US GDP, Inflation, Currency Face Greater Risk Of Downgrades Compared To INDIA

FinTech BizNews Service

Mumbai, 1 August, 2025: The State Bank of India’s Economic Research Department has come out with a Research Report titled “STIRRED… NOT SHAKEN”, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

Imposition of 25% tariff on India with Penalty is a Bad Business Decision but the mysterious forces of Global Supply Chain should auto adjust and cushion the impact...Indian businesses and Firms would do well to reinvigorate the “Made In India” as a hallmark of unquestionable Quality...Not surprisingly US GDP, Inflation and currency face greater risk of downgrades compared to INDIA.....

The political reasons for the current trade stalemate

The trade talks are an incorrect lever in the fallacies of the current regime.....

6 months into second term, job approval ratings of POTUS Donald Trump seem to hit bottom (37%) basis Gallup findings, just a tad better than all time lows of 34% witnessed at the end of his first term... alarmingly, the steepest fall has been seen amongst independents (17-point decline to 29%) while adults have a 10 points decline in these months marred by many decisions/

"we have a situation“ has long defined the Washington DC culture, complex and evolving threats camouflaged under the seemingly innocuous phrase.... We wonder if the lingering stalemate in trade talks, with an unrelenting Indian delegation protecting her sovereignty fiercely, led to a decision imposed upon the largest democracy whose reverberations stretches beyond mere numbers.

CRYPTO is not the King ......WORSE, It could get into mainframe banking......

❑ With a frenzy created around VDAs (Virtual Digital Assets), chiefly crypto currencies and stablecoins, the US administration’s agenda of making America the crypto capital increases the prospect of loss of confidence in the Greenback, which itself appears destined to reach a tipping point as the reserve currency of the world, as Us strives to reduce trade deficit withs its partner countries through trade deals..

❑ President’s Executive Order 14178 (Strengthening American Leadership in Digital Financial Technology), aiming for the United States to lead the blockchain revolution and usher in the Golden Age of Crypto through enabling policies and regulations ensures the Congress frames legislations that eliminates existing gaps in regulatory oversight by providing the CFTC authority to oversee spot markets for non-security digital assets, while embracing DeFi technology and recognizing the potential of integrating such technology into mainstream finance

❑ The SEC and CFTC are mandated to use their existing authorities to immediately enable the trading of digital assets at the Federal level by providing clarity to market participants on issues such as registration, custody, trading and recordkeeping

❑ The recently passed GENIUS act proposing a regulatory makeover and deeper integration of Stable coins with the traditional financial system, wishes the hegemony of the Dollar to remain intact since the stablecoins (pegged 1:1 to USD) would require tokens to be backed by liquid assets, viz. the USD and T bills – while mandating issuers to publicly disclose the composition of their reserves each month

❑ Interestingly, there is a mad rush by non-depository financial technology companies (crypto companies engaged in the business of banking), Ripple to Circle to Wise to BitGo towards procuring special purpose national bank (SPNB) charter in the USA which would allow these firms (essentially crypto companies) to sneak into the mainframe banking while bypassing intermediary banks, all this with a stamp of legitimacy, triumphing over years of alleged regulatory sidelining

Spirited efforts to rejuvenate the BRICS partnership, could have sparked stalemate....

❑ Across the border, a rogue nation with broken economy, has taken a mistaken leap of faith by launching a digital currency pilot programme and showing the intent towards development of legislation for virtual assets through creating a regulatory and legal framework to govern digital currencies in banking, trade settlement, Fx and gold ...The mess this neighbor of ours has put itself into on all counts makes the evolving situation simultaneously gravely ridiculous and comically pathetic

❑ With economic integration intended through the National Crypto Council, whose CEO was appointed this May as the PM’s special assistant on blockchain and cryptocurrency with Minister of State status—this troubled neighbor looks set to venture into an area where the angel would fear to trade... Worse, its policy makers and Central Bank could have read the writing on the wall which is evident through blocking the CBDC developments in the US

❑ One is just reminded of the infamous Silkroad episode (the illegal dark web marketplace peddling drugs trafficking, cyber crimes, money laundering and illegal arms trade through crypto coins), or El Salvador’s costly experiments with adopting the Bitcoin as a legal tender in 2021, making a silent retreat by 2024 despite much of its populace toying with digital wallets in early period

