Maharashtra and Gujarat accounted for 80 per cent of the total 153 mergers since 2004-05; The number of UCBs in Tier 2 and Tier 3 cohorts is large and the impact of credit default risk is higher than other types of risk for both these cohorts; UCBs in the small-sized cohort (i.e., Tier 1) would pass all stress tests, except one bank which fails in the liquidity stress test

FinTech BizNews Service

Mumbai, December 29, 2023: The Reserve Bank of India released the Report on Trend and Progress of Banking in India 2022-23, on Wednesday. This Report, a statutory publication in compliance with Section 36 (2) of the Banking Regulation Act, 1949, presents the performance of the banking sector, including co-operative banks during 2022-23 and 2023-24 so far.

Primary (Urban) Cooperative Banks

As per latest data available, there were 1,502 UCBs and 1,05,268 RCCs. The combined balance sheet of urban co-operative banks (UCBs) expanded by 2.3 per cent in 2022-23, driven by loans and advances. Their capital buffers and profitability improved through 2022-23 and Q1:2023-24. Urban co-operative banks (UCBs) expanded their combined balance sheet in 2022-23, driven by loans and advances, along with a strengthening of asset quality.

Number Of UCBs Declined Steadily

The liberal licensing policy adopted in the 1990s resulted in the mushrooming of a large number of UCBs. Nearly a third of the newly licensed banks subsequently turned financially unsound. Starting 2004-05, the Reserve Bank initiated a process of consolidation, including mergers of unviable UCBs with viable counterparts, cancelling licences of non-viable entities and suspension of new licence issuances. As a result, the number of UCBs declined steadily between March 2004 and March 2023.

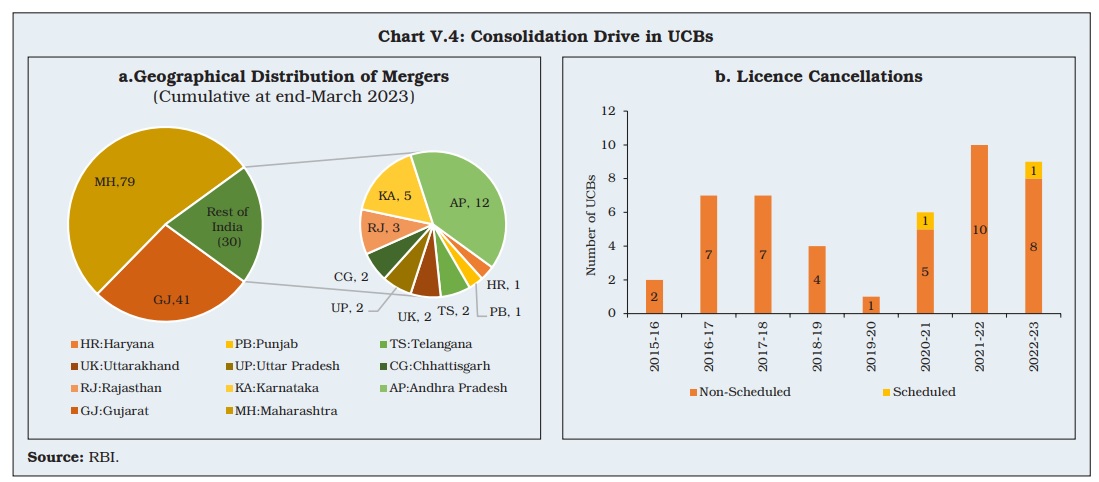

Cumulatively, the UCB sector has undergone 150 mergers since 2004-05, including 3 in 2022-23. Maharashtra and Gujarat accounted for 80 per cent of the total mergers. Licence cancellations have also been high during this period, with the total number of cancellations being 46 since 2015-16. Most of the mergers and cancellations took place in the non-scheduled category.

4-Tiered Regulatory Framework

During 2022-23, the Reserve Bank adopted a four-tiered regulatory framework for UCBs in line with the recommendations of the Expert Committee on Urban Co-operative Banks (Chairman: N. S. Vishwanathan, August 2021). UCBs with deposits up to Rs100 crore have been classified as Tier 1; those with more than Rs100 crore and up to Rs1,000 crore as Tier 2; those with deposits more than Rs1,000 crore and up to Rs10,000 crore as Tier 3, and those above Rs10,000 crore are placed in Tier 4. At end-March 2023, an overwhelming majority of UCBs were in the Tier 1 category. Six UCBs residing in Tier 4 contributed more than a fifth of the sector’s deposits.

Expansion In Balance Sheet, Deposit Growth

Following the consolidation drive in 2004-05, UCBs’ assets registered double digit compound annual growth (CAGR) over the following decade. Since then, their growth has moderated, trailing that of SCBs. As a result, the balance sheet size of UCBs fell to a decadal low of 2.8 per cent of that of SCBs at end-March 2023. Within the sector, growth in assets of nonscheduled urban co-operative banks (NSUCBs) decelerated for the second consecutive year, while scheduled urban co-operative banks’ (SUCBs’) balance sheet expansion picked up.

