A level playing tax regime for bank deposits in accordance with other asset classes is now a must

Dr. Soumya Kanti Ghosh

Member, 16th Finance Commission &

Group Chief Economic Advisor

State Bank of India

Mumbai, 6 October, 2024: Money in Inflation Targeting framework evolves endogenously in tune with the structural changes in the economy as well as the evolution of the payment system landscape with credit creating deposits and not bank reserves...

Stable Money Supply and Lower Reserve Money now coexist with digitization.... Cost of deposits likely to stay higher with growing layers of financial intermediation....RBI rate action could be independent from Fed.. Possibility of growth slowing down incrementally & increasing geopolitical risk might prompt a rewording of communication from RBI.

Deposit growth: misplaced wisdom

❑ Deposit growth is finally outpacing credit growth at least on a year to date /YTD basis as incremental growth in credit is lower by a sharp Rs 7.5 trillion but deposits lower by Rs 2.7 trillion. On a yearly basis, however the gap between credit and deposit growth still persists though now down to only 220 basis points and is the lowest since credit and deposit growth had started diverging since FY23

❑ Notwithstanding the narrowing of the gap, the continued argument in some quarters over last few years that the slowdown in deposit growth is a result of contraction in money supply growth as a result of lower reserve money growth is a reflection of

misplaced wisdom and unfortunately escape the intellectual rigour of monetary economics

❑ in principle, while it is true that growth in reserve money /RM has slowed down markedly over the last 2 years, the same cannot be said about the growth in broad money that has remained largely in sync with nominal GDP growth

Interest rate is the key instrument of policy

❑ With India moving over from a monetary aggerate framework to a flexible inflation targeting (FIT) framework in 2016, interest rate and not monetary aggregates, is the key instrument of policy. Money in this framework evolves endogenously in tune with the structural changes in the economy as well as the evolution of the payment system landscape with credit creating deposits and not bank reserves. In FIT framework, systemic liquidity is the most relevant metric than reserve money for achieving the specified short-term rate Reserve money (RM) declined to 3.9% as on 13 Sep’24, compared to 10.5% last year. However, excluding the impact of changes in CRR (I-CRR of 10%), recorded a growth of 5.9% YoY compared to 8.4% a year ago.

❑ The evolution of the payment landscape has also ensured that the link between reserve money growth and money supply through the money multiplier route has become agnostic with a steady increase in money multiplier as currency deposit (as also reserve deposit ratio declining) with significant digitization since pandemic. A lower growth of reserve money is thus now consistent with a stable money supply growth.

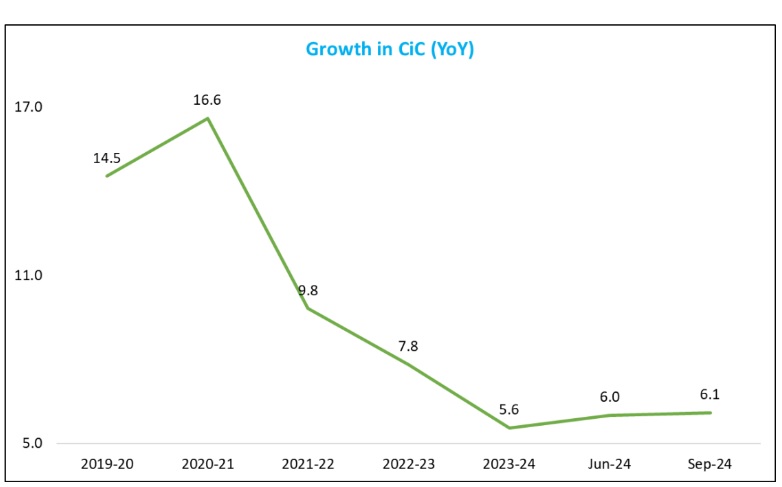

Growth in currency in circulation

Retail digital payment continue to grow, which is due to the continuous innovations. For example, the auto- replenishment of FASTags and National Common Mobility Card (NCMC) under the e-mandate framework for recurring transactions is likely to boost the NETC and card transactions, respectively. CiC to GDP ratio declined to 12.07% in FY24 from 14.37% in FY21. The volume of digital payments is projected to increase threefold to reach 481 billion transactions in 2028-29

Reserve money (RM) declined to 3.9% as on 13 Sep’24, compared to 10.5% last year. However, excluding the

impact of changes in CRR (I-CRR of 10%), recorded a growth of 5.9% YoY compared to 8.4% a year ago.

