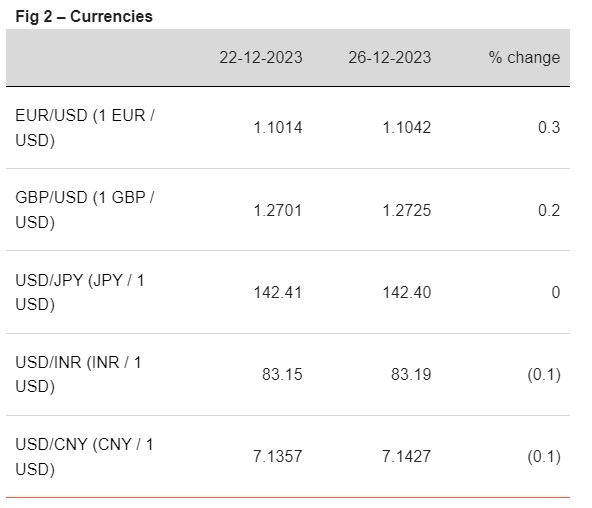

INR is trading further weaker today, while other Asian currencies are trading mixed

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, December 27, 2023: With many global markets still closed, trading volumes remained thin. In US, expectations of an imminent Fed pivot have led to a rally in stocks. On the other hand, DXY trailed near a 5-month low. After surging by 3.3% last week, global oil prices rose by another 2.5% yesterday, amidst fresh attacks in Red Sea region. In India, CAD moderated to 1% of GDP in Q2FY24 from 1.1% of GDP in Q1. This was led by higher net services receipts and remittances, even as merchandise deficit was higher. Separately, pressure on liquidity continued with deficit trailing at Rs 2.7lakh crore. As a result, overnight rate also inched up, with call rate at 6.81%. This is attributable to transient factors such as month-end GST outgo and advance tax payments, which would gradually smoothen out.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)