Credit Growth to drive GDP

SBI Research: Nothing unsecured about unsecured lending

Credit Growth to drive GDP

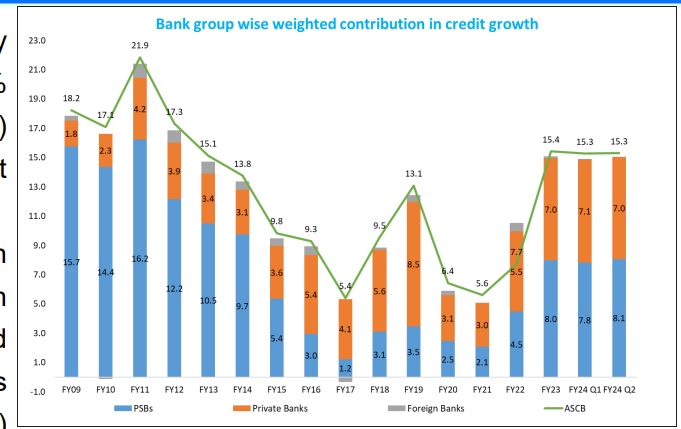

As an omen of things to unfold, the total asset/liabilities growth of the banking system during FY14-23 stands 1.3 times higher than the growth in the last 63-years (the combined incremental growth in assets and liabilities of ASCBs for the 9-year period ended March 2023 comes to Rs 187 lakh crore against Rs 142 lakh crore growth cumulatively clocked during the six-plus decades post independence (FY1951-2014).

Multiplier Effect

• With credit growth clocking new highs since early 2022, there is a growing need to assess the multiplier effect created through the broader economy within the overarching objective of sustainability

• In FY24, credit to nominal GDP ratio may end up being around 1.7 times, up from 1.2 times in FY23, boosting the flow of funds to the broader economy, as also ensuring a bull phase of growth is sustained.

- The credit-to-GDP gap has also narrowed, reflecting the improved credit demand in the economy in the face of rising capacity utilization in the manufacturing sector.

- There is one-way causal relationship between GDP and ASCB credit, with increase in credit leading to higher GDP using credit data from 1990 and GDP.

- Analyzing Time trend in retail loans shows no major compositional shifts (since April’2021 for secured as also unsecured portfolio of retail credit) with both secured and unsecured segments growing since COVID-19. Also, the share of secured portfolio dominates the unsecured portfolio within retail space. Further, total share of unsecured retail loans is only around one-tenth of ASCBs credit portfolio, indicating contained risk at the time.

- Lenders could also draw comfort from the fact that Secured loans are mostly long term (Housing loans constitutes nearly half of the retail portfolio) while unsecured loans are mostly demand loans that have lower comparative presence on lenders’ balance sheet while higher RoI also nudges borrowers to opt for pre-payment in many cases. Quality of retail portfolio growth of NBFCs (including Fintechs + P2P) has recovered in FY23.

- While approval rate for NTC (New to Credit) borrowers, whom lenders treat cautiously in the beginning, stood at 23% for the period ending march’23 (lower compared to 34% and 28% in 2020/21 respectively) the score tier upgrade for borrowers from Subprime, Near prime and Prime segments clocked better numbers than score tier downgrade (FY 23 over FY22) emphasizing much improvement in underlying spirits.

Consumer Credit

Recent origination statistics by Risk Tiers in consumer credit showcase increasing sectoral alignment: PSBs clearly trumping peers in terms of better rated customer onboarding.

- Basis CIBIL CMI data (Mar’23), Personal loans of Rs 50,000 and more comprise 98% of the total personal loan book size in terms of value. Small-ticket personal loans of less than Rs 50,000 form 2% of the personal loan book size (in terms of value) and account for only 0.3% of the total retail loan book size at industry level.

- Household debt as measured by credit card outstanding per credit card in India has been either static or declining both in nominal and real terms (after adjusted for CPI inflation) in 2023. The decline in real credit card outstanding per card despite higher inflation expectations is a positive development. In nominal terms, the outstanding per credit card rose by 13% in August, down from 24% in January. The real outstanding per credit card growth in August declined to 5.8% from 16.4% in January.

Borrowing Profile

- Heuristic data analysis of select borrowing profile reveals that both NTC (New to Credit) and NTCC (New to Credit Card) segments (i.e. people getting inducted into formal credit mechanism first time, either through institutional lenders or a credit card company) are showing little divergence in credit behavior post onboarding, alleviating concerns being raised from select quarters • In fact, NTC customer profile shows judicious adherence to repayment discipline vis-à-vis NTCC populace.

- Continued better and evolving risk monitoring and robust lending practices by all systemic players in sync with Credit Information Companies is the optimal approach to anchor consumerism optimally.

- Bank results declared so far indicate the good run continuing with bottom line further improving while GNPA falling sub-3%.

(SBI Research is led by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI)