Some Bit Of Crowding Out Of Bank Deposits By MF Is Noticeable

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, August 20, 2024: The recent debate on whether mutual funds are displacing bank deposits has been analyzed in detail using econometric analysis to ascertain relations between the two variables.

1. An econometric analysis does not show a causal relation between bank deposits and mutual funds either ways.

2. Data however shows that in the pre-covid period the elasticity of growth in deposits to growth in mutual funds was higher at 0.56 and came down to 0.35 in the post covid period. So clearly, there has been some displacement.

3. The ratio of AUM of mutual funds to bank deposits has been rising from FY14 onwards. However, it had plateaued around 21% before covid. Subsequently it has moved up sharply and peaked at 35% in FY24.

4. There is a strong relation between stock indices and AUM under mutual funds (assuming these indices represent both equity and debt market) which has heightened post FY20. Therefore, the future of AUM can hinge on the market performance.

MF/BD? The new age shift?

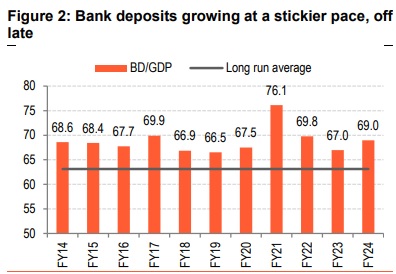

Recently, two important instruments of household financial savings have garnered quite a bit of attention. There have been debates that increase in AUM (assets under management) of MFs (mutual funds) are happening at the cost of BD (Bank deposits), with conjectures that lucrative returns, promise of higher earnings of companies and a stable growth environment have turned the compass from a traditional savings set-up to a market-oriented investment tendency. This study looks at different aspects of the issue. Prima facie, a shift in savings pattern is noticeable, especially post Covid when there has been a spurt in financial savings of households. The elasticity of BD to MF has also reflected the changing behavioral pattern of households. However, statistical exercises to show a causal relationship do not lead to concrete results. A time series analysis between MF and BD has been conducted using Granger causality test and Cointegration regression, which shows neither MF Granger causes BD nor the other way round. The variables are not cointegrated as well, under different iterations. A plausible explanation could be that the cycles of MF outweighing BD are transient, and a very recent phenomenon. Besides both the variables have been growing albeit at differential rates. Background: There has been growing debate around changing structure of households’ financial savings. From traditional Bank deposits (BD), the shift has been towards the capital market, with an inclination of increased allocation towards mutual funds (MFs). Growing risk appetite amid stable domestic growth environment and booming stock markets has resulted in this rebalancing of portfolio. Apart from this, growing financialization of savings, higher relative return and liquidity could be a plausible explanation for the shift. The ratio of Assets under Management (AUM) of MFs to GDP has risen to 18.1, which is the highest print seen in the entire series. Notably, the sharp increase in ratio was seen particularly post Covid period which coincided with buildup in precautionary savings of households (share of gross financial savings to gross savings of household shot up to 68.1% in FY21 from 58.9% in FY19). In case of banks deposits to GDP, ratio was 69% in FY24, down from 76.1% in FY21 . The take-off phase of rechanneling of instruments from deposits to MFs was glaringly visible in FY22. The share of deposits in gross financial savings of household, albeit considerably higher at 29.4% has witnessed deceleration from 33% (long run average), whereas share of MF has risen considerably to 6% from 2% (long run average). The quantum of the two may not be comparable, but it cannot be denied that some rejigging is happening.

The question, which is pertinent here, is the shift structural and likely to sustain or not? There is an argument that even if individuals are moving deposits to mutual funds, the money must finally rest with banks as it will only mean transfer from a retail to a corporate account. In continuation of this logic, it is argued that deposits can never go down as any shift will only mean change in nomenclature of deposits in terms of ownership. There is merit in this argument and this could possibly the reason as to why we have not been able to determine a causal relationship in this analysis. Also, both the variables have been increasing during this period and hence a negative relation is not visible even though the pace of growth in deposits has slowed down. Interestingly RBI data shows that on an annual basis the share of mutual funds in total deposits is insignificant and has not changed over time.

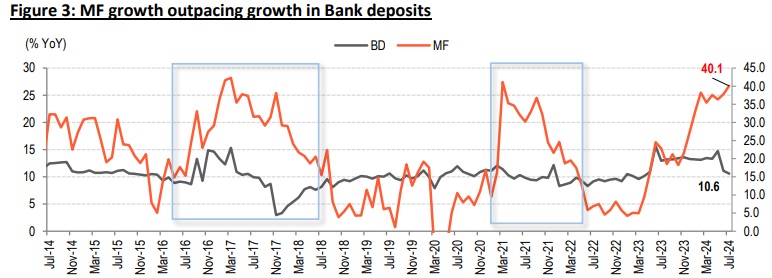

How did the growth in MF and BD fare?

· It is clear that growth in MF is far outweighing BD. The CAGR of MF for the past 10 years is double that of BD at 20.5%, whereas for BD it is at 10.3%. Notably, with the popularization of MF as an instrument, the cycle where MF growth has exceeded BD has become entrenched. The past two notable cycles of MF growth exceeding BD growth lasted for 28 months and 15 months respectively, albeit most of it being transient and impacted by a favourable base especially for MF. The current cycle is 15 months and yet running.

· Even after discounting the seasonal fluctuation in both MF and BD series, the current cycle where MF growth exceeded BD has been a persistent one since Nov’23.

