Dr. Soumya Kanti Ghosh argues: “We must refrain from policy mistakes promising undesirable short term fiscal bonanza like loan waivers, unscientific and universal crop price guarantees should be avoided. Farm loan waivers have been a self-inflicted Harakiri, distorting the credit culture of borrowers and not even marginally serving the purpose in the medium to long term...similarly, only MSP driven agricultural growth is more fiscally extravagant and results in extreme ground water depletion;

FinTech BizNews Service

Mumbai, 6 November, 2024: The Blip in Growth in Q2 might be an Impasse, tailwinds of recovery is now reinvigorated by a surge in rural demand... a proxy of better income levels...better capturing of soft data need of the hour as the shift towards Q-commerce has accentuated in urban areas, regulatory actions having a desired impact on credit profile of urban demographics...Policy mistakes promising undesirable short term fiscal bonanza like loan waivers, unscientific and universal crop price guarantees should be avoided, states Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, in his latest, extra ordinary research report.

Global Growth Momentum Expected to be Stable

❑ A slowdown in global growth momentum in Q3CY24 weighed down by intensifying geopolitical conflicts

❑ The geopolitical risk indicator has shown an upturn in October due to the ongoing tensions in the Middle East

regional war risk as recent exchanges between Israel and Hezbollah have significantly increased tensions

❑ U.S.-China strategic tensions risk given escalating tension between China and the Philippines in the South China Sea

GDP growth

Our initial estimates for Q2FY25 GDP growth is at 6.5%, data for which will be released on 29 November...expected buoyancy in Q3 and Q4 growth numbers could still push overall yearly GDP growth

closer to 7% in FY25

Domestic Leading Indicators are still resilient

❑ Leading indicators are showing mixed signals. For instance, domestic passenger vehicle sales which is an indicator of urban demand as well as other indicators of consumption and demand as diesel consumption, electricity demand and bitumen consumption have eased. Transport and communication indicators as passenger and freight traffic at airports and toll collection are showing traction, however, e-vehicle registration continues to lose steam in Aug’24 and Sep’24. Thus, growth seems to be entering a softer patch

❑ We track 50 leading indicators in consumption and demand, Agri, Industry, service and other indicators, which indicate a dip in Q2FY25. The % of indicators showing acceleration is declined to 69% in Q2 FY25 vs 80 % in Q2 FY24 and 78 % in Q1 FY25

Auto Sector: Comparative Analysis

❑ Two-wheeler sales – a proxy for rural consumption demand – has recorded exponential growth (YoY) in FY25 as compared to FY24

❑ However, the auto sector is relatively sluggish in urban area – as proxied using passenger vehicle sales – in FY25 as compared to FY24

❑ Oct24 projections paints positive picture for next quarter – for both rural and urban economy

...However...IT sector is now recording positive hiring...Q3 and Q4 could be better

❑ All four IT companies - TCS, Cognizant, Infosys and Wipro - have shown positive employee hiring in the

September quarter

❑ IT companies are back on the college campus for bulk hiring with employee utilisation reaching high levels

Leading Indicators Declined/Contracted

Domestic Vehicle sales declined but showing growth in Oct’24

❑ Average daily petroleum consumption contracted

for the second consecutive, driven by a decline in diesel

consumption

❑ Electricity Demand also declined

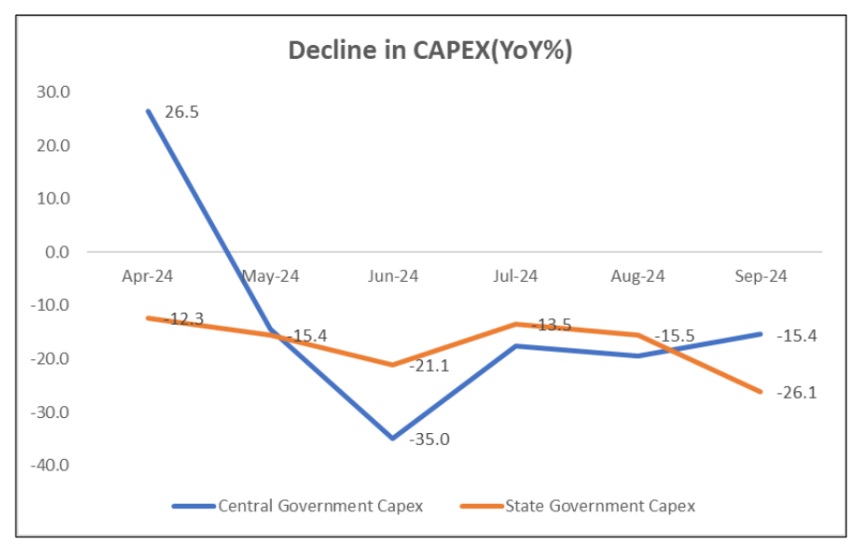

CAPEX declining, and REVEX outpacing CAPEX

Capital expenditure has also slowed down in current fiscal. Majority of the states Capex as % of BE is lower in H1FY25, while Committed Expenditure continue to increase as a %age of expenditure pie for most of the states

