Fresh slippages in 4QFY25 would remain elevated for banks with high exposure to unsecured retail and microfinance viz. IDFCB, RBL and IIB

FinTech BizNews Service

Mumbai, April 7, 2025: YES SECURITIES has come out with a report on Banks with regard to Q4 Earnings Preview. The report has been authored by Shivaji Thapliyal, Head of Research (Overall) & Lead Sector Research Analyst; Siddharth Rajpurohit, Analyst and Suraj Singhania Associate of YES SECURITIES.

BANKS - COMMENTARY

▪ Asset quality:

Fresh slippages in 4QFY25 would remain elevated for banks with high exposure to unsecured retail and microfinance viz. IDFCB, RBL and IIB but may not rise materially on sequential basis from already elevated levels seen in 3QFY25. In general, slippages have been moderately on the rise sequentially for the system and a similar moderate rise may continue. Sequential evolution of provisions would be a function of not only slippages but also of recoveries and upgrades and pre-existing provision buffers. Hence, we see a marginal rise in provisions, sequentially, for HDFCB, ICICI, SBI, AXSB, BOB and INBK whereas we see flattish trend in provisions for KMB, IDFCFB, KVB, CUB, CSB and DCB. Provisions would decline sequentially for IIB, RBL and FED as we expect IIB and RBL to utilize their contingency buffer in 4Q while FED had created accelerated provision in 3Q.

▪ Net interest margin:

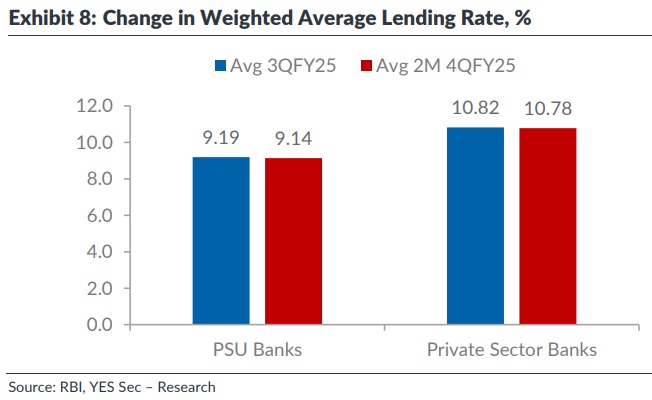

Banks will see a sequential decline in net interest margin (NIM) as the impact of RBI’s repo rate cut by 25 bps in February-25 will result in reduction in the yield on advances. There would have been some residual repricing of legacy low-cost deposits, causing blended cost of deposits to rise but the quantum would be lesser than preceding quarters. On the flip side, some banks may see favourable loan mix change. The average Weighted Average Domestic Term Deposit Rate (WADTDR) for private sector banks for 2M4QFY25 rose 2 bps, to 6.93%, compared with the average for 3QFY25. The corresponding Weighted Average Lending Rate (WALR) was down by -4 bps to 10.78%, implying that Loan Spread declined -6 bps. For PSU banks, the WADTDR rose around 5 bps to 7.16% and the WALR declined around -5 bps QoQ to 9.14%, which implies that Spread declined -11 bps. It may be noted that the WADTDR and WALR for 2M4QFY25 excludes March month. We see NIM for banks to be lower (5-8 bps) sequentially.

▪ Loan growth:

At the time of publishing the consolidated multi-sector Preview, sequential loan growth has been / will be healthy (>4.5%) for KMB, IDFCFB and CSB, reasonable (3.5- 4.5%) for SBI, BOB, INBK, ICICI, AXSB, IIB, FED, CUB and DCB and moderate (2.0-3.5%) for HDFCB, KVB and RBL.

▪ Opex growth: For both private and public sector banks, sequentially opex growth would slightly lag business growth.