The ratio of AUM to BD (Term deposits) reflects some readjustment of portfolio of household savings. The current ratio is far higher than the long-run average. It is thus clear that the pace of accretion of MF is happening at a faster pace than BD. From the elasticity angle as well, this stands out. The elasticity of BD to MF has gone down 0.35 post Covid which reflects changing behavioral pattern of household. Thus, some bit of crowding out of BD by MF is noticeable.

Does data show substitution or not?

A statistical exercise is conducted to show whether some degree of crowding out persists between MF and BD or not. Here it is important to mention that we have performed a couple of iterations.

1) On outstanding Bank Deposits and Outstanding AUM of MFs Time period considered in our analysis runs from Oct’99, based on the availability of data, with a total number of observations at 298. To examine the causality, we have performed the Granger Causality test. The prerequisite of series being stationary has been fulfilled and the series turns out to be stationary in its first difference.

Thus, as per results, Mutual fund does not Granger Cause Bank Deposits, but Bank Deposits does Granger Cause Mutual fund. To further check whether the relationship is spurious or not, we have used the concept of cointegration. Here, as seen before performing Granger causality test that both BD &MF I (1) [Integrated of order 1] and the error term is I (0) i.e. stationary.

However, OLS estimates give hint of spurious regression as t-statistic is very high, R2>Durbin Watson stat.

To further establish whether the series are cointegrated or not, we run the cointegration regression and Engle Granger and Phillips Ouliaris tests, both of which do not confirm that series are cointegrated.

2) Next, we divide it into two periods (FY14-19) and FY20 onwards, especially to reflect the changing pattern of household’s preferential savings instrument. The rationale of choosing the break is on account of faster pace of accretion of AUMs of MFs post Covid. The results of Granger causality for both the periods show no causality between MF and BD and the other way round as well, after checking the prerequisite of stationarity. This contrasts with what we have seen for the full series, where one way causality turned out to be true, which was seen to be spurious later in the cointegration test.

For both the periods, both BD and MF turned out to be I (1), while for residual it turned out to be stationary at 10% and 5% level of significance for 2014-19 and for 2020 onwards, respectively. The OLS results turned out to be spurious, thus further progressing with the test of cointegration, there appears to be no relationship between BD and MF.

3) Seasonally adjusted BD and MF series: For the entire series, we get similar results as for the unadjusted series. The only contrast that is visible is that Granger causality test does not show any causality between BD and MF. We have again validated using tests of cointegration, where the series found out to be not cointegrated. For 2014-19, the error term turns out to be nonstationary in level for 2014-19, thus we cannot proceed. For 2020 onward series, there turns out to be causality, but in cointegration test, the variables turn out to be not cointegrated.

4) Accretion of MF and BD: Both AUM of MF and BD are stock variables. Thus, accretion is used. However, the results don’t differ much. For the entire series, neither Granger causality nor cointegration tests show any relationship. For 2014-19, BD I (0) and MF I (1), thus we cannot proceed, we have used the ARDL model, however, the results show that no stable relationship holds. For 2020 onwards, the residual turns out to be non-stationary in level, thus we cannot proceed.

5) The YoY series also shows no causality and cointegration relationship between MF and BD. For two time periods, the result of 2020 onwards turns out to be interesting as both Enger Granger and Phillips-Ouliaris show variables are cointegrated, however, the Error Correction Mechanism (ECM) shows that the coefficient of the lagged residual doesn’t lie between -1 and 0, thus a stable relationship doesn’t hold.

6) The MoM series from 2020 onwards as well shows no causality between MF and BD.

Why does data not capture the degree of substitution between MF and BD?

· Firstly, the take-off in MF has been more of a recent phenomenon and originating from a low base, seen in the past. Also, in line with MFs, even deposits have garnered pace, thus the data necessarily doesn’t capture any concrete statistical relationship between the two. Even while calculating simple correlation coefficient between the two series, it has never turned out to be negative. Thus, the time series data does not capture the recent transitory cycles of MF outpacing BD. It is to be noted that, for structural breaks, cointegration tests fail.

· To simplify our analysis, only bi-variate relationship between MF and BD are looked at, ceteris paribus. Also, our study has the limitation of not exploring the non-linear relationship that may exist and outside the scope of the tools which we have used. Apart from this, cointegration tests also fail to say anything about which of the variables is used as regressor and why and the results change accordingly.

· Another limitation of cointegration which we have used is that it does not shed any light on short run dynamics but focusses more on long run relationships.

· A better way to capture the changing relationship would be to use the ratio of MF and BD to financial assets of household (FA). This indeed will capture the changing share of the instruments in the overall pie which itself is increasing at a faster pace (between FY19-23, FA rose at a CAGR of 8.5%). The limitation is that we don’t have a long run series of the same.

· Another argument of not seeing a clear relationship between MF and BD would be just changing hands of money; the logic that for every investment, simply flow of money would move around savings to current account and vice versa. In conclusion it is still not clear that there is a causal relationship statistically between growth in deposits and mutual funds. Being a more recent phenomenon, the long-term time series did not show significant trend for mutual funds in the past and hence this can be a reason for the absence of significant relations between the two. In terms of plain elasticities, there has been a lower number in the period starting FY20 when mutual funds gained in ascendency. It would need to be seen whether this tendency will be sustained as a large part of the migration to the equity market has been due to a booming stock market. Interestingly, there is a steady relationship between changes in the stock indices with AUM of mutual funds assuming the former is taken to be representative of the capital market even though the debt segment is different. For the period of FY14 to FY19 stock index changes explained just 11% of the variation in AUM (the coefficient of determination). For the period FY20 onwards to July 2024 this ratio went up to 56% while the coefficient for stock index remained range bound. The takeaway is that the state of the stock market would be a major driver of the AUM of mutual funds in future.