The expansion in the consolidated balance sheet of all UCBs during 2022-23 was attributable to net worth (capital plus reserves) and deposits on the liabilities side, and loans and advances on the assets side. Higher profits during the year were ploughed back into reserves to comply with enhanced regulatory requirements for net worth. Cash and bank balances were drawn down to fund credit and investment expansion.

Reversing the contraction in 2021-22, UCBs’ deposit growth – especially that of SUCBs – rebounded in 2022-23. Although the revival was sustained during Q1:2023-24 with 1.8 per cent growth in their deposits, it was much slower than SCBs. The low deposit accretion over the years has altered the funding structure of UCBs, with the share of deposits falling from 82 per cent of their total liabilities at end-March 2017 to 78.4 per cent at end-March 2023.

Highest Loan Growth

The growth of advances of UCBs during 2022-23 was the highest in 4 years. During Q1:2023-24, it accelerated further to 5.9 per cent, but remained lower than that of SCBs. In the case of SUCBs, financial constraints such as elevated NPA ratios and low profitability may have led to this sustained deceleration over more than a decade.

Primary urban cooperative banks (UCBs) recorded a pick-up in credit growth. Larger UCBs led the credit growth: the share of Tier 4 UCBs (with deposits of more than Rs10,000 crore) in total gross loans of UCBs increased from 23.9 per cent to 25.7 per cent during H1:2023-24, mainly at the cost of Tier 3 UCBs (having deposits in the range Rs1,000 crore to Rs10,000 crore), whose share declined from 34.2 per cent to 31.8 per cent during the period.

C-D Ratio Up

The credit-deposit (C-D) ratio of UCBs rose for the third consecutive year in 2022-23. It, however, remained below that of SCBs and the wedge has been widening. The distribution of the number of UCBs in terms of assets and deposits has been shifting rightwards over the years. At end-March 2016, the modal class of deposits was Rs25 crore to Rs50 crore, which had moved upwards to Rs100 crore to Rs250 crore by end-March 2023. For advances, the distribution was bimodal at end March 2022 with Rs10 to Rs25 crore and Rs25 to Rs50 crore buckets as modes. At end-March 2023, however, the advances’ modal class gravitated towards the Rs25 to Rs50 crore bucket. More than two-thirds of UCBs’ advances are concentrated in the smaller range of less than Rs100 crore.

UCBs’ Investments

During 2022-23, UCBs’ investments decelerated in sharp contrast to SCBs. Over time, the share of state government securities has increased in UCBs’ statutory liquidity ratio (SLR) investments. SUCBs have 85 per cent of their total investments in SLR, while the ratio is higher at 94 per cent for NSUCBs.

Capital Adequacy, CRAR, PCR

The capital position of UCBs improved further during H1:2023-24 with their CRAR increasing in September 2023 across all tiers of UCBs to well above the minimum requirement. Although the GNPA and NNPA ratios of UCBs increased in H1:2023-24, they have exhibited a downward movement in the post-pandemic period. Similarly, the provisioning coverage ratio (PCR) also showed improvement. A decline in asset quality in H1:2023- 24 was observed in Tier 1, Tier 2 and Tier 3 UCBs, while the largest UCBs showed improvement.

The revised regulatory framework introduced in July 2022 increased the minimum regulatory capital requirements for Tier 2 to Tier 4 UCBs to 12 per cent, while keeping it at 9 per cent for Tier 1 UCBs. At end-March 2023, while 40 per cent of UCBs belonged to the upper tiers (Tiers 2 to 4), 88 per cent maintained CRARs above 12 per cent In terms of the CRAR distribution of SUCBs, an improvement was observed in 2022- 23, although 2 SUCBs recorded negative CRARs at end-March 2023. V.22 During 2022-23, the consolidated CRAR of all UCBs improved on the back of higher profit accretion and capital raised through long-term subordinated bonds. Moreover, the revaluation reserves, which were earlier reckoned in Tier II capital, have been allowed as Tier I capital from end-March 2023, subject to certain conditions. This helped strengthen their Tier I capital during the year. At end-June 2023, UCBs further shored up their CRAR on the back of lower provisioning and improving profitability.

Financial Performance & Profitability, RoA & RoE, NIM

Net profits of UCBs expanded for the third consecutive year in 2022-23, albeit at a slower pace than in previous years. Profitability (before as well as after taxes) of UCBs is yet to fully recuperate from the stress during 2019-20. The uptick in net profits during 2022- 23 was due to a revival in total income and a contraction in total expenditure. A pick up in loans and advances led to higher interest income. On the other hand, interest expenses continued to decline. The decline in noninterest income of NSUCBs led to a reduction in non-interest income of the sector, whereas noninterest expenditure expanded for the second consecutive year.

