif output point to January’s inflation easing further to ~4.5-4.6% yoy, suggesting 1Q25 average will stand at 4.5%, in line with the RBI’s projection.

Recent rupee depreciation and escalation in oil prices have raised concerns over pass through to price pressures. A 5% deprecation in the currency adds 0.35pp to headline inflation according to the central bank, although manufacturers are unlikely to immediately and fully pass on costs amidst the ongoing cyclical slowdown. An escalation in US-China trade skirmish will also impart a deflationary impulse as China will seek to channel more exports into this region. Risk of transmission from higher oil onto local fuel prices is limited as official preference will be to keep domestic petrol and diesel costs unchanged to preserve households’ purchasing power. The RBI monetary policy committee faces a difficult decision at the February meeting as a slowing inflation outlook is accompanied by mounting INR depreciation pressures. Anticipating higher weightage to easing inflation and a cyclical slowdown, we expect the MPC to undertake a modest cut to make policy less restrictive next month. Market players have sought the RBI’s support in easing the domestic liquidity squeeze, which failed to abate despite the largest variable rate repo auctions last week, and similar efforts in Dec24. Shorter-tenor dollar rupee swap worth $3bn was reportedly undertaken to inject INR liquidity, according to Bloomberg, but this further complicated FX management.

Much like the Asian peers, a strong dollar continues to weigh on the rupee, with the currency weakening past 86.0 to a new low yesterday. While a shift in the RBI’s tolerance is palpable, the pace of rupee decline can’t be only attributed to the change in guard at the central bank. A shift in the global environment (sharp USD rally and heightened uncertainty) has also given rise to trade-offs between managing the cost of strong intervention and its economic impact vis-à-vis easing grip on the rupee. Excessive intervention in the face of a one-sided move in the US dollar is likely to prove ineffective, instead tightening liquidity conditions (left unsterilised) and dampen growth conditions. Authorities are likely to show their hand to limit sharp swings but not turn the tide this week, as the dollar stands to gain from a firm US inflation print and resultant cautious stance from the US Fed on further rate cuts. Our revised FX forecasts were published in Monday’s Weekly note.

USD Rates: Sticky inflation risks (Eugene Leow)

Market participants will be scrutinising this week’s CPI data to gauge if disinflation has stalled. Consensus expects headline and core CPI to be 0.3% MoM and 0.2% MoM respectively. Going forward, inflation should face upside risks from tariffs (at least optically), in whatever form that they will finally be delivered by the Trump administration. Given that ISM prices paid shot up last month, there would likely to be unease that even the threat of tariffs could have an inflationary impact on prices. Moreover, we would also keep an eye on rising oil prices (WTI is now trading at USD 78/bbl). If US inflation turns out to be sticky around 3%, there would no longer be any narrative for the Fed to cut rates from this angle.

Investors have taken notice, pushing up 2Y breakevens to 2.79%, up from around 1.6% in September. As inflation worries rise and growth worries dissipate, rate cut bets are pushed even further back. The market is pricing in just 29bps of cuts by the end of 2025. At this point, even if CPI stays sticky, we think that the hurdle for the Fed to flip to rate hikes is probably high. There will be considerable uncertainties from Trump’s policies and it will probably be more prudent from a policy maker’s perspective to wait and see how events play out. Accordingly, we think that upside to short-term UST yields are likely capped for now.

FX Daily: USD’s rally paused, eyeing US inflation and Bessent’s hearing (Philip Wee)

Currencies were mixed on Monday. Commodity-led currencies appreciated the most, followed by Northeast Asian currencies, amid relatively neutral European currencies. Market participants probably bought back these currencies after the USD’s aggressive rise on better-than-expected US nonfarm payrolls last Friday pushed most currencies into weak or oversold levels, according to their 14-day RSIs. Today, they would probably do the same for the INR and Southeast Asian currencies that weakened during yesterday’s Asian session.

The DXY Index, which tested the critical 110 level during the European session, retreated in the final hours of the overnight session, driven by news that Trump’s incoming economic team was working on a strategy of gradual tariff increases to avoid reigniting inflation. Hence, markets will pay close attention to Scott Bessent’s confirmation hearing as Treasury Secretary on January 16.

The US Treasury 10Y yield rose for a seventh session by 1.9 bps to 4.778%. The New York Fed’s Survey of Consumer Expectations reported that consumers expected inflation to rise on potential tariffs during Trump’s second term. Following Trump’s victory in the US elections on November 5, 3-year inflation expectations rose to 3% in December from 2.6% a month earlier, while 5-year expectations increased to 3% from 2.7%.

Hence, markets are bracing for today’s PPI final demand to bounce to 3.5% yoy in December from 3% in November and tomorrow’s CPI inflation to rise to 2.9% YoY from 2.7%. The futures market has a small bet for one Fed cut in June, fewer than the two cuts projected by the Fed last month. The next few days could become volatile, depending on whether inflation surprises or Bessent affirms a gradual approach to implementing Trump’s tariffs.