RBI Revises Guidelines On Several Loan, including housing loans under PSL; Loans Up To Rs50 Crore To MSMEs & Agri Start-Ups To Be Eligible As PSL; These Directions shall come into effect on April 01, 2025

FinTech BizNews Service

Mumbai, March 24, 2025: Reserve Bank of India has issued the revised guidelines on Priority Sector Lending (PSL) today after a comprehensive review of existing provisions taking into account feedback from stakeholders. The new guidelines which come into effect from April 01, 2025, include the following major changes:

The enhanced coverage of the revised guidelines is expected to facilitate better targeting of bank credit to the priority sectors of the economy.

The Reserve Bank of India has, from time to time, issued a number of instructions/ guidelines to banks relating to Priority Sector Lending (PSL). New Master Directions - Reserve Bank of India (Priority Sector Lending – Targets and Classification) Directions, 2025 are issued today. These Directions shall come into effect on April 01, 2025, and shall supersede the earlier Directions on the subject. The provisions of these Directions shall, unless otherwise provided, apply to every Commercial Bank [including Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank (LAB)] and Primary (Urban) Co-operative Bank (UCB) other than Salary Earners’ Bank.

All loans categorised as Priority Sector Lending (PSL) under the erstwhile Master Directions on PSL dated September 04, 2020 (updated as on June 21, 2024) shall continue to be eligible for such categorisation under these Directions till maturity.

Categories under Priority Sector

The categories under priority sector are as follows: i. Agriculture ii. Micro, Small and Medium Enterprises iii. Export Credit iv. Education v. Housing vi. Social Infrastructure vii. Renewable Energy viii. Others

Computation of Adjusted Net Bank Credit (ANBC)

For the purpose of calculation of Credit Equivalent of Off-Balance Sheet Exposures (CEOBSE), banks shall be guided by the circular on ‘Large Exposures Framework’ issued by Department of Regulation, RBI vide DBR.No.BP.BC.43/21.01.003/2018-19 dated June 03, 2019 and as updated from time to time.

While calculating Net Bank Credit as above, if banks subtract prudential write off at Corporate/Head Office level, it shall be ensured that the credit to priority sector and all sub-sectors so written off shall also be subtracted category wise from priority sector target and sub-target achievement. Investments or any other items which are treated as eligible for classification under priority sector target/sub-target achievement, shall also form part of Adjusted Net Bank Credit.

Targets/Sub-targets for Priority sector

The targets and sub-targets set under priority sector lending, to be computed on the basis of the ANBC/CEOBSE2 as applicable as on the corresponding date of the preceding year.

The priority sector lending targets for UCBs shall be as follows:

Targets as a percentage of ANBC or CEOBSE, whichever is higher

Total Priority Sector 60%

Micro Enterprises 7.5%

Advances to Weaker Sections 12%

Adjustments for weights in PSL Achievement

To address regional disparities in the flow of priority sector credit at the district level, it was decided to rank districts on the basis of per capita credit flow to priority sector and build an incentive framework for districts with comparatively lower flow of credit and a dis-incentive framework for districts with comparatively higher flow of priority sector credit. With effect from FY 2024-25, a higher weight (125%) shall be assigned to the incremental priority sector credit in the identified districts where the credit flow is comparatively lower (per capita PSL less than RS9,000), and a lower weight (90%) will be assigned for incremental priority sector credit in the identified districts where the credit flow is comparatively higher (per capita PSL greater than Rs42,000).

Adjustments for weights to incremental PSL credit will be done by RBI, based on reporting of district wise credit flow to FIDD, CO through the ADEPT database. RRBs, UCBs, LABs and foreign banks (including Wholly Owned Subsidiaries) would be exempted from adjustments of weights in PSL achievement due to their currently limited area of operation/catering to a niche segment.

ELIGIBLE CATEGORIES

The lending to agriculture sector will include Farm Credit (Agriculture and Allied Activities), lending for Agriculture Infrastructure and Ancillary Activities.

Loans against pledge/hypothecation of agricultural produce (including warehouse receipts) for a period not exceeding 12 months subject to a limit up to Rs90 lakh against Negotiable Warehouse Receipt (NWRs)/Electronic Negotiable Warehouse Receipt (eNWRs) and up to Rs60 lakh against warehouse receipts other than NWRs/eNWRs viii. Loans to farmers for installation of stand-alone solar agriculture pumps and for solarisation of grid connected agriculture pumps ix. Loans to farmers for installation of solar power plants on barren/fallow land or in stilt fashion on agriculture land owned by farmer

Corporate farmers, Farmer Producer Organisations/ Companies (FPOs)/(FPCs) of Individual Farmers, Partnership firms and Co-operatives of farmers engaged in Agriculture and Allied Activities (a) Loans for the relevant activities, subject to an aggregate limit of Rs4 crore per borrowing entity, will be eligible.

Loans up to Rs4 crore against pledge/hypothecation of agricultural produce (including warehouse receipts) for a period not exceeding 12 months against NWRs/eNWRs and up to Rs2.5 crore against warehouse receipts other than NWRs/eNWRs (c) Loans up to Rs10 crore per borrowing entity to FPOs/FPCs undertaking farming with assured marketing of their produce at a pre-determined price (d) Loans up to Rs10 crore for purchase of the produce of members directly engaged in agriculture and allied activities

Note: UCBs are not permitted to lend to co-operatives of farmers.