❑ Growth in currency in circulation (CiC), the largest component of RM, increased to 6.1% YoY as on 13 Sep

2024, from 3.0% as on May 17, 2024, on account of the base effect of the withdrawal of Rs2000 banknotes

(announced on 19 May’2023), 97.96% of which has been returned to the banking system, mostly in the form of deposits (as on August 31, 2024)

Increasing layers of disintermediation

❑ Thus the apparent inability of central banks like RBI to control base money and money multiplier in a financial ecosystem characterized by new business models and evolving technology is resulting in newer innovations within the broader markets with increasing layers of disintermediation as money is returning to banks through round tripping

❑ As an example, the TREPS market volume is now double the combined values of Repo and uncollateralized Call/Notice/Term. The interest earned through TREPS fares much better than similar yields offered by banks on short duration deposits, incentivizing MFs to incrementally side with TREPS while banks benefit through ultra flexibility, pledging securities and borrowing for short duration, helping in ALM management. The hesitation on part of many banks to source bulk deposits locking in for a longer time frame as expectation of Mint street taking a pivot grows also bodes well for the TREPS market.

❑ The TREPS money seems to reflect mostly the AUM of liquid funds with MFs from Corporate India recording handsome gains at the bottom of the balance sheet, while the capex plans have been tepid in comparison, mirroring the global volatility / tensions...any future increase in capex could change the dynamics

❑ The growing layers of financial intermediation and rapid digitization is likely to keep cost of funds and hence deposit rates higher for longer....Thus the increasing calls for banks to innovate novel products and features in deposits to lure the average savers back into their fold does not take into account the time proven efficacy of either the efficient market hypothesis or the theory of rational investors presumably...the post tax return for bank deposits does not cut much ice for a large swathe of these rational investors...If banks are not able to pedal up their post-tax returns (for no fault of theirs) component to this ‘aware’ populace their Safety and Liquidity propositions might be defeating such very purpose in a risk-on scenario. A level playing tax regime for bank deposits in accordance with other asset classes is now a must

Possibility of growth slowing down

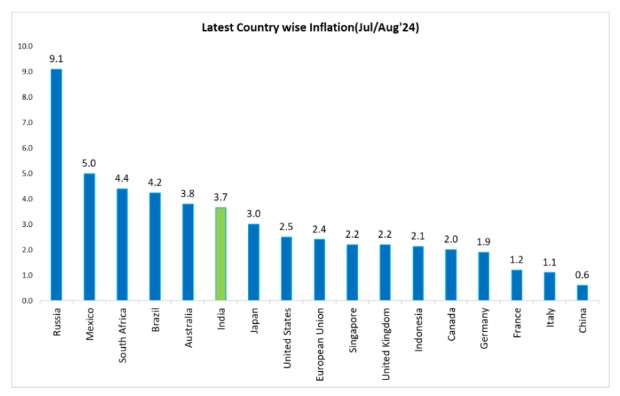

❑ Elsewhere, RBI may disassociate from the recent interest rate developments in the US and may take independent view on the domestic rates based on evolving conditions...CPI is expected to remain below 5.0% in the remaining months, except for Sep’24 because of unfavourable base effect....for the full year FY25, CPI inflation is likely to average to 4.5%-4.6% and will remain In the RBI’s targeted range of 4-6%

❑ First cut likely in Dec 2024 / Feb 2025...any disintegrated rate cut and change in stance could front load market movements one way up... We however believe a possibility of growth slowing down incrementally with the leading indicators showing a declining momentum and increasing geo political risk might prompt a rewording of communication from RBI highlighting the need to have a balanced growth inflation balance