Fiscal Deficit For FY25 Likely To Be Around 5.5% Of GDP

Govt's Gross Borrowing Likely At Rs15.3 Trillion In FY25; Gross Tax To GDP Ratio At 16 Year High In Fy24, Could Touch Highest Ever In The Last 2 Decades In FY25

Dr. Soumya Kanti Ghosh,

Group Chief Economic Adviser,

State Bank of India,

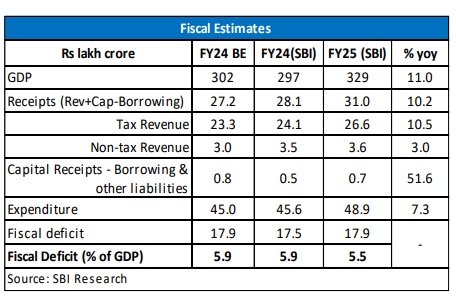

The Interim Budget to be presented against the backdrop of a 7.3% growth in current fiscal. The strong momentum will allow the Government to work towards the path of fiscal consolidation. We believe net tax revenue is likely to exceed budget estimates by Rs 80,000 crores in current fiscal over the budget estimates. Non tax revenue is likely to exceed budget estimates by Rs 50,000 crores. Expenditure is likely to exceed budget estimates by around Rs 60,000 crores, but this number could be scaled down with the Government already employing an automatic fiscal stabilizer in terms of just in time fund releases based on spending patterns of several Ministries. Gross tax revenue at 11.6% of GDP in FY24 is likely to be a 16 year high. In FY25, we expect gross tax revenue to be at the highest ever in the last 2 decades. We believe fiscal deficit in absolute terms could decline in FY24 but as a % of GDP it could be at 5.9% and likely to be set at 5.5% in FY25 Interim Budget.

Government will continue to rely on small saving schemes

The final budget to be presented in July could set it at lower level of 5.3%-5.4% depending on GDP numbers that will be released in May 2024. We believe in FY25, net market borrowing of the Centre will be around Rs 11.7 lakh crore and with repayments of Rs 3.6 lakh crore, gross borrowing are expected at Rs 15.3 lakh crore. However, the Government will adjust in switches and this could adjust gross borrowings lower than Rs 15 lakh crore. Even net issuance of T-Bills to the tune of Rs 50,000 crore is expected. Regarding the financing of fiscal deficit, the Government will continue to rely on small saving schemes. It can give a hard push to SSY (Sukanya Samriddhi Yojana), through encouraging fresh registrations in a mission drive mode, allowing one time registrations for all leftover cases up to 12 years. Roping in Business Correspondent (BC) channel partners by banks can be extremely useful since banks have a low share vis-à-vis Post offices (16% in number of SSY accounts though 32% share in deposits). We expect the Government to make a mention of the push to solar roof tops to 1 crore households as envisaged by PM. In a similar vein, the Government could put out a road map to give a massive push to PMAY. The Government can unlock the Land Bank available with various Institutions across states and put them to constructive use for providing housing units to slum dwellers and marginalized segment of the population

BUDGET 2024-25: FISCAL ARITHMETIC

- Global economy continues to decelerate for the third consecutive year. Tight monetary policies, restrictive credit conditions, sluggish trade and investment are expected to weigh on growth.

- Meanwhile, India continues to remain the bright spot supported by its strong macro fundamentals. Against this backdrop, government will present an interim budget for FY25 for supporting growth while at the same time allowing for gradual fiscal consolidation.

- As per the first advanced estimates, real GDP will grow by 7.3% in FY24, and nominal GDP growth is expected at Rs 296.5 lakh crore (+8.9%).

- For FY25, real GDP growth is likely to be around 6.8% and with deflator expected at 4.2%, nominal GDP would grow by 11.0% to Rs 329 lakh crore in FY25 budget.

- Monthly data from CGA indicates that overall expenditure has reached 58.9% of the BE till Nov’23, with revenue expenditure at 59.0% of BE and capital expenditure at 58.5% of BE. This is lower than what was achieved during the same time last year.

- There was a total cash outgo of Rs 58,378 crore on account of the first supplemental grant of Rs 1.29 lakh crore (remaining Rs 70,968 crore matched by savings. However, we believe this additional outgo will also be matched by the decline in spending by various ministries as shown by the CGA data.

- Meanwhile, total receipts of the Government are 64.3% of the BE during Apr-Nov'23 (owing to higher non-tax revenue) leading to fiscal deficit of 50.7% of the BE till Nov’23, compared to 58.9% of BE till Nov’22.

