Gold is the new stable multi-bagger: Liquidity management needs unconventional tools

Markets destined for 'Interesting Times' in 2024; Domestic Economy nearing Tipping Point to embrace next wave of growth

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, December 4, 2023: The emergence of a consistent theme in the US non-farm payroll (NFP) releases this year – wherein the headline figures have been revised lower for 8 of the nine months does not bode well for the US economy, where better than expected GDP growth numbers have of late raised hopes of the economy avoiding a hard landing, in particular as latest unemployment numbers take US a little closer to triggering the Sahm Rule (SR), a foretelling Recession Indicator....Soft landing begets....

- In US, despite inflation remaining elevated, the disinflationary environment continued, helped out by a significant fall in energy prices. The most dramatic changes have come in the form of Core PPI, with it now matching the mid-2019 low of 2.4%, and lower than the 2018 year-end peak of 2.9%. The fall in PPI means there is less pressure on corporations to pass along higher prices to consumers. They will, of course, until competition and/or a recession forces their hand

- In US, the consumer remains in spend mode but is shifting behaviour to heavier discount retailers and continues to pull back on durable purchases. Recent statistics show majority of holiday spending anchored on BNPL model, led by PayPal which vindicates our assumptions that US households are dipping fingers into last pie of their residual savings (~$1 trillion) even as loan repayments (mortgage/auto/education) have inched to nearly 50% of the household income at stretched RoI (30 years mortgage Fixed Rate is ~7.22% now, though falling recently from decadal highs of 7.79% in October) and credit card outstandings soar ($1.08 Trillion).

Additionally, new home sales are showing cracks (down by nearly 10%). So, while growth numbers, post revision, are coming good, jobs openings are still strong, checkmating market’s elevated hope of Fed pivoting from its restrictive rate stance as early as April/May’24. We believe this catch-22 makes treasury yields susceptible to volatile swings and can claw back gains from stocks seen in recent period, lured by promise of easy money flowing at softer rates in the hot and fragile election year of 2024......

- Despite PBOC’s frantic efforts to calm the frayed nerves of local markets as also overseas investors, real estate troubles are getting confounded with slowing economic indicators (both exports and imports are falling) that can have a destabilizing impact on supply and logistics value chain globally

- Based on all the scenarios, RBI may keep the repo rate unchanged at 6.5%, although control in CPI demands the lower repo rate but taking all factors together, this is the time of status quo...AS SUCH, FIRST RATE CUT NOT BEFORE Q2’FY25 (as of now)

ASCB credit, as of 17th Nov’23, grew by 20.6% (ex HDFC: 16.2%, compared to last year growth of 16.0%), driven by Personal, Services, Agriculture and MSME segments with Housing/Commercial Real Estate growing more than 35% yoy. Credit to NBFC sector reported 22% growth YoY(o/s~15 trillion)

- While the deficit in wheat sowing is narrowing gradually (hampered due to late harvest of kharif-grown paddy in a few States, a fall-out of ill-effects of El Nino as also electoral duty by staff in select states), there is an urgent need to cover at least 60% of the normal area under wheat immediately as the rise in prices, accentuated by the decline in sowing may have around 30 bps impact on overall CPI

- Government’s efforts to increase MSP is now making a clear impact with the MSP becoming a floor for prices at Physical/digital marketplace. Mandi and e-NAM are for most crops now significantly higher than MSP prices. In many State elections, parties promised to pay higher MSP for paddy to farmers,conveniently ignoring to fact check that the e-NAM price of Paddy much higher than the MSP. We believe there is a structural change in pricing behavior

- In a flux scenario, where Demand for liquidity is on-tap and supply of liquidity is ad-hoc, managing liquidity post proposed JUST-IN-TIME (JIT) mechanism will lead to temporary frictional mismatch between the sources and uses of fund by impacting the Government surplus cash balances, resulting in operational conduct of monetary policy being subject to vagaries of liquidity conundrum

- The penchant for the banking/FI ecosystem for financing assets of higher tenor through short maturities/On-Demand deposits (acquired at significantly higher rates with fierce inter-firm competition) does not bode well for the resilience of the system as it can anchor the deposits rate, thereby seeping into loans/investment benchmarks too....market players need to increasingly look at alternative to deposit recourse to fund credit growth.....

