Challenges in unsecured retail and microfinance are receding.

FinTech BizNews Service

Mumbai, 21 February 2026: Banks delivered ~10% yoy earnings growth in 3QFY26, led by 10% yoy operating profit growth. NIM was broadly unchanged, and there are clear signs of acceleration of loan growth. Asset quality trends show no signs of worry; challenges in unsecured retail and microfinance are receding. Deposit growth, sustained competition from PSU banks and its consequent impact on NIM are the key areas of concern, as per the latest Kotak Institutional Equities report on the banking sector.

A steady recovery in earnings growth led by operating profit growth

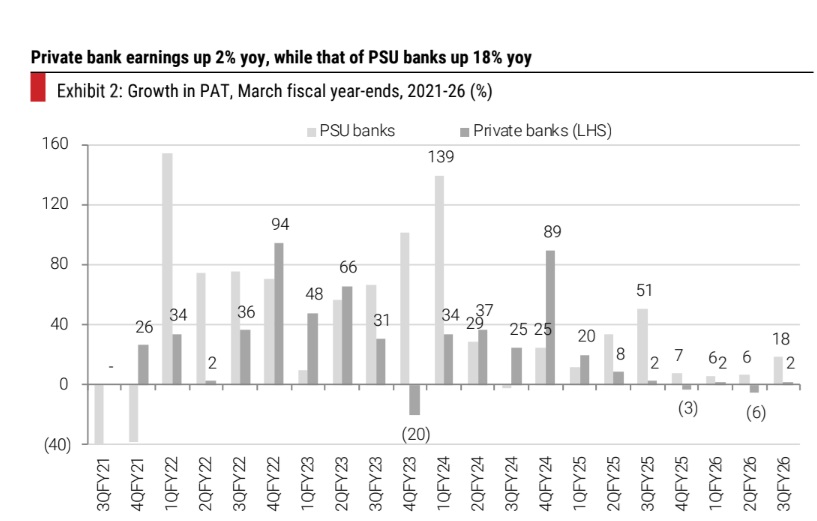

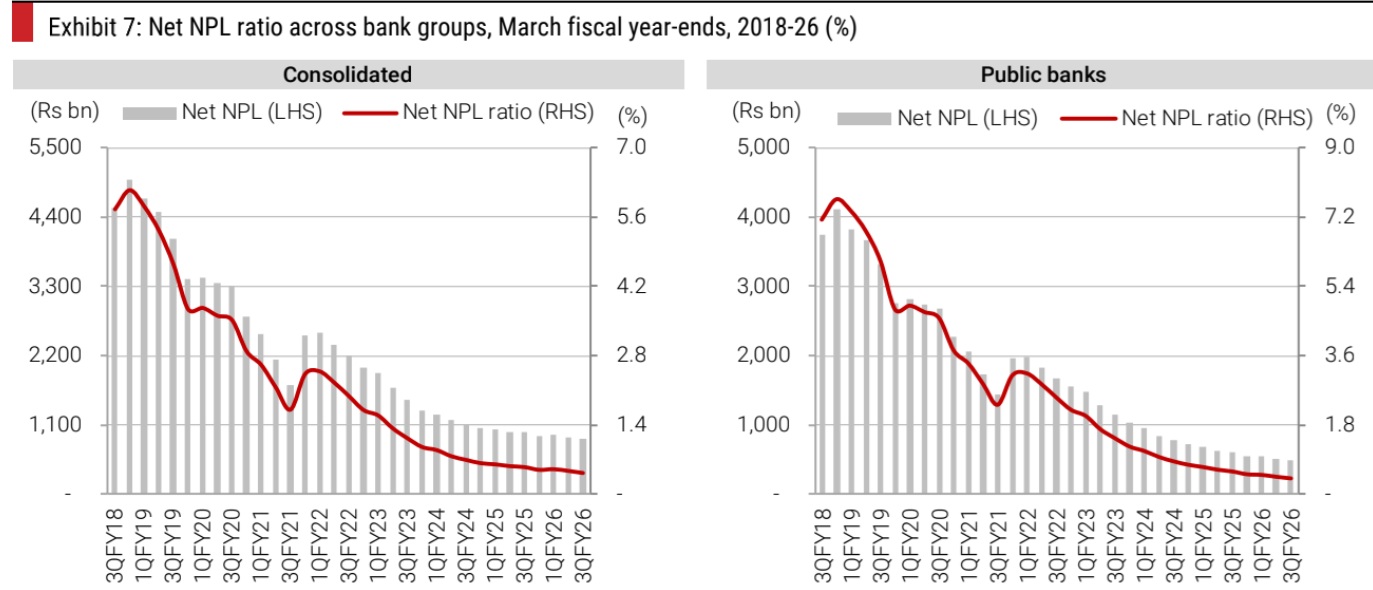

Banks under coverage posted 10% yoy earnings growth in 3Q, led by similar operating profit growth. NII growth was weak at ~5% yoy as compared to loan growth. PSU banks delivered ~18% yoy earnings growth, while it was flat yoy for private banks. (1) NIM was flat qoq for most lenders, as the repricing of liabilities is slowly underway, which offset any lagged repricing of loans. (2) Loan growth showed a steady recovery led by PSU banks. (3) Treasury income remained weak, while recoveries in written-off assets held up well. (4) Asset quality metrics remain in a favorable position, including firm recovery trends in unsecured loans. (5) The impact of the labor code was fairly negligible across banks, specifically PSU banks. Earnings growth for SFBs was supported by a decline in credit cost (high base), while PPOP has room to improve.

Asset quality and growth less concerning; deposits and NIM take center stage

We look at the near-term performance through the following lens: (1) Loan growth appears less concerning, with PSU banks marginally outpacing private peers. Lender interactions indicate a recovery in disbursements across retail and MSME segments. Corporate loan growth has been strong but appears tactical, driven by shifts between bond and bank financing amid yield differentials rather than a cyclical upturn. (2) Asset quality remains pristine and should stay benign. Stabilization in unsecured and MFI portfolios has lowered credit costs, while select banks are proactively building floating provisions ahead of the ECL transition. Conservative underwriting in recent years should keep credit costs contained. (3) Deposit growth, particularly household deposits, remains a key constraint, limiting lenders’ ability to accelerate loan growth. (4) NIMs are likely to remain flat near term, as prior rate cuts are transmitted, although term-deposit repricing should partly offset the impact.

Meaningful upsides are lower from current levels; playing on relative basis

The rally in PSU banks and relative lag in private banks have compressed valuation gaps, limiting the scope for strong outperformance across our coverage. A re-rating could be driven by large private banks, but it would need greater comfort and confidence in growth and NIM outlook. We see limited upsides in mid-tier banks barring Bandhan Bank, Federal Bank and DCB Bank. Outside of SBI, we like BoB and Union Bank at current levels. Select small finance banks offer a tactical opportunity to play the microfinance recovery, while operating profitability improvement can offer an additional leg to the re-rating; we prefer a basket of Equitas, Ujjivan and Utkarsh.