❑ It is rather not difficult to see that the stubborn yet strategically superb diplomacy of India could be rattling the feathers as Operation Sindoor, along with outreach to various jurisdictions post the tactical strike and frontloading efforts for a spirited BRICS partnership across trade and commerce augurs well for a credible alternative to the world at large, and the Global South in particular. This strategic positioning of brand India, the economic juggernaut and military prowess now ringing alarm bells across DM, could be one of the reasons for the House of Cards being built which can temporarily checkmate our journey, but would do little to stifle our spirits, or the can-do mentality.

The economic implications for the current trade stalemate.. not surprisingly the impact on US will be worse compared to India with a lower GDP and higher inflation and a weaker $

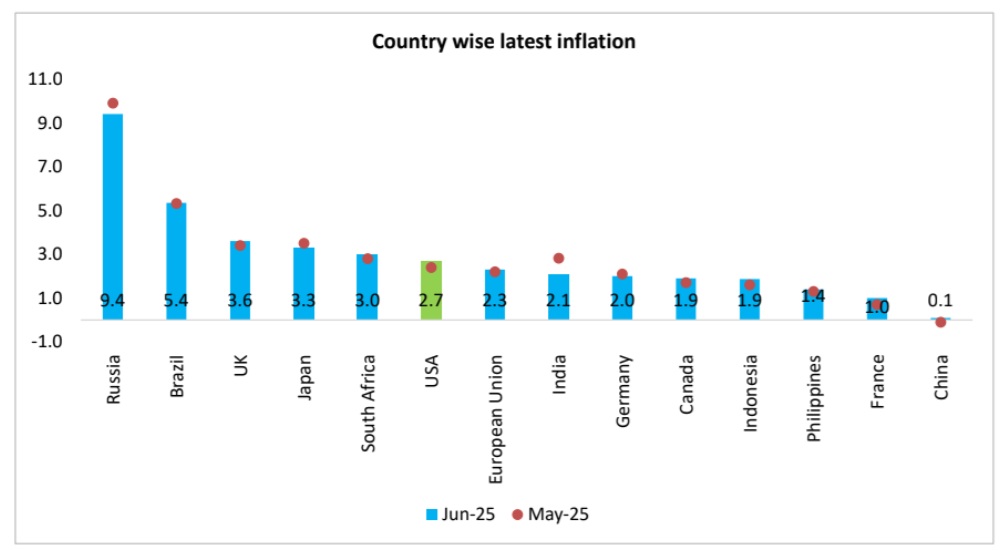

US Inflationary pressures: Uptick has began

❑ The U.S. is beginning to show signs of renewed inflationary pressure, driven by the pass-through effects of

recent tariffs and a weaker dollar—particularly in import-sensitive sectors such as electronics, autos, and

consumer durables (WEO,Jul’25)

❑ U.S. inflation is expected to stay above the 2 percent target through 2026, driven by supply-side effects of tariffs and exchange rate movements

Boomerang Effect of US Tariff on Inflation

❑ Tariffs act as a supply shock, pushing up intermediate goods costs and broadening into consumer prices as they pass through the value chain. We estimate the inflationary effect tariffs imposed by the USA on its imports. Specifically, we quantify how much these tariffs will contribute to U.S CPI in both the short run (before substitution and supply chain adjustment) and the long run (after markets partially adjust to new trade costs)

❑ The total U.S. imports from the rest of the world stood at approximately $3,266 billion. The newly announced average tariff

rate is assumed to be 20% across all imports. Thus, the tariff shock applies to nearly the entire import volume

❑ To translate the tariff shock into its potential effect on CPI inflation, we apply a stylized pass-through framework commonly used in international macroeconomics...The change in prices is denoted by the following equation

Δπ = τ⋅θ⋅ω

Where

Δπ is the change in CPI inflation

τ is the average tariff rate (assumed to be 0.20 or 20%)

θ is the pass-through elasticity from import prices to consumer prices

ω is the share of the CPI basket that is sensitive to import prices

We approximate the CPI weight of import-sensitive goods (ω) at 20%, based on Bureau of Labor Statistics (BLS) CPI weightage. This estimate includes imports such as apparel, footwear, electronics

Short Run

In the short run, we assume a pass-through coefficient of θ=0.6 Δπshortrun=0.20×0.50×0.20=0.024= 2.0 %.