- Given the precarious situation wherein both stocks and gold are on fire, while bond yields are retreating, the aftermath of monetary policy when Central Banks are emerging as largest purchasers of bullion suggests impeding de-dollarization by economies en masse...could India resort to better recycling and move towards an industry specific Self Regulatory Organization (SRO) for this highly lucrative asset class that can help in streamlining higher imports while also positioning India as a Jeweller to the World, duly collaborating with our diverse Indian diaspora as brand ambassadors

Using ANN Model of Machine Learning

We Constructed 4-Scenarios of repo rates..results show 6.5% is now the new normal… Our Artificial Neural Network (ANN) model upto Aug 23 (which has been earlier trained for the period of Feb 22 to Nov 22) with lag 1 data of CPI, Core CPI and Fed rate

- SCENARIO 1: If the MPC to only considered domestic CPI headline inflation numbers, while taking a call on repo rate, the current rate would be at 5.93%

- SCENARIO 2: If the MPC had considered only Fed rate hikes, while taking a call on repo rate, the current rate would be at 6.55%

- SCENARIO 3: If the MPC had considered both domestic CPI headline inflation & Fed rate hikes, while taking a call on repo rate, the current rate would be at 6.53%

- SCENARIO 4: If the MPC had considered domestic CPI headline inflation, CPI Core inflation & Fed rate hikes, while taking a call on repo rate, the current rate would be at 6.64%

- Based on all the scenarios, RBI may keep the repo rate unchanged at 6.5%, although control in CPI demands the lower repo rate but taking all factors together, this is the time of status quo…AS SUCH, FIRST RATE CUT NOT BEFORE Q2’FY25 (as of now).

Global Backdrop: Into the House of Flying Daggers

US Economy: Unemployment & Inflation remain a ‘close-watch’… US economy poised for a recession

- While better than expected growth in the US have raised hopes of the economy avoiding a hard landing the unemployment number are not encouraging. A consistent theme has emerged in the US non-farm payroll releases this year – the headline figures have been revised lower for 8 of the nine months

- The latest unemployment number taking US a little closer to triggering the Sahm Rule (SR). Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months. We are not sure the SR has been updated yet as the low of the three-month moving average of the UR is 3.5%, so a trigger should be at 4.0%, given the 50 bps rule

- In US, despite inflation remaining elevated, the disinflationary environment continued, helped out by a significant fall in energy prices. The most dramatic changes have come in the form of Core PPI, with it now matching the mid-2019 low of 2.4%, and lower than the 2018 year-end peak of 2.9%. The fall in PPI means there is less pressure on corporations to pass along higher prices to consumers. They will, of course, until competition and/or a recession forces their hand

- In US, the consumer remains in spend mode but is shifting behaviour to heavier discount retailers and continues to pull back on durable purchases. While the decline in used car prices has stabilized, it has stabilized at a 6.4% rate since March (the pre-pandemic average since 2000 was an average annual gain of 1.8%)

How Revision in US Economy impacts bond yields

The latest (second) revision to US GDP was higher and higher than expected (5.2% vs. 5.0% expected, 4.9% last), which could be bad news for the bond market. But an unexpected downward revision to Personal Consumption (PC; 3.6% vs. 4.0% expected, 4.0% last) and to Core PCE (2.3% vs. 2.4% expected, 2.4% last) are indicating giving the bond market a boost. Plus, the downward revision to PC reflected slower spending on services

- After all, the consumer strength last quarter (especially in services) and continued sticky core inflation