Slowdown in Manufacturing in Q2FY25: Recovering in October

❑ Manufacturing and services Purchasing Managers’ Index declined till September, driven by a downturn in manufacturing output

❑ Though, both IIP and IIP- Manufacturing are declining which is partly by high base and party by sluggish in manufacturing growth

Deposits Growth Surpassed Credit Growth in October 2024

❑ Latest numbers shows that SCBs deposit growth has now surpassed credit growth. In the Current FY so far (till 18 Oct), ASCBs deposits grew by 11.7% YoY compared to last year growth of 13.4%, while credit grew by 11.5% YoY compared to last year growth of 20.0%. Deposit Credit differential has now turned positive, which was last seen in April 2022. However, for PSBs (10 out of 12), which have reported their Q2 earnings, deposit growth has lagged behind credit growth (except IOB), while for private players credit growth has slowed down

❑ In terms of profitability, PSBs have trumped the PVBs by a wide margin on YoY basis.

Sector-wise Credit Growth Indicates contribution of retail loans are declining

❑ The sector-wise credit growth for September 2024, indicate that except industry all business segment growth has been moderated

❑ Credit to agriculture and allied activities grew by 16.4% (last year: 16.7%); credit growth to industry improved to 9.1% (last year: 6.0%). Credit growth to services sector decelerated to 15.2% (last year: 21.6%), primarily due to lower growth in credit to NBFCs

❑ Personal loans growth moderated to 16.4% (last year: 18.2%), largely due to decline in growth in ‘other personal loans’, ‘vehicle loans’ and ‘credit card outstanding’. However, ‘housing’ – the largest constituent of this segment – recorded accelerated growth

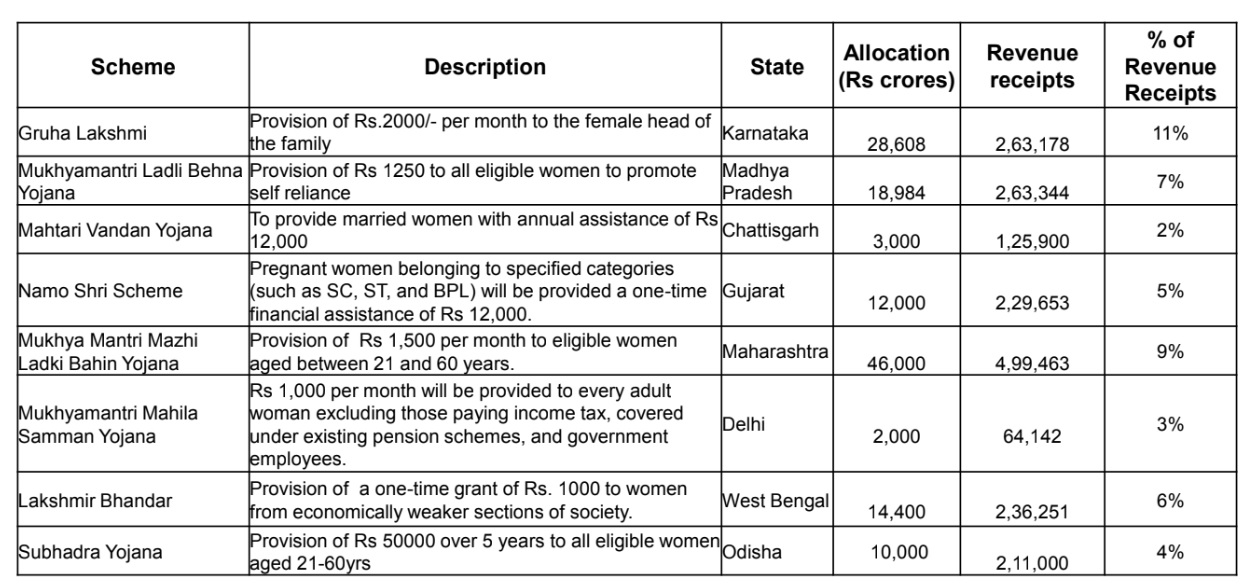

Direct Benefit Transfer Schemes for women across states has now crossed Rs 2 trillion...

In a bid to women voters in the elections, all the parties have announced similar to the women-centric schemes, which give direct cash transfer ranging from Rs 1000-2000 per month. The total cost of 8 states amounts Rs2.11 lakh crore ( Trillion-Tn), which varies 3-11% of the states revenue receipts.. Could boost consumption and spending.

Dr. Soumya Kanti Ghosh argues: “We must refrain from policy mistakes...For example, farm loan waivers, have been a self-inflicted Harakiri, distorting the credit culture of borrowers and not even marginally serving the purpose in the medium to long term...similarly, only MSP driven agricultural growth is more fiscally extravagant and results in extreme ground water depletion."