Given the current assessment of a resilient economic condition, the rate cutting cycle this time is likely to be shallow

Indranil Pan, Deepthi Mathew,

Economics Knowledge Banking,

YES Bank

Mumbai, March 28, 2024: The Government of India, in consultation with the Reserve Bank of India, has finalized its borrowing programme for the first half (H1) of FY 2024-25.

H1 FY25 G-sec borrowing:

Lower than expected G-sec issuances of INR 7.5 tn in H1FY25, or 53.2% of its gross borrowing target of INR 14.1 tn came in lower than expected. Last year, the gross borrowing amounted to INR 8.9 tn (or 58% of FY24BE target). With redemptions in H1 FY24 amounting to INR 1.7 tn, the net G-sec borrowing comes to INR 5.8 tn (lower than the net G-sec issuance size of INR 7.3 tn of H1FY24). From a demand-supply perspective, FY25 looks favorable for the Indian bond market. The comfort of the lower net and gross government supplies will be also supported by increased foreign demand that is set to increase with the index inclusion (JP Morgan GBIEM in June 2024). We expect RBI to ease policy rates in August 2024 assuming no further food price shocks and Fed cutting the rates in its June policy. Consequently, we expect the India 10-year benchmark G-sec yield to trade in the range of 6.50-7.0% in FY25.

H1 FY25 bowering came in lower:

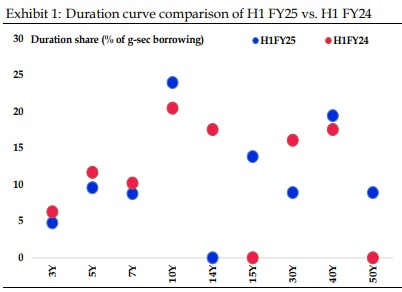

The G-sec auctions will be spread over 26-weeks from April 2024 to September 2024, with size ranging between INR 220-380 bn on weekly basis as against INR 310-390 bn in H1FY24. From supply perspective, June 2024 will be the best month with the lowest net borrowing at INR 91.6 bn due to redemptions of INR 1.07 tn. The highest supply pressure will be witnessed in August 2024 and May 2024, with a net borrowing of INR 1400 bn and INR 1370 bn respectively. A new 15Y tenor paper was introduced accounting 14% of the total gross borrowing in H1FY25. The belly of the curve (10–15year segment) will see the highest share of supply at 37.9%. Long duration papers (30Y to 50Y) also accounted for 37% in the total borrowing. This is mainly on account of the increased demand from life insurance companies, pension funds and provident funds. The supply in the shorter tenor of 3Y is at 4.8% compared to 6.3% in H1FY24. Importantly, SGrBs will contribute 2% of the total gross borrowings in H1FY25.

T-bill issuances lower than last year:

The T-bill calendar for Q1FY25 was also released with a gross issuance of INR3.12 tn. The calendar was lower by 26.2% when compared to Q1FY24 when the gross issuance was at INR 4.2 tn. The size of the weekly auctions ranges from INR 220 bn - 270 bn. The Q1FY25 calendar is more concentrated in the 91-day segment (45%) and less concentrated in the 182-day segment (25%). Accounting for the redemption of INR tn 3.6, the net T-bill issuance is expected at (-) 400 bn.

Demand to possibly swamp supply of G-secs in FY25:

Traditionally, the markets have waited upon the announcement of the H1 calendar to determine the direction for G-sec yields. This time, the markets had the comfort of a fiscal consolidation, and armed by the redemption of the compensation bond repayment, the gross market borrowings were lower for FY25 than in FY24. Further, the market also now has the comfort that the government will be raising only 53% of its total gross issuance size for FY25, compared to 57.6% being raised in H1FY24. This was possibly on account of the government carrying a large cash balance, thereby requiring less borrowings to meet its funding requirements. An election year also implies that the expenditure needs of the government could be muted before the announcement of the full budget in July 2024. Even as no negative surprise was expected, for FY25, the demand for G-secs was anyways expected to be much higher than the supplies, on account of India being included in the JPM Bond Index, for which the flows are to start in June 2024 and extend to March 2025. The total flows expected under this route is USD 20-22 bn. Active funds have already started frontrunning the start date of the event in June 2024. The JPM bond index inclusion was announced in September 2024 and in that month itself, the FPI flows through the debt route was at USD 11.1 bn. Further, from October to March 2024 till date, the total flows through the debt route from the FPIs have cumulated to another USD 11 bn. Given these flows perspective, the India 10Y bond yields have diverged from the traditional determinants from the global side – namely UST 10Y bond yields and crude oil prices. Apart from the demand coming in from the JPM bond index inclusion side, we expect the domestic players to continue to exhibit robust demand. Penetration of financial products is likely to continue to increase the demand from domestic insurance companies and pension funds. Commercial banks can also step up its purchases, given our anticipation of a slower credit growth in FY25 compared to FY24, as the Indian economy remains strong but slows on a relative basis in FY25. Apart from the flows, FY25 is also expected to see the start of a rate cutting cycle. Even as monetary policy needs to stay restrictive in the AEs, given that the central banks are getting frustrated with a sticky retail inflation, the latest dot plots from the US Fed continue to indicate a 75-bps cut in 2024, with the markets pricing in a June 2024 start. For India, we expect the RBI to lag the US Fed in the rate cutting cycle, and possibly start in August 2024. However, given the current assessment of a resilient economic condition, the rate cutting cycle this time is likely to be shallow. The RBI is consequently expected to cut the repo rate by 50-75 bps in FY25, and the cumulative amounts of cuts can be limited to 125-150 bps. Flows into the G-sec market along with the fiscal comfort is unlikely to lead to any significant steepening of the bond, despite expectations of a rate cut. Given our assumption of 50-75 bps of repo rate cut in India, we expect the benchmark 10-year yield to move within a range of 6.50-7.00% in FY25. Yields can remain volatile, given the large number of uncertainties, mostly from the global economy. Risk to the above view emanates from a) a shallower rate cut cycle globally and domestically; b) possibility of RBI conducting OMOs to suck out significantly high doses of rupee liquidity that might emerge from RBI buying foreign exchange to prevent any sharp appreciation of INR, c) a sharp synchronous growth slowdown globally can lead to safe haven flows, thereby leading to lower-than expected flows through the bond index route.