Rate Cut Chances are Now Fading For Rest of FY25

FinTech BizNews Service

Mumbai, 12 November, 2024: The State Bank of India’s Economic Research Department has come out with a research report on CPI Inflation.

Highlights from the report, authored Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, are as follows:

India’s inflation touched 6.2% in Oct’24, the highest in 14 months. We expect Nov’24 inflation numbers are likely to be closer to 5.3% and the average FY25 inflation numbers are now trending at 4.8%-4.9%, against RBI 4.5%. Inflation is only likely to dip from January onwards, but this will be driven by base effects. We are now less hopeful of a February rate cut. We believe the first rate cut is now effectively pushed back beyond Feb’25.

If we look the State-wise Inflation, inflation in bigger states continue to outstrip the all India inflation rate of the same month. Among the States, Chhattisgarh clocked the highest inflation rate of 8.8% in Oct, followed by Bihar at 7.9% and Odisha at 7.5. Interestingly, a comparison of year on year changes and year to date changes reveal that year on year changes are far outpacing year to date changes. For example, there are 7 states, whose year-on year inflation has crossed more than 2% in a year. These indicates that the momentum of food prices has continued to climb up.

The gap between urban and rural consumers’ inflation trends was sharp for the 8th consecutive month, with rural households paying 1.07% higher than urban India. This is mainly due to the higher food prices and the rural basket of food items weight (54.2%) is higher than the urban weights (36.3%).

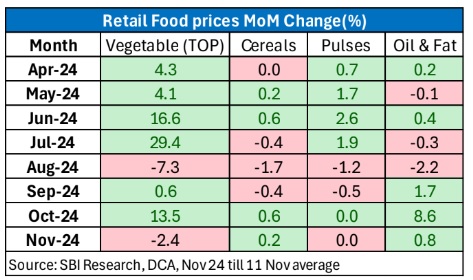

We believe that there will be some moderation in vegetable prices in month of November. The retail prices data till 11 Nov, indicate decline in vegetable prices. CPI headline inflation has peaked in Oct’24, but November and December numbers could still be higher than 5%.

With the currency market being subject to turbulence , we believe a higher inflation number could act as a blessing in disguise for RBI not to signal a rate easing cycle.