▪ Treasury profit: The long-term bond yields have declined on sequential basis, with the 10- year averaging 6.71% over 4QFY25, lower by -9 bps QoQ. However, there will be no MTM gain/loss on investment book but any profit actually booked will travel through the P&L.

Banks ‐ Earnings expectation snapshot –

HDFC Bank: Sequential loan growth will be in the 2% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be slightly lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be lower on sequential basis due to seasonality. Provisions will be higher on sequential basis.

ICICI Bank: Sequential loan growth will be in the 3.5% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits which will be partially offset by lower interest reversals on KCC loan. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be lower on sequential basis due to seasonality. Provisions will be higher on sequential basis.

State Bank of India: Sequential loan growth will be in the 4.0% ballpark due to idiosyncratic growth trajectory. NII growth will be slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income will be higher than loan growth due to seasonality. Opex growth would be higher than business growth. Slippages would be broadly stable on sequential basis. Provisions will be higher on sequential basis as there was a reversal of provision in Q3.

Kotak Mahindra Bank: Sequential loan growth will be in the 5.0% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be slower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be slightly higher on sequential basis due to seasonality. Provisions will be broadly stable on sequential basis.

Axis Bank: Sequential loan growth will be in the 3.5% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will be higher than loan growth due to seasonality. Opex growth would slightly lag business growth. Slippages would be lower on sequential basis due to seasonality. Provisions will be higher on sequential basis.

Bank of Baroda: Sequential loan growth will be in the 3.5% ballpark due to idiosyncratic growth trajectory. NII growth will be slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will be higher than loan growth due to seasonality. Opex growth will be in-line with the business growth. Slippages would be broadly stable on sequential basis. Provisions will be higher on sequential basis.

Indian Bank: Sequential loan growth will be in the 4.0% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower then average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be slightly lower sequentially. Sequential fee income will be higher than loan growth due to seasonality. Opex growth would slightly lag business growth. Slippages would be higher on sequential basis. Provisions will be higher on sequential basis.

Indusind Bank: Sequential loan growth will be in the 3.5% ballpark due to idiosyncratic growth trajectory. NII growth will be slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be higher on sequential basis. Provisions will be lower on sequential basis as we expect the bank will utilise its contingency provision buffer in 4Q. There will be a loss in other income of Rs. 16 bn (net of tax) due to discrepancy in accounting of derivatives reported by the bank.

IDFC First Bank: Sequential loan growth was 4.7% due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be marginally higher on sequential basis. Provisions will be broadly stable on sequential basis.

Federal Bank: Sequential loan growth will be in the 4.0% ballpark due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be slightly lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth will be in-line with the business growth. Slippages would be lower on sequential basis due to seasonality. Provisions will be lower on sequential basis as the bank had created accelerated provision in 3Q.

Karur Vysya Bank: Sequential loan growth was 2.0% due to idiosyncratic growth trajectory. NII growth will be slightly slower than average loan growth due to rise in cost of deposits outpacing yield on advances. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be higher on sequential basis. Provisions will be broadly stable on sequential basis.

City Union Bank: Sequential loan growth will be in the 4.0% ballpark due to idiosyncratic growth trajectory. NII growth will be slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be broadly stable on sequential basis. Provisions will be stable on sequential basis.

RBL Bank: Sequential loan growth will be in the 3.0% ballpark due to idiosyncratic growth trajectory. NII growth will broadly slower than average loan growth due to fall in yield on advances outpacing cost of deposits. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be marginally lower on sequential basis. Provisions will be lower on sequential basis as the bank had created additional provision in 3Q.

CSB Bank: Sequential loan growth was 10.1% ballpark due to idiosyncratic growth trajectory. NII growth will be slower than average loan growth due to rise in cost of deposits outpacing yield on advances. Consequently, NIM will be lower sequentially. Sequential fee income growth will broadly match loan growth. Opex growth would slightly lag business growth. Slippages would be broadly stable on sequential basis. Provisions will be stable on sequential basis.