The Management of the SFB expects the collection efficiency to improve in the fourth quarter

FinTech BizNews Service

Mumbai, January 5, 2025: The provisional business updates of Equitas Small Finance Bank for Q3 FY25 are as under:

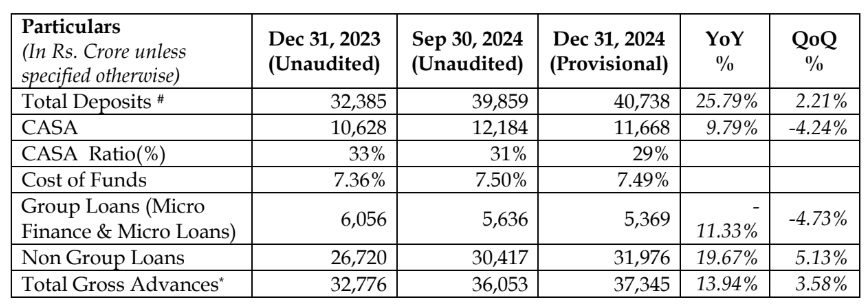

· Gross Advances as of 31st December 2024 at Rs. 37,345 Crs, up 13.94% YOY and 3.58% QOQ

· Total Deposit as of 31st December 2024 at Rs. 40,738 Crs, up 25.79% YOY and 2.21% QOQ

· Cost of Funds Stands at 7.49% as on 31st December, 2024

· CASA Ratio Stands at 29% as on 31st December, 2024

Total Gross Advances includes IBPC/Securitized/ Assigned portfolio of Rs. 1,228 Crore as on December 31, 2024 and Rs. 1,398 Crore as on September 30, 2024

#Total deposits include Certificate of Deposits.

The numbers mentioned above as on December 31, 2024 are provisional unaudited numbers and is subject to approval of the Audit Committee and Board of Directors and also subject to limited review by the Joint Statutory Auditors of the Bank.

In accordance with the applicable clauses of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and Code of Practices and Procedures for Fair Disclosure of Unpublished Price Sensitive Information framed in terms of Regulation 8 of SEBI (Prohibition of Insider Trading) Regulations, 2015, the SFB has intimated the NSE & BSE the above details with respect to Bank's Deposits and Advances for the quarter ended December 31, 2024:

Management Commentary:

The non-microfinance portfolio of the bank which now forms 86% of the total advances, has grown by 20% YoY. The bank has consciously slowed down disbursements in micro finance, leading to a 11% drop in advances YoY. The stress in microfinance is finally showing early signs of stability, with the collection efficiencies of Q3FY25 being at the same level as Q2FY25.

With the many initiatives taken by the bank, along with the tightening of lending discipline by the Industry SRO, we expect the collection efficiency to improve in the fourth quarter.

The Bank has successfully raised Rs.500 crores of Tier II Bonds in Dec’24. The Bank’s Capital adequacy is now healthy at above 20%.