Profitability of UCBs improved in terms of RoA and RoE ratios in H1:2023-24. scheduled UCBs (SUCBs) and Tier 4 UCBs witnessed an improvement across all their profit parameters though the net interest margin (NIM) of non-scheduled UCBs (NSUCBs) declined in September 2023. From having the lowest RoA and RoE in March 2023, Tier 4 UCBs now have the highest RoA and RoE amongst all the Tiers.

During 2022-23, the key indicators of profitability viz., return on assets (RoA), return on equity (RoE) and net interest margin (NIM), improved for UCBs, despite an increase in provisions and contingencies. During Q1:2023-24, UCBs’ profitability improved further.

Soundness

The claims settled by the Deposit Insurance and Credit Guarantee Corporation (DICGC) during 2022-23 amounted to Rs752 crore and pertained entirely to co-operative banks placed under liquidation/ all-inclusive directions (AID). These included: (a) claims settled under Section 18(A) amounting to Rs646 crore pertaining to UCBs placed under AID, within the statutory timeline of 90 days after imposition of the directions; (b) supplementary claims in respect of 10 UCBs amounting to Rs46 crore under Section 17(1); and (c) an amount of Rs59 crore provided to Unity Small Finance Bank (USFB) for making payment to the depositors of erstwhile Punjab and Maharashtra Co-operative Bank Ltd. (PMCBL) pursuant to the latter’s merger with USFB with effect from January 25, 2022 under Section 16(2).

Asset Quality

UCBs’ asset quality improved further in 2022-23, partly reflecting lower slippages and stronger loan recovery. The GNPA ratio has declined from a peak in 2020-21, although an uptick was evident during Q1:2023-24. Among UCBs, while NSUCBs have higher GNPA ratios, improvement during 2022-23 was sharp. A significant decline in outstanding GNPAs led to an increase in their provision coverage ratio (PCR). Going forward, with the harmonisation of UCBs’ provisioning norms for standard advances, effective April 2023, their PCR is likely to rise further.

Large borrowal accounts, i.e., accounts with exposures of Rs5 crore and above, constituted 25 per cent of UCBs’ total lending and 31 per cent of their total GNPAs at endMarch 2023. Among UCBs, a large disparity exists in exposure to these accounts, with 45 per cent of SUCBs’ total lending concentrated in large borrowers, as against NSUCBs’ 8 per cent. Although NSUCBs’ GNPA ratio stemming from large borrowal accounts is much higher than SUCBs, it declined during the year, leading to an overall reduction in UCBs’ GNPA from such accounts. For the sector as a whole, SMA-0 and SMA-1 ratios registered an uptick during the year, but the SMA-2 ratio declined.

PSL Up

The increase in priority sector lending by UCBs during 2022-23 was led by credit to MSMEs — particularly micro enterprises — constituting 41 per cent of their total lending. Like SCBs, UCBs are required to lend a minimum of 7.5 per cent of their adjusted net bank credit (ANBC) / credit equivalent amount of off-balance sheet exposures (CEOBE) to micro enterprises. In addition, the target for UCBs for 2022-23 for lending to weaker sections was 11.5 per cent of their ANBC/CEOBE. UCBs met both these targets at end-March 2023. Housing loans, which comprised close to 10 per cent of UCBs’ total lending at end March 2023, contracted during the year despite increased housing lending limits.

Stress Testing

Stress tests were conducted on a select set of major UCBs34 to assess credit risk (default risk and concentration risk), market risk (interest rate risk in trading book and banking book) and liquidity risk, based on their reported financial positions as of September 2023. One bank in the Tier 4 UCB cohort would fail to meet the minimum regulatory CRAR requirement under both types of credit risk and interest rate risk in the trading book. In the case of liquidity risk, one Tier 4 UCB would have liquidity mismatch exceeding 20 per cent under medium and severe stress scenarios. The number of banks in Tier 2 and Tier 3 cohorts is large and the impact of credit default risk is higher than other types of risk for both these cohorts. UCBs in the small-sized cohort (i.e., Tier 1) would pass all stress tests, except one bank which fails in the liquidity stress test. In general, the impact of interest rate shock on the UCBs’ banking book would be low.

Under the severe stress scenario, the consolidated CRAR of 214 UCBs diminishes by 324 bps and 120 bps for credit default risk and interest rate risk in trading book, respectively. The consolidated CRAR of 139 UCBs diminishes by 334 bps for credit concentration risk under the severe stress scenario. The application of interest rate shock to the banking book indicates a decline in net interest income (NII) of 214 UCBs by 5.8 per cent under the severe stress scenario. System level liquidity mismatch remains positive (i.e., no liquidity gap) for liquidity risk even under the severe stress scenario.