SBI Special Research Report: Build Budget On Pillars Of Social Security, Financial Stability, Health Care, Consumption; We estimate GoI can ensure better tax compliance and bolster consumption through enhancing disposable income, by moving all and one under the New Tax regime, at a nominal loss(es) by foregoing certain amount of tax collection

FinTech BizNews Service

Mumbai, January 30: The State Bank of India’s Economic Research Department has come out with a special research report titled ‘Prelude to Union Budget 2025-26.’ The report argues to introduce certain changes, with likely far-reaching implications in the upcoming budget:

FY26 budget could be built on the edifice of: Social Security, Financial Stability, Health Care and Consumption ...We envisage the pareto optimal

solution of Rationalizing Direct taxes across various options with least revenue loss / Rs 50,000 crores / a meagre 0.14% of GDP and maximum

gains to consumer as following (a) Remove all exemptions and bring all under new tax regime, but retain and enhance the NPS limit from Rs

50,000 to Rs 1 lakh and enhance medical insurance exemption to Rs 50,000 from Rs 25,000 (b) Tax rates to be rationalised at 15% from 20% at Rs

10-15 lakhs income bucket (c) 15% tax on deposits and across all maturities and such tax treatment should be same like other asset classes, i.e.

clubbing it in other income and taxing it at redemption and not accrual basis and increasing Savings Bank tax exemption limit to Rs 20,000..India

INC should match up Government efforts and efficiency without much further ado.

A progressive Tax regime, coupled with reforms in taxation system, has ensured that tax mop up has grown handsomely over time...

❑ We estimate GoI can ensure better tax compliance and bolster consumption through enhancing disposable income, by moving all and one

under the New Tax regime, at a nominal loss(es) by foregoing certain amount of tax collection as under cases 1, 2 and 3

• Assumptions: (i) All exemptions under old tax regime are removed (~Rs 4.5 lakh per person) - except Health and NPS of ~1.5 crore taxpayers (at present which are tweaked upwards under two scenarios from Rs 25k to Rs 50 k and NPS from Rs 50,000 to Rs 75,000 and Rs 1 lakh.

• Likely loss to GoI under different Tax Adjustments are envisaged

– Case-1: Peak rate reduced to 25% for income above 15L and all exemptions are removed but healthcare and NPS are retained at the same level of Rs 25k and Rs 50 k and increased to Rs 50k and Rs 75 k in scenario 1 and Rs 50k and Rs 1 lakh in scenario 2. The revenue losses of the Government stands at Rs 74000 crores to Rs 1.08 lakh crores. Additionally, a flat 15% tax is imposed on bank deposits that is added to other income and delinked from highest income bucket, with an increase in limit to Rs 20,000 tax exemption for savings bank (SA) deposits

– Case-2: Peak rate retained at 30% for income above 15L. However, tax rates are reduced to 15% from Rs 10 lakhs-Rs 15 lakhs and all exemptions are removed but healthcare and NPS are retained at the same level of Rs 25k and Rs 50 k and increased to Rs 50k and Rs 75 k in scenario 12 and Rs 50k and Rs 1lakh in scenario 2. The revenue losses of the Government stands at Rs 16,000 crores to Rs 50,000 crores. Additionally, a flat 15% tax is imposed on bank deposits that is added to other income and delinked from highest income bucket, with an increase in limit to Rs 20,000 tax exemption for SA deposits . We propose this option for the Government and Consumers with the revenue loss at Rs 50,000 crores / 0.14% of GDP

– Case3: Peak rate cut to 25% for income above 15L Tax rates are reduced to 15% from Rs 10 lakhs-Rs 15 lakhs and all exemptions are removed but healthcare and NPS are retained at the same level of Rs 25k and Rs 50 k and increased to Rs 50k and Rs 75 k in scenario 12 and Rs 50k and Rs 1lakh in scenario 2. The revenue losses of the Government stands at Rs 85,000 crores to Rs 1.19 lakh crores . Additionally, a flat 15% tax is imposed on bank deposits that is added to other income and delinked from highest income bucket, with an increase in limit to Rs 20,000 tax exemption for SA deposits

❑ We believe that sensitivity of consumption demand is more responsive to indirect taxes vis-à-vis direct taxes... this thus calls for

further rationalization of indirect tax structure to smoothen consumption activity in economy

❑ India Inc. should match the pace/intent of the GoI in terms of visualizing for the next 50 years, that has frontloaded building robust

infra across physical-technical-social space that have ensured traction amongst various income groups...with good profitability post

pandemic, and viable financing options through a mix of sources (a resilient, deep and vibrant capital markets in harmony with a

strong banking system that has got its mojo back) augurs well for the investments that harness India’s strategic pitching for

becoming the manufacturer of the new world order.

