Capital flows were in surplus to the tune of USD 17.4 bn (or 2.0% of GDP) supported by net FPI flows and banking capital

Indranil Pan, Deepthi Mathew,

Economics Knowledge Banking,

YES Bank

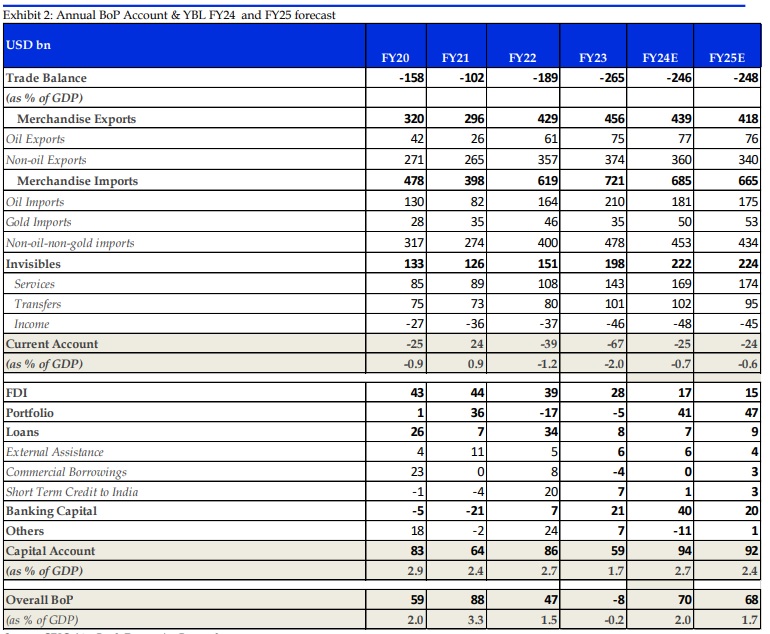

Mumbai, March 27, 2024: India’s Q3FY24 CAD was at USD 10.5 bn (1.2% of GDP), marginally better than USD 11.4 bn (1.3% of GDP) in Q2FY24. This was led by improving invisible flows – both services and transfers, while trade gap widened. Capital flows in Q3FY24 came in stronger with the support coming from net FPI flows and banking capital. We now estimate CAD/GDP at 0.7% for FY24, continuing to assume India oil basket at USD 85 pb. For FY25, we expect CAD/GDP to be 0.6% of GDP, assuming India oil basket to average at USD 80 pb. We expect USD/INR to trade in the range of 83.00-81.50 in FY25.

CAD gets better in Q3FY24:

India’s Q2FY24 merchandise trade deficit came at USD 71.6 bn vs USD 64.5 bn in Q2FY24. On a YoY basis, both exports and imports registered an improvement. However, as per the data released by the Ministry of Commerce and Industry, exports declined by 1.5% QoQ, with non-oil exports registering a de-growth of 5.5% QoQ. Merchandise imports increased by 3.2% QoQ, with oil imports registering a growth of 22% QoQ while non-oil-non-gold imports (NONG) declined by 0.5% QoQ. On the other hand, gold imports increased by 8.7% QoQ to USD 13.7 bn in Q3FY24 compared to USD 12.6 bn in Q2FY24 reflective of the festive demand and higher gold prices amidst the geopolitical tensions. Despite a weaker trade balance, CAD was contained due to a rise in net invisibles that was led by both services and transfers. The net outgo of primary income (interest income) worsened to USD (-) 13.2 bn vs USD (-) 11.8 bn in Q2FY24.

Net Capital account inflows improve:

Capital account improved to USD 17.4 bn from USD 13.0 bn in Q2FY24. The improvement was mainly on account of the increase in banking capital and net FPI flows. The announcement on the inclusion of India’s government bonds in JP Morgan’s GBI-EM index supported net FPI flows that came at USD 12.0 bn in Q3FY24vs USD 4.9 bn in Q2FY24. Banking capital came to USD 16.4 bn compared to USD 4.3 bn in Q2FY24. Net FDI flows were at USD 4.6 bn vs (-) USD 0.6 bn in Q2FY24. ECB net outflows were at USD 4.4 bn while external assistance was at USD 3.2 bn (USD 0.8 bn in Q2FY24).

BoP estimated to be in surplus in FY24 and FY25:

We expect CAD to improve further in Q4FY4 with the exports sector performing better than anticipated. Importantly, exports in January 2024 and February 2024 surprised on the upside even when they de-grew by 3.4% in FY24TD compared to same period last year. Alongside the services sector exports have shown consistent strength, amidst fears of a global slowdown. Factoring in the latest BoP quarterly data and the monthly trade data, we see the FY24 CAD/GDP at 0.7% (earlier 1.0% of GDP).

More critical is to understand what is in store for the external sector dynamics for FY25, given the uncertainty in the global economy. In CY24TD, oil prices have increased by 14% weighed by both supply and demand concerns. The continuing geopolitical tensions, lower discounts in Russian oil, and sanctions on Russian shipment are likely to put pressure on oil import bill. Accordingly, we expect crude oil price to average ~USD 80 pb from the earlier USD 75 pb. Gold imports are expected to maintain a positive momentum basis our assumption of elevated gold prices through FY25 on account of (i) global risk aversion (ii) major central banks starting the rate cutting cycle in FY25, and (iii) central bank buying. NONG imports is expected to moderate in FY25 as we expect India’s growth to be weaker in FY25 than in FY24. We expect services exports to register a steady growth given the growing contribution of non-software exports. Overall, we expect CAD to be at 0.6% of GDP or USD 24 bn in FY25.

Capital inflows in FY24 are likely to remain strong as JP Morgan index inclusion related flows are expected from June 2024 onwards. However, we expect FDI flows to remain muted given the concerns in the global demand. Some pickup in ECB is also expected with the onset of the rate cutting cycle globally. Considering all the above, we expect an appreciation bias for INR in FY25. However, we should be mindful of RBI intervention to limit volatility in the USD/INR. Recent experience shows that the RBI is willing to intervene on both side. The RBI will have to weigh the direction of the rest of the EM currencies to determine if the INR can be allowed to appreciate significantly. A sharp appreciation of INR would make Indian exports uncompetitive especially when the global demand is expected to moderate. Overall, we expect USD/INR to trade in the range of 83.00-81.50 in FY25.