Agriculture Infrastructure

Loans for agriculture infrastructure will be subject to an aggregate sanctioned limit of Rs100 crore per borrower from the banking system. List of activities is furnished in Annex II (Item I).

Ancillary Services

The following shall be eligible to be classified in this category: i. Loans specified in Annex II (Item 2) ii. Loans up to Rs50 crore to Start-ups that are engaged in agriculture and allied services iii. Loans for Food and Agro-processing up to an aggregate sanctioned limit of Rs100 crore per borrower from the banking system

Lending by banks to NBFCs and MFIs for on-lending in agriculture

Bank credit to registered NBFCs (other than MFIs) towards on-lending for ‘term lending’ component under agriculture will be eligible for PSL classification up to Rs10 lakh per borrower subject to conditions specified

Micro, Small and Medium Enterprises (MSMEs)

All bank loans to MSMEs shall qualify for classification under priority sector lending. (iii) Loans up to Rs50 crore to Start-ups, that conform to the definition of MSME, shall also be eligible to be classified under this category.

Factoring transactions pertaining to MSMEs taking place through the Trade Receivables Discounting System (TReDS) shall also be eligible for classification under priority sector.

Other Loans eligible to be classified under PSL in the MSME category These include: (i) All loans to units in the Khadi and Village Industries sector, which shall be categorised as lending to micro enterprises.

Loans to registered NBFCs (other than MFIs) for on-lending to micro and small enterprises up to Rs.20 lakh per borrower as per conditions specified in para 23 of these Master Directions (not applicable to RRBs, SFBs and UCBs)

Outstanding deposits with SIDBI and MUDRA Ltd. on account of priority sector shortfall.

Education

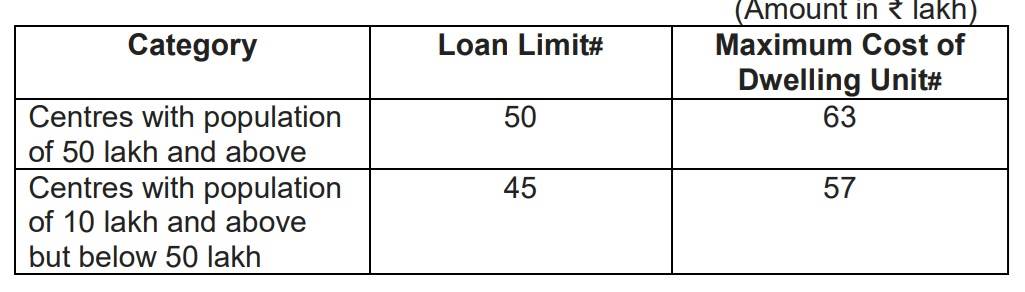

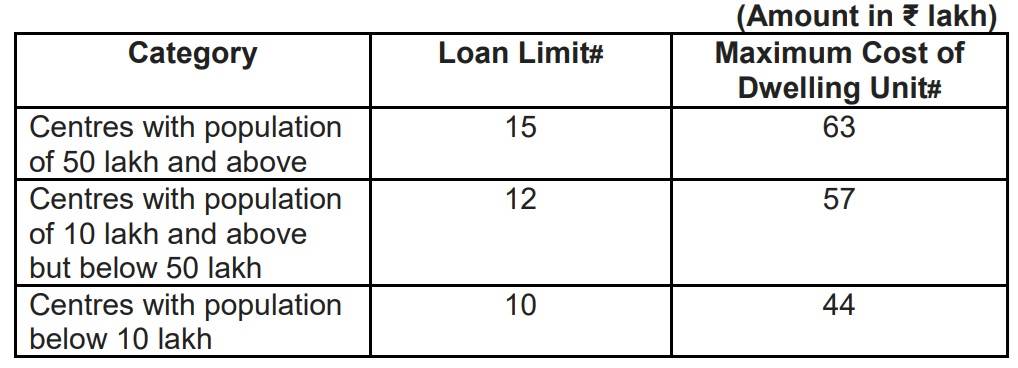

Loans to individuals for educational purposes, including vocational courses, not exceeding Rs25 lakh will be considered as eligible for priority sector classification. 13. Housing 13.1. Bank loans to Housing sector as per limits prescribed below are eligible for priority sector classification: i. Loans to individuals for purchase/construction of a dwelling unit per family subject to the following limits:

Loans for repairs to damaged dwelling units shall be eligible for priority sector classification subject to the following limits:

Social Infrastructure

Loans up to a limit of Rs8 crore per borrower for setting up schools, drinking water facilities and sanitation facilities including construction/refurbishment of household toilets and water improvements at household level, etc.

Loans up to a limit of Rs 12 crore per borrower for building health care facilities in Tier II to Tier VI centres. In case of UCBs, the equivalent centres are those in Category ‘D’.

Renewable Energy

Bank loans up to a limit of ₹35 crore to borrowers for renewable energy-based power generators and for renewable energy based public utilities, viz., street lighting systems, remote village electrification etc., will be eligible for priority sector classification. For individual households, the loan limit will be Rs10 lakh per borrower.

For furtherdetails:https://rbidocs.rbi.org.in/rdocs/notification/PDFs/128MD66C4DDCB167C4DC9A5BD913570CB3D47.PDF