The estimates are corroborated with the in-house developed SBI-ANN (Artificial Neural Network) model, with 30 high frequency indicators

FinTech BizNews Service

Mumbai, February 26, 2024: As per the Research Report from the State Bank of India’s Economic Research Department, the Q3 FY24 GDP growth likely at 6.8% on an unchanged base: Could hit 7% on the back of likely downward revisions in Q3 FY23 estimates. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Highlights from the report:

The likelihood of the global economy exhibiting stronger than expected growth in 2024 has brightened in recent months, with risks broadly balanced. Accordingly, the IMF upgraded its global growth forecast to 3.1% in 2024 and 3.2% in 2025 in its Jan’24 World Economic Outlook. On the flip side though, both UK and Japan slipping into recession warrants return to drawing board, situation exacerbated by Bundesbank hinting at stress factors driving beleaguered German economy. The joining chorus of countries from diverse localities (primarily EU) reflects the divergent fault lines economies from AEs to EMs are embracing as they come out of pandemic era Quantitative Easing and wrack caused by spiralling prices on consumers in last two years.

Global complexity also further gets clouded with the marked slowdown in China facing deflationary concerns now, a fallout of property bubble amidst overhang of debt among local governments that has slowed bank lending (despite cuts in key rates of late to spruce demand) and industrial enterprises profits dropping YoY, coupled with surging joblessness. The waning might of the mainland that has been battling tech and strategic isolation at world stage does not augur well for industrial and commodity demands for a world order limping back to normalcy in the short run at least.

As a counter narrative to the global gloom, consumer confidence has strengthened further in India, driven chiefly by optimism about the general economic situation and employment conditions. Various enterprise surveys also point towards strong business optimism.

The CLI Index (a basket of 41 leading indicators which includes parameters from almost all the sectors) based on monthly data shows a slight moderation in economic activity in Q3. Factoring the slight decline in economic activity in Q3 FY24, we estimate GDP should grow in the range of 6.7-6.9% with a GVA growth of 6.6%. Our estimates are corroborated with the in-house developed SBI-ANN (Artificial Neural Network) model, with 30 high frequency indicators. ANN has been trained for the quarterly GDP data from 2011Q4 to 2020Q4 and the in- sample forecast performance of the model in the training period has been precise.

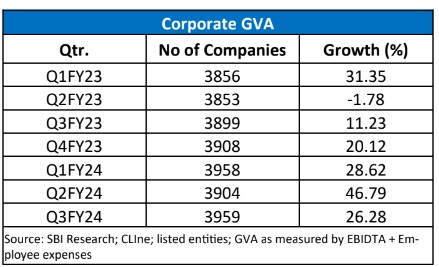

Corporate India has continued its robust performance buoyed by incrementally accelerating consumption patterns across urban-rural landscape. Corporate results, as recorded from around 4000 listed entities, for Q3FY24, shows robust growth of more than 30% in both EBIDTA and PAT, while top line grew by around 7% as compared to Q3FY23. Further, listed entities reported improvement in margin, as reflected in results of around 3000 listed entities ex BFSI, with EBIDTA margin of 14.95%, on aggregate basis, during Q3 FY24 as compared to around 12% during the same period previous year.

Corporate GVA, as measured by EBIDTA plus employee expenses reported a strong growth of around 26% in Q3FY24 as compared to Q3FY23.

As per First Advance Estimates, the estimated production of major Kharif crops for 2023-24 is 148.5 MMT, which is a decline of ~4.6% from FY23. While, the sowing season for rabi crops concluded on 23 Feb, indicate a slight increase in overall acreage compared to the previous year. However, concerns arose over the sown area under cereals, which saw a decline of 6.5% from the previous year.

While agriculture may see some moderation if the rabi output does not offset the kharif shortfall, value added in in agriculture will decline. The inland fish production has shown a rapid growth from 2014-15 to 2022-23. and reached to 131.13 lakh tonnes in 2022-23. The share of Fisheries sector constitutes about 1.07 % of the total national GVA and 6.86 % of Agricultural GVA. So, this might support the Agri & Allied sector growth in FY24.