- Thus the fiscal deficit of the Government in FY24 is expected to come down to Rs 17.5 lakh crore. However lower nominal GDP growth estimates compared to the BE will keep the fiscal deficit at 5.9% of the GDP.

- In FY25, we assume the Government expenditure may increase around ~6.5% over FY24 estimates to Rs 48.9 lakh crore. Subsidy bill which increased in FY24 is likely to be capped in FY25 to around Rs 3.8 lakh crore and capital expenditure is expected to grow by at least 15%.

- Meanwhile, receipts (minus borrowing and other liabilities) are expected to grow by 9% with tax revenue receipts growth likely at 10.5%. Thus, fiscal deficit for FY25 is estimated at around Rs 18.0 lakh crore or 5.5% of GDP in FY25, thereby limiting the fiscal consolidation to 40 bps from the current fiscal.

- In the past, there has not been much difference in the fiscal deficit announced in interim budget and the final budget with only a modest change mainly due to change in GDP estimates. ¨ This will help the Government to reach the deficit of 4.5% of GDP by FY27.

- MARKET BORROWING

- We believe in FY25 net market borrowing of the Centre will be around Rs 11.7 lakh crore and with repayments of Rs 3.6 lakh crore, gross borrowing are expected at Rs 15.3 lakh crore.

- The states have already borrowed around Rs 6.4 lakh crore so far in FY24 and are likely to borrow around Rs 9.5 lakh crore. With Rs 2.9 lakh crore repayments state net borrowing will come around Rs 6.6 lakh crore. For FY25 state borrowing is expected at Rs 10 lakh crore on a gross basis and Rs 6.9 lakh crore on a net basis. ¨ The overall gross borrowing by Centre and States is likely to be Rs 25.4 lakh crore (Rs 24.9 lakh crore in FY24) and net borrowings Rs 18.6 lakh crore (Rs 18.4 lakh crore in FY24).

- Regarding the financing of fiscal deficit, the Government will continue to rely on small saving schemes (Rs 5 lakh crore likely in FY25). It can give a hard push to SSY (Sukanya Samriddhi Yojana), through encouraging fresh registrations in a mission drive mode, allowing one time registrations for all leftover cases up to 12 years. Roping in Business Correspondent (BC) channel partners by banks can be extremely useful since banks have a low share vis-à-vis Post offices (~16% in number of SSY accounts though ~32% share in deposits).

- Even net issuance of T-Bills to the tune of Rs 50,000 crore is expected.

- A smooth borrowing program would require the RBI to issue papers by matching the profile of redemption of Government paper. Ideally, papers up to 7 years in the short term segment, 10-15 years in the mid segment and beyond 15 years in the long term segment could be the ideal mix of meeting the borrowing appetite of market players. Currently, commercial banks and insurance companies account for 64.01% of the outstanding G-sec papers (Sep’23).

- For short term segment, Banks, Mutual Funds (debt & hybrid), General Insurance Companies and Life Insurance Companies (ULIP & Hybrid) are the potential players. EPFO, Pension Fund, Other Provident Fund and Life Insurance Companies owing to their long liability profile are the players in the long term segment.

- A demand for the mid segment has to be created to keep the pressure off the 10-year segment by doing OMO in the mid-segment. From the redemption profile of the Government till FY43, we estimate that FY29, FY30, FY37 & FY38 have more legroom to absorb redemption.

- A quarterly borrowing calendar, in place of half yearly calendar on the lines of T-bill and SDL calendar will provide Government the flexibility to manage borrowing in line with evolving revenues and expenditures.

- ¨Switch auctions may be used proactively during first two quarters. This will help market participants to take into account lower maturities during next financial year (FY25) and increase demand for securities during FY24.

PUSH REGARDING PMAY AND PM SURYODAY YOJANA

- Due to Interest Rate rise, affordability has become a constraint for home buyers. Affordable Segment Home Loan has been showing a declining trend since last year as compared to Regular Home Loan Segment. To boost Affordable Segment and creation of Separate Housing Fund exclusively to provide Housing to slum dwellers, may be examined. Government may collaborate for construction of homes on the land owned by Institutions etc., to provide Housing to the poor.

- With Honourable PM announcing a target of 1 crore solar roof tops, embedding roof top solar in the individual dwelling unit/ building can be made a precondition to push solar mission to be eligible for PMAY-U Scheme.

- Mandatory bundling of Solar Roof Top, Solar Heating systems with Affordable Housing as a part of project approval may be implemented.