Gap between credit and deposit growth rates warrants a rethink by the banks

FinTech BizNews Service

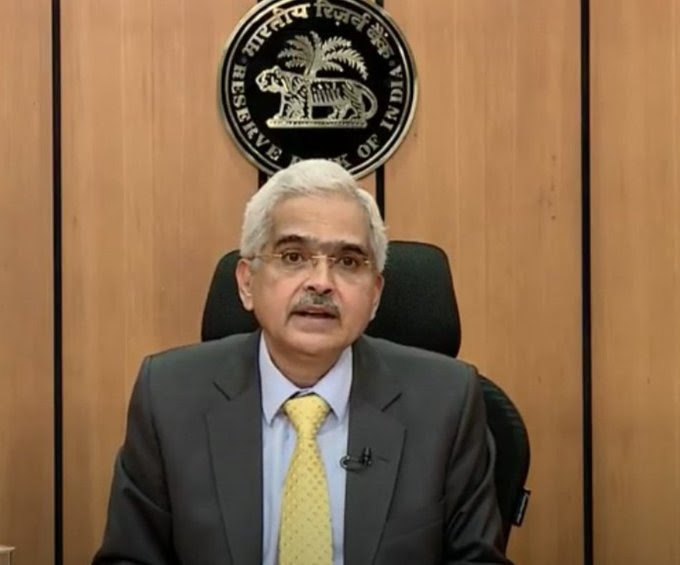

Mumbai, June 7, 2024: Shaktikanta Das, Governor, the Reserve Bank of India, gave a statement today following MPC meeting. The Monetary Policy Committee (MPC) met on 5th, 6th and 7th June 2024.

REs should improve governance standards

The annual financial results for 2023-24 indicate that the banking system remained sound and resilient, backed by improvement in asset quality, enhanced provisioning for bad loans, sustained capital adequacy and rise in profitability.46 The non-banking financial companies (NBFCs) also displayed strong financials in line with the banking sector. Notably, the gross non-performing assets (GNPAs) of scheduled commercial banks (SCBs) and NBFCs are below 3 per cent of total advances as at end of March 2024. It is important that the Regulated Entities (REs) should continue to improve their governance standards, risk management practices and compliance culture across the organisation.

In November last year, we had flagged certain concerns on excessive growth in the unsecured retail loans and over-reliance of NBFCs on bank funding. Recent data suggests that there is some moderation in these loans and advances.

We are closely monitoring the incoming data to ascertain if further measures are necessary. The Boards and top management of REs should ensure that risk limits and exposures for each line of business are kept well within their respective risk appetite framework. The persisting gap between credit and deposit growth rates warrants a rethink by the Boards of banks to re-strategise their business plans. A prudent balance between assets and liabilities has to be maintained.