Adherence to fiscal prudence is a sine qua non for the government while continuing the fiscal consolidation path. The Fiscal

deficit as % of GDP may come at 4.5% in FY26 (Rs 15.9 lakh crore) that looks like the new normal in a world of uncertainties,

offering flexibility in tinkering the glide path a little to romp up inclusive growth

❑ With smart usage of switch and buyback Gross market borrowing (Rs 14.4 lakh crore) can be expected in FY26 due to an

increase in redemptions, when part of the COVID-19 pandemic borrowings are due for repayment, resulting in a net

borrowing of Rs 11.2 lakh crore (Rs 4.05 lakh crore redemption in FY26 and expected switch of Rs ~75000 to 100000 crore)

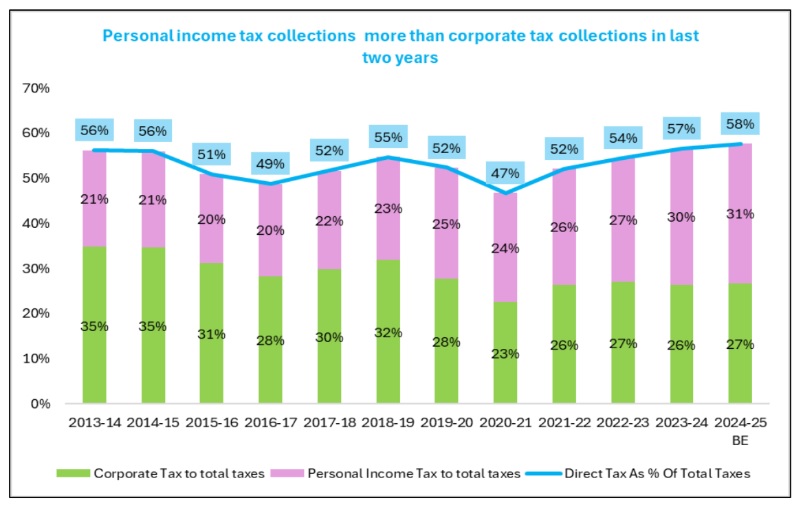

❑ Direct taxes contribution to total tax revenue rose to ~58% in 2023-24, the highest in 14 years and in lockstep with trends

seen in DMs like the US. Personal income tax (PIT) collections (7%) are surging higher than corporate tax collections (4%) in

5 years since FY21

❑ Of late, there is a Tsunami of women centric schemes unleashed by multiple states offering direct benefit transfers

(some badly guised as pure electoral realpolitik, we believe) that can bleed select states’ finances going forward as

the wedge between revenue receipts and such expenditures may vault to 3-11% of the states revenue receipts...With

income transfer to women likely to be promised competitively by states in future, even the Union may be tempted to

follow suit.. It would be worth taking course to adopt a universal income transfer scheme (matching grant from

center to states) towards substantially reducing several market disturbing subsidies

In line with MF/direct equity investments, we understand that the Government should consider lowering tax on accrued interest rate

on deposits, in alignment with capital gains to give a level playing field between Bank deposits and capital markets

❑ The present dispensation for Equity/MF holdings stipulates taxing STCGs at a flat rate of 15% while the LTCGs are taxed at a

moderate 10%, with exemption allowed till income of LTCG up to one lakh during a given FY...also, the setting-off of loss against

profits and carrying over the loss up to next eight years makes the opportunity cost of such alternate investments quite lucrative for

investors up the wealth ladder

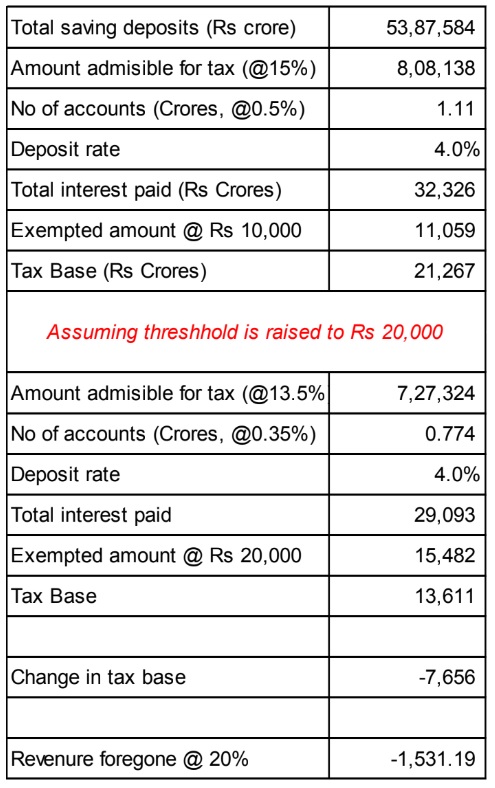

❑ The threshold for tax exemptions on Savings deposit at Rs 10,000 may be reconsidered and raised to Rs 20,000- the revenue

foregone using Pareto Principle comes around ~Rs 1,531 crore (flat RoI at 4%), leading to multiple benefits viz. Stability in core

deposit base, financial stability, better visibility of system liquidity against growing digital payments and most important allowing banks

to pass on the benefits accruing through low-cost deposits to fund the humongous social commitments (FI 2.0) / sunrise sectors led

demand in continuum

❑ Term deposits, that have witnessed greater favor with savers with elevated rates attracting higher proportions, may witness a revenue

foregone figure of Rs 10,500 crore if current tax treatment across maturity ladder is to be replaced by a simple flat 15%rate across all

maturity. Combined revenue foregone including both saving deposits and terms deposit comes around ~Rs 12,000 crore

❑ The National Health Policy 2017 has set a target of increasing healthcare spending to 2.5% of GDP. However, a more aggressive

target of 5% could be required to address the growing needs of India’s ageing and expanding population... Allocate proceeds from

healthcare cess and a proposed higher GST slab on tobacco and sugar products can strengthen public health programme