Deposit And Credit Growth Of UCBs Has Trailed That Of SCBs In Recent Years; The licenses of 24 UCBs have been cancelled since 2015-16; 6 Mergers Of UCBs Happened In 2023-24

FinTech BizNews Service

Mumbai, 26 December, 2024: Deposit growth of urban co-operative banks (UCBs) recovered in 2023-24 and credit growth remained steady. The financial performance of UCBs improved on the back of higher profitability, strengthened capital buffers and lower gross non-performing assets (GNPA) ratio. The GNPA ratio of state co-operative banks (StCBs) and district central co-operative banks (DCCBs) declined, but remained elevated relative to commercial bank, as per the Reserve Bank of India’s “Report on Trend and Progress of Banking in India 2023-24”, released today.

The Reserve Bank introduced a prompt corrective action (PCA) framework in July 2024 for urban co-operative banks (UCBs) in Tier 2 to 4 and enhanced monitoring for Tier 1 UCBs, which will be effective from April 1, 2025.

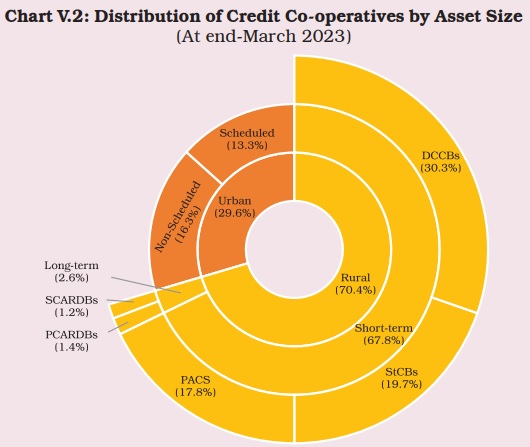

During the period under review, there were 1,472 UCBs and 1,07,961 RCCs. In terms of number of institutions, more than 97 per cent of total co- operative sector are primary agricultural credit societies (PACS), although in terms of assets, their share is only 17.8 per cent in the total cooperative segment and 25.3 per cent in RCCs.

The consolidated assets of the cooperative banking sector at end-March 2023 stood at Rs22.9 lakh crore, accounting for around 9.5 per cent of scheduled commercial banks’ (SCBs’) assets, down from 11.2 per cent at end-March 2014. RCCs comprise 70.4 per cent of the assets of the total co-operative sector (rural and urban co-operatives combined).

Rural co-operatives were set up with the primary objective of lending to agriculture. In 2023-24, their share in total credit to agriculture declined for the second consecutive year to less than 10 per cent due to increasing reach of commercial banks via technology and branch expansion.

UCBs

Since 2004-05, the sector has witnessed 156 mergers, including six in 2023-24, of which three were in Maharashtra, two were in Telangana and one was in Gujarat. Maharashtra accounted for majority of the mergers in the last two decades, followed by Gujarat and Andhra Pradesh. During 2023-24, licences of 24 UCBs were cancelled, raising the total number of cancellations to 70 since 2015-16. 94.3 per cent of the cancellations have been in the non-scheduled category.

At end-March 2024, the share of UCBs in Tier 1 declined, while that of Tier 2 increased year on-year (y-o-y), partly reflecting a growing deposit base. Tier 3 UCBs, with nearly 5 per cent share in the total number of UCBs, dominated the sector with more than one-third share in deposits, advances as well as total assets.

Balance Sheet

During 2023-24, the consolidated balance sheet of UCBs exhibited a muted growth of 4 per cent, albeit higher than 2.3 per cent in the previous year. The balance sheet size of UCBs relative to SCBs fell for the seventh successive year to 2.5 per cent at end-March 2024 from 3.8 per cent at end-March 2017, dragged down by subdued deposit growth on the liabilities side and loans on the asset side. Deposit growth of all UCBs exhibited a marginal improvement to 4.1 per cent during 2023-24, remaining well below 13.4 per cent growth in SCBs. The pace sustained in H1:2024-25 with 4.4 per cent growth in deposits of UCBs. Credit growth of UCBs was steady at 5.0 per cent in 2023-24, less than a third of the expansion of 16.0 per cent recorded by SCBs. The credit growth of UCBs, however, accelerated to 6.2 per cent at end-September 2024. Deposit and credit growth of UCBs has trailed that of SCBs in recent years reflecting, inter alia, the decline in the number of UCBs and their branch network. SCBs, on the other hand, have been leveraging technology as well as the business.

The credit-deposit (C-D) ratio of UCBs increased for the third consecutive year in 2023-24 to 62.5 per cent. The share of borrowings in total liabilities of UCBs was 0.8 per cent at end-March 2024, less than a tenth of that of SCBs (9.0 per cent).

The distribution of the number of UCBs in terms of assets and deposits has been shifting rightwards over the years and has turned from bi-modal to unimodal. In 2014-15, more than 40 per cent of UCBs were in the asset classes Rs25 crore to Rs50 crore and Rs100 crore to Rs250 crore; in 2023-24, 44.3 per cent of UCBs were in the asset classes Rs50 crore to Rs250 crore. In terms of advances, the modal class was Rs 25 crore to Rs50 crore at end-March 2024, with more than 80 per cent of UCBs with total advances less than Rs250 crore.

During 2023-24, UCBs’ investment growth remained largely unchanged, widening the wedge with SCBs. 90 per cent of UCBs’ investments were in SLR instruments, as compared with 83 per cent for SCBs. During 2023-24, the SLR investments of UCBs in central government securities contracted. Over the years, the share of state government securities in total SLR investments of UCBs has been rising.

Financial Performance and Profitability

The operating profits of UCBs fell during 2023-24 as total expenditure expanded at a faster pace than total income. However, net profits (before as well as after tax) were higher due to decline in provisions and contingencies on the back of improved asset quality. Non-interest income fell due to decline in dividend income, loss on sale of fixed assets and reduced profits on forex operations. The growth in non-interest expenditure of UCBs decelerated, partly on account of moderation in staff expenses. The share of non-interest income in total income was higher in larger SUCBs and inversely related to their profitability.

Reflecting higher net profits, UCBs’ return on assets (RoA), return on equity (RoE) and net interest margin (NIM) improved during 2023-24. During H1:2024-25, UCBs’ profitability improved further.

UCBs’ profitability, which dipped in 2019-20 due to losses incurred by a large UCB, has recovered since then with an improvement in asset quality (Chart V.10 a and b). 3.3. Soundness V.19 The number of instances of penalty imposition on co-operative banks (including UCBs) increased by 22 per cent to 215 during 2023-24 from 176 in the previous year. However, the amount of penalty imposed declined by 13.8 per cent.

The Deposit Insurance and Credit Guarantee Corporation (DICGC) settled claims of Rs1,432 crore during 2023-24, which pertained entirely to co-operative banks placed under liquidation/ all-inclusive directions (AID).

Capital Adequacy

In July 2022, the revised regulatory framework (effective from April 1, 2023) for UCBs increased the minimum regulatory capital requirement for Tier 2 to Tier 4 UCBs to 12 per cent, while keeping it at 9 per cent for Tier 1 UCBs. At end-March 2024, 42.3 per cent of the UCBs belonged to upper tiers (Tier 2 to Tier 4), while more than 90 per cent maintained CRARs above 12 per cent.

During 2023-24, the consolidated CRAR of UCBs improved on the back of higher Tier I capital, driven inter alia by increased profitability due to lower provisions and regulatory permission to include revaluation reserves in Tier I capital. Additionally, UCBs’ efforts to raise long-term subordinate bonds strengthened their capital base.

Reflecting sharper accretion to capital from 2021-22 onward, UCBs’ CRAR was higher than that of SCBs at end-March 2024. The CRAR remained stable at 17.5 per cent at end-September 2024.

Asset Quality

The asset quality of UCBs, measured by the gross non-performing assets (GNPA) ratio, improved for the third consecutive year, although remaining well above that of SCBs. At end-September 2024, the GNPA ratio of UCBs was 9.6 per cent as compared to 10.9 per cent at end-September 2023. Among UCBs, NSUCBs had higher GNPA ratios. As the decline in GNPAs outpaced falling provisions, the provision coverage ratio (PCR) improved and is likely to increase further with the phased harmonization of UCBs’ provisioning norms for standard advances.

At end-March 2024, large borrowal accounts, i.e., accounts with exposures of Rs5 crore and above, constituted 24.3 per cent of UCBs’ total lending and 31.1 per cent of their GNPAs. These accounts exhibited varied behavior between SUCBs and NSUCBs. 43 per cent of SUCBs’ lending was concentrated in these accounts, while NSUCBs’ exposure to these borrowers was less than 10 per cent. The large borrowers accounted for 15.3 per cent of NSUCBs’ NPAs, and 63.0 per cent of SUCBs’ NPAs. For the sector as a whole, special mention accounts-1 (SMA-1) declined during the year but SMA-2 increased, mainly led by SUCBs.

Priority Sector Lending

The revised guidelines for priority sector lending set higher targets for UCBs to be achieved in a phased manner7. The target for end-March 2023 and end-March 2024 was 60 per cent of the adjusted net bank credit (ANBC) or CEOBE. While the UCBs had met the target comfortably at end-March 2023, they missed it at end-March 2024.

During 2023-24, the share of MSMEs, particularly small enterprises, in total priority sector lending declined. UCBs’ lending to micro enterprises exceeded the target of 7.5 per cent. Although lending to weaker sections declined, UCBs met the target of 11.5 per cent. The share of renewable energy in total advances increased, albeit marginally.