Long Run

We assume a lower pass-through coefficient of θ=0.3 Δπlongrun =0.20×0.30×0.20=0.012=1.2%

This suggests that in the absence of supply chain re-optimization or domestic substitution, the tariffs could push U.S.

inflation up by 2.4%. In the long run, when economic actors have had time to adjust to the new trade regime, the tariffs are

expected to add 1.2% to baseline inflation

❑ This stylized estimation shows that even without including general equilibrium spillovers, the direct mechanical impact of tariffs on CPI inflation is nontrivial

US Households Cost of Tariffs

❑ US tariffs are projected to cost the average U.S. household about $2,400 in the short term, mainly due to

higher prices from tariff-driven inflation. Low-income families may lose around $1,300 nearly triple the relative

burden compared to high earners while high-income households could face losses of up to $5,000, though

with less impact on their overall financial stability

US Households Cost of Tariffs

❑ US tariffs are projected to cost the average U.S. household about $2,400 in the short term, mainly due to higher prices from tariff-driven inflation. Low-income families may lose around $1,300 nearly triple the relative burden compared to high earners while high-income households could face losses of up to $5,000, though with less impact on their overall financial stability

....Tariffs on US to import to affect US GDP by 40-50 bps and higher input cost inflation

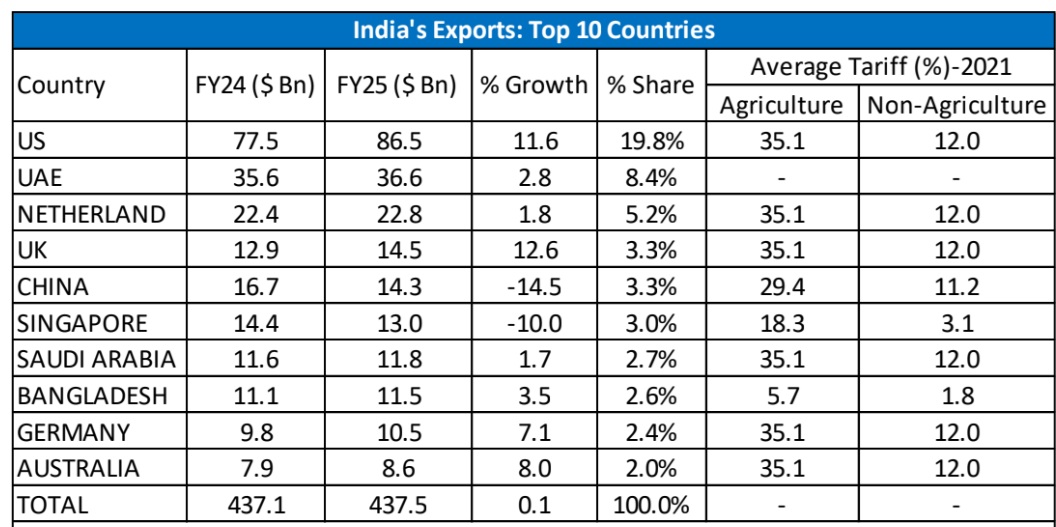

India’s Top 10 Export Countries

❑ Though US is India’s top exporter (share 20% in FY25), yet India has diversified its export destinations, and the top 10 countries only accounted for 53% of total exports

Trade Deal/Framework with Other Economies.......

Vietnam: The US and Vietnam struck a trade agreement that sets 20% tariffs on exports however any trans-

shipments from third countries would face a 40% levy. Since 2018, Vietnam’s exports are up nearly threefold

from less than $50 billion that year to about $137 billion in 2024, Census Bureau data shows. US exports to

Vietnam are up only about 30% in that time – to just over $13 billion last year from less than $10 billion in 2018

❑ Britain: Britain negotiated a limited trade deal with the US administration, accepting a 10% US tariff on many

goods, including autos, in exchange for special access for aircraft engines and British beef

❑ China: Trade deal with US seeks to allow rare earth exports and easing of tech restrictions

❑ EU: The US and the EU announced a trade framework that imposes 15% tariffs on most European goods —

warding off US most recent threat of 30% if no deal had been reached by Aug. 1

❑ Japan: US announced a trade framework to impose 15% tariffs on Japan — down from his previously-

threatened rate of 25%. The US also said Japan would invest $550 billion into the US and would “open” its

economy to American autos and rice

❑ Philippines: Tariffs on imports from the country to 19% — down just 1% from his previous threat of 20%

❑ Indonesia: Lower tariffs on Indonesian goods to 19% — down from a previously-threatened levy of 32%

.....Many Asian countries tariff rates are still higher than India

❑ Most of the Asian countries face higher tariff rates compared to India at present

❑ Vietnam faces reduced tariff rate of 20% after the deal with the US. It is to be seen how much India can make

the US to reduce the tariffs

India-US: Current Trade Dynamics show trade infact has not slowed down...even after 10% tariff imposition....

❑ US share in India’s exports reached 20% in FY25 and 22.4 % in FYTD 26

❑ Top 15 items exported to US accounted for 63% of total exports

The US 25% tariff is expected to impact India’s GDP growth by 25 to 30 bps for FY26

Domestic price formation to see additional deflationary pressure due loss of demand

The thumb rule of global business postulates that businesses would operate, source, sell from/at places that offer maximum rewards for the minimum risk, thereby maximizing value to shareholders

Ringfencing this basic tenet that has held true since the early days predating BC period as great civilizations engaged in trading across 7 Seas would create counter forces that would distort the global order

Primary exports will be impacted by 25% tariff by the US

❑ Electronics, Gems and Jewelry, Pharmaceuticals and Nuclear Reactor & Machinery account for 49% of India’s exports to US

❑ The table shows the key subsectors at 6-digit which will be affected most by tariff increase

❑ The earlier tariff imposed by the US on such articles varied from 0% (on diamonds, smartphones, pharma products among others) to maximum 10.8% (other bed linen of cotton). Now all of them will face 25% tariff

❑ Exports of smartphones and photovoltaic cells to the US have got spurt by the PLI scheme of the

Government and rationalization of the GST on cut and polished diamonds have pushed gems and jewelry exports to the US. For the other products it’s the robust demand from the US that led to higher exports

Impact on Pharmaceutical Sector

❑ India has been a cornerstone of global supply chain for affordable, high-quality and availability of essential medicines, particularly life saving oncology drugs, antibiotics, and chronic dieses treatments.

❑ In generic drug market, India supplies nearly 47% of the pharmaceutical needs of the US. If US shift manufacturing and API production to other countries or domestic facilities, which will take minimum 3-5 years for meaningful capacity. So, tariff may lead to drug shortages and price increase for American citizens.

❑ As US accounts for 40% of India’s pharma exports, if 25% tariff continues, it may hit earnings of pharma companies by 2-8% in FY26, as many big pharma companies' revenue from US stood in the range of 40-50%.

❑ Further, tariff will reduce competitiveness in the world’s largest pharma market and profit margin pressure due to inability to pass on costs.

Solar Module Trade may be Impacted

❑ India has been an emerging supplier to US solar Industry, as US restricts Chinese products by US. So, imports from India to US has increased massively in 2023 and reached over 8 GW in 2024

❑ With this new tariff could make products from India more expensive for US buyers. So, Indian supply will become less attractive to US companies, and they may replace solar modules from with tariff-free nations

Sectors such as Automobile, Capital Goods, Man made Fibre, Alcoholic Beverages have scope for reduction of tariff rate ...This could result in lower prices to consumers as industry become competitive

❑ Sectors like refineries, Automobile, mining and mineral products, crude oil and gas made more than Rs 1 lakh crore as operating profit in FY25

❑ When we map the sectors with MFN tariffs imposed by India on the corresponding imports from the US, the average MFN tariff comes to around 20%

❑ Certain sectors like Automobile, FMCG, alcoholic beverages & tobacco, electrical equipment, textile and consumer durables stand out as tariff applied is 15% or more. The Indian government can think of reducing the tariffs in such sectors