Both rural and urban CPI inflation have increased in Aug’2025, to 1.69% and 2.47%, compared to 1.18% and 2.10% in July respectively.

FinTech BizNews Service

Mumbai, September 12, 2025: The State Bank of India’s Economic Research Department has come out with a research report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India.

THE CURIOUS CASE OF KERALA’S GALLOPING INFLATION

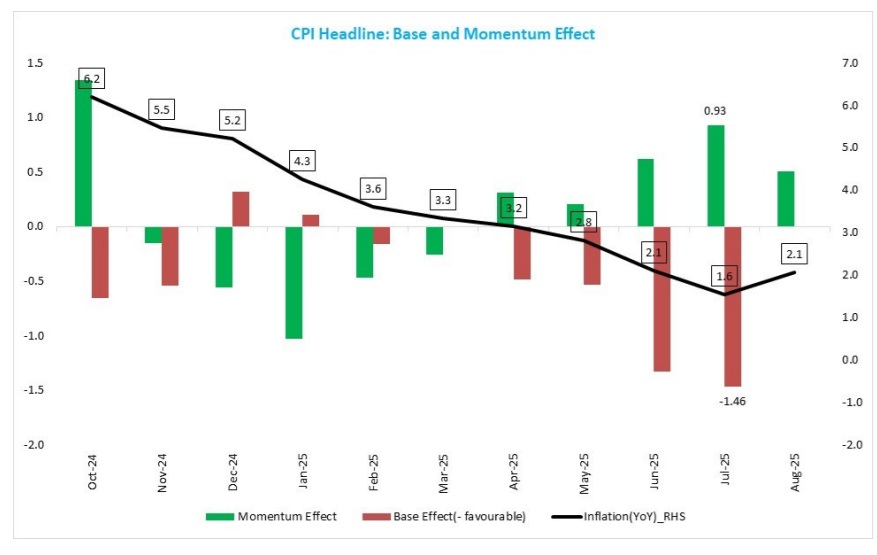

India’s CPI inflation which moderated to 98-months low of 1.55% in July’25, exhibited slight uptick for Aug’25 at 2.07%, driven by rise in food & beverages inflation while core inflation increased to 4.16%. Both rural and urban CPI inflation have increased in Aug’2025, to 1.69% and 2.47%, compared to 1.18% and 2.10% in July respectively. As base effects turned to zero, the price momentum has contributed to the rise in headline inflation. The state-wise inflation indicate that out of 35- States/UTs, inflation in 26 States/UTs inflation is below 4%. There are only 2-states /UTs, namely Kerala and Lakshadweep, whose inflation is more than 6%.

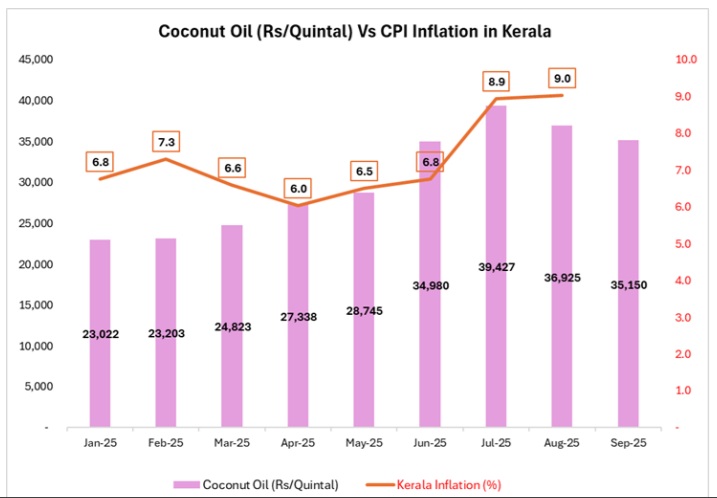

Even as the national CPI inflation has settled close to the 2% mark, the current month’s data shows wide regional variations in CPI print, from a negative 0.66% in Assam to 9.04% in Kerala. The Kerala case is clearly the most interesting outlier. The rural-urban breakup of inflation in the states shows that the rural inflation is at 10.05% and the urban inflation at 7.19%. The driving factor is the oil and fats component which is common for the entire combined CPI. However, in the case of Kerala the steep rise in coconut oil prices has driven the trend and local preference has dominated index momentum. The torrential rainfall in most of the north-west states (India's largest kharif crop producers) is a matter of worry and may impact food inflation. All-India rainfall between August and September (till 11/09) was nearly 8.7% above normal, with sharp excesses reported in Punjab (+109%), Haryana (+66%), Rajasthan (+47%), Gujarat (+29%), and Jammu & Kashmir (+78%). Southern states, too, were hit, with Andhra Pradesh recording 34% higher rainfall and Telangana 58%. Since the GST rate of essential items (around 295 items) has declined from 12% to 5%/NIL, the CPI inflation in this category may also come down by 25-30 bps in FY26 after considering a 60% pass through effect on food items.

Apart from this, the rationalization of GST rates of services should also lead to another 40-45 bps reduction in CPI inflation on other goods and service items, considering a 50% pass through effect. Overall, we believe CPI inflation may be moderated in the range of 65- 75 bps over FY26-27.

With August inflation print a tad higher that the 2% mark, a rate cut in October looks onerous. Even a rate cut in December looks a little difficult if growth numbers for Q1 and Q2 (estimates) are taken into consideration.

THE CURIOUS CASE OF KERALA’S GALLOPING INFLATION

Even as the national CPI inflation has settled close to the 2% mark, the current month’s data shows wide regional variations in CPI inflation. From a negative 0.66% in Assam to 9.04% in Kerala.

The Kerala case is clearly the most interesting outlier. The rural-urban breakup of inflation in the states shows that the rural inflation is at 10.05% and the urban inflation at 7.19%.

The driving factor is the oil and fats component which is common for the entire combined CPI.

However, in the case of Kerala the steep rise in coconut oil prices has driven the trend and local preference has dominated index momentum coupled with impact of changing climate on coconut production which is also absorbed domestically within the state.

Another factor is that the weight of personal care in CPI for Kerala is higher than other states which includes gold prices has also contributed to the build -up in state level CPI in Kerala.