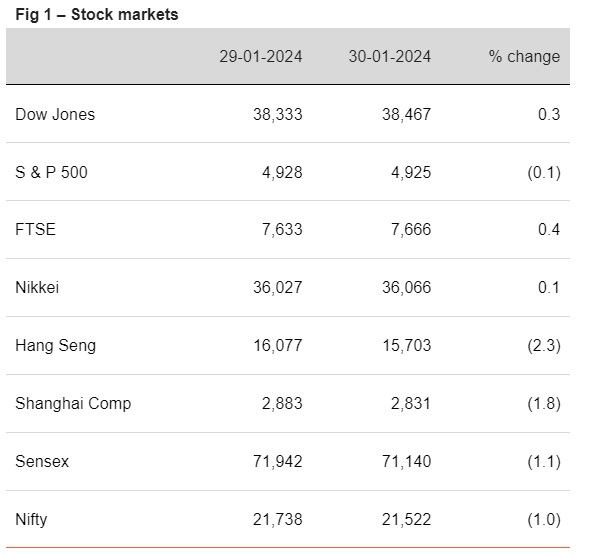

Sensex ended in red and was dragged down by losses in consumer durable and capital good stocks. It is trading lower today in line with other Asian indices

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, January 31, 2024: IMF has revised its global growth projections upward for CY24 to 3.1% (+0.2% from Oct’23 projection) and expects 3.2% growth in CY25. The revision is on account of resilience witnessed in US growth and fiscal support announced in China. US GDP forecast for CY24 has been revised up from 1.5% (Oct’23 projection) to 2.1%. China is expected to clock in 4.6% (4.2% earlier) growth in CY24. Even for India, the Fund now expects FY25 growth at 6.5% versus 6.3% earlier. In US, high frequency data such as JOLTS data reaffirms Fund’s views. Job openings in Jan’24 rose to 9.03mn, up from 8.93mn in Dec’23. Even conference board consumer sentiment index ticked up to 114.8 in Jan’24 (highest since Dec’21) from 108 last month. All eyes are now on Fed’s rate guidance due later today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)