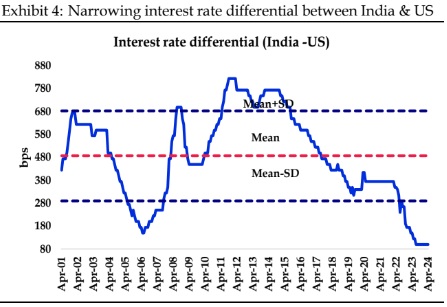

RBI cannot move ahead to the Fed as interest differential between US and India is at an all time low

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking.

YES Bank

Mumbai, May 3, 2024: As was widely expected, the FOMC left the fed funds target range unchanged at 5.25%-5.50%.

FOMC: Limited forward guidance!

It is assessed that inflation's return to the 2% target will be an uncertain journey with strong momentum seen in recent inflation prints. FOMC will however slow the pace of quantitative tightening (QT) starting June 1 as the Fed’s balance sheet is slowly moving to the pre-covid levels. With growing uncertainty about further progress on inflation, the market is now pricing in the first rate cut from the Fed in November, with September being a close call.

While the start remains uncertain, the certainty is about the cycle being much shallower than earlier expected and may even be restricted to only ONE in CY2024. RBI is expected to follow the Fed and is expected to cut by 25 bps in October 2024.

FOMC sees lack of further progress in reducing inflation:

US CPI inflation surprised on the upside at 3.5% YoY in March with a monthly momentum of 0.4% (similar level seen in February 2024). At the press conference, Fed Chair Jerome Powell noted that inflation was proving "more persistent than expected”, with four major risks: (i) pressure on housing prices, (ii) resurgence in commodity prices (iii) waning base support, and (iv) labor market tightness. Labor market tightness continues to be an area of concern, though signs of rebalancing are visible.

The unemployment rate came to 3.8% in March 2024 vs 3.9% in February2024. The nominal wage growth came to 4.1% YoY in March, registering a momentum of 0.3%, still not compatible with the 2% inflation target.

“Fed to reduce the pace of balance sheet run off”:

Fed began reducing the size of its balance sheet via Quantitative Tightening (QT) in June 2022 by not reinvesting proceeds of maturing securities. Fed has now said that beginning June, it will slow the pace of the decline in its

treasury securities portfolio to USD 25 bn a month (current USD 60 bn a month). In our March FOMC policy note (FOMC: “Last mile” proving to be the most challenging), we had mentioned that the tapering of QT should be read along the line that the Fed is bringing its balance sheet to the pre-covid level rather than loosening the liquidity conditions. As per the latest data, Fed’s balance sheet as % of GDP stands at 26.9% in February 2024 vs the peak of 37.5% in February

2022 and 24.2% in March 2020 when the Covid related easing had started. Alongside, to keep the overnight interest rates in check (benchmark for other short-term instruments), Fed had to ensure that bank reserves are ample. In January 2024, Fed Governor Christopher Waller said that 10-11% of GDP could be “an approximate end point for draining reserves”. Presently, bank reserves stand at USD 3.4 tn, or around 13%. Further, the Fed would have to ensure that there

is no adverse move in the short-term yields, especially the 2-year UST beyond the 5% level as this could hurt bank balance sheets. Fed probably is also looking at neutralizing the impact on yields from the offloading of US treasury securities by China.

Forward guidance eludes:

The median dot plots at the previous Fed policy had pointed to a 75-bps cut (or 3 cuts of 25 bps each) in the course of 2024, with the start date in June. Stickier inflation data had, in the run-up to this policy, led to Fed talk turning hawkish. Now, the CME Fed watch tool indicates 50:50 chance of a September cut, that may even be delayed into November. Talks of US exceptionalism was common before data weakness in the US threatened this theory. One thus will have to be careful of such situations again in the future, given the large doses of uncertainty that exists. Hence, the Fed would have to take data from policy to policy before determining the time of the cut. However, it is becoming evident that the rate cutting cycle will be very shallow, probably restricted to only ONE in 2024.

When the US sneezes, the world catches a cold, so goes the saying. The repricing of US yields higher, driven by expectations of “higher for longer” policy rates has led to an appreciation of the US dollar. For the EM economies, a rise in the US yields means that the interest gap between EM economies v/s the US widens in favour of the US, thereby leading to a depreciation in the EM currencies. Along with higher global commodity prices, this does lead to fears of emergence of inflation pressures once again, that may in-turn lead to global economies surrendering easing of monetary policy. A case in point is the recent depreciation of the Indonesia Rupiah (IDR) by 3.2% since beginning of March. This led to the Bank of Indonesia to raise interest rates by 25bps to contain the IDR depreciation pressure.

We think that the RBI cannot move ahead to the Fed as interest differential between US and India is at an all time low, that has also led to debt FPI outflows and some depreciation pressure for the INR. Hoping that the Fed starts cutting in September, we see the RBI cutting repo rate as also changing the policy stance in October 2024.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)