RBI expected to cut rates in February 2025 cumulative 75 bps and such a decision is unlikely to be impacted by what is happening to $

FinTech BizNews Service

Mumbai, 7 December, 2024: The State Bank of India’s Economic Research Department has come out with a Research Report on the MPC meet, concluded on Friday.

Highlights of the report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, are as follows:

As widely expected, the MPC decided to keep repo rate at 6.50% (eleventh time in a row), with a 4-2 voting. MPC however unanimously decided to continue with the neutral monetary policy stance and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth.

RBI has sharply downgraded its real GDP growth forecast for FY25 from 7.2% to 6.6% (Q3: 6.8%, and Q4: 7.2%) with risks evenly balanced. Such a downward revision in growth forecast is nothing new as in FY22 and FY23 the growth forecasts were downgraded on an average by 90 basis points. In current fiscal, growth forecast was indeed revised, but upwards from 7 to 7.2%. This is the first time in the last 5 years that the RBI has first revised the growth estimates upwards and then downwards to 6.6%. This is indeed an implicit recognition by RBI of missing the growth estimates by a wide margin. We believe that GDP growth for FY25 will be lower than the RBI’s estimate and we are pegging the GDP growth at 6.3% for FY25.

RBI has revised upwards its inflation projection for FY25 by 30 bps to 4.8% with Q3 at 5.7% (earlier: 4.8%), and Q4 at 4.5% (earlier: 4.2%). At the same time, although the policy is mute on rates, it is considerably loaded on regulatory and development front.

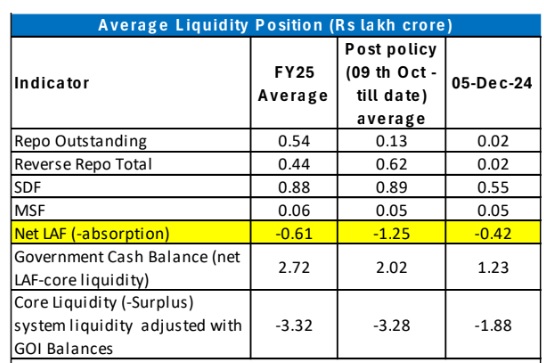

RBI reduced CRR by 50 bps in two equal tranches of 25 bps each to 4.0% of NDTL with effect from the fortnight beginning 14 Dec’24 and 28 Dec’24, respectively. ₹1.16 lakh crore will be released due to CRR cut will may ease the liquidity situation in the coming months. However, the reduction in CRR may not mathematically translate to any change in deposits and lending rate, however, it may have positive impact on margins (3-4 bps on NIM) of the banks.

To be fair to RBI, liquidity in the system has been significantly impacted by the wide volatility in Government cash balances a counter cyclical measure to address systemic liquidity. This has entered a new phase with the launch of SNA Sparsh, replacing the earlier CSS-SNA and absorbing huge float funds from the banking system. 27 Major CSS schemes having a Budget outlay of ~Rs 3.70 lakh crore have migrated to SNA SPARSH in FY 2024-25. SNA SPARSH eliminates the role of commercial banks, as central ministries and state treasuries are integrated on RBI’s eKuber platform using IFMIS (Integrated Financial Management and Information System). The next couple of years will thus be the biggest challenge for the RBI liquidity management to take care of an estimated Rs 7.5 trillion fund flow through IFMIS. Thus we strongly recommend that CRR may be brought down to 3% , that was prevailing in March 2020. This could release an additional Rs 2.32 trillion in the banking system. The decision to raise the upper limit of FCNR rates will not bring any new capital inflows. Instead, a CRR cut on such products would have been very helpful.

RBI has allowed SFBs to extend pre-sanctioned credit lines through the UPI. This may have potential to make available low-ticket, low-tenor products to ‘new-to-credit’ customers. In a significant move, RBI has announced Introduction of the Secured Overnight Rupee Rate (SORR) – a Benchmark based on the Secured Money Markets. The measure is a continuation of the ongoing reform measure in financial benchmarks. The SORR is expected to give further boost to derivate markets, provide an additional input for banks to price loan if necessary. The decision to hike loan limit to Rs 2 lakhs is also helpful. On the digital banking side, RBI has constituted a committee to develop a Framework for Responsible and Ethical Enablement of AI. The objective is to provide firms providing financial products and services with a set of foundational principles to consider when using AI in decision-making and promote public confidence and trust in the use of AI. In a similar vein, the use of technology to detect mule accounts is significant for banks as mule accounts is a sophisticated mechanism to misuse banking channel for money laundering.

On the communications side, RBI expanded the policy consultation process of the RBI through Connect 2 Regulate. The measure will be open to all including scholars for directly sharing suggestions and ideas with the RBI. The measure makes financial regulation process more democratic and participatory. RBI will also use podcast for wider information dissemination. We expect RBI to cut rates in February 2025 cumulative 75 bps and such a decision is unlikely to be impacted by what is happening to $, as was the case in 2018 when the RBI did not hike rates even as rupee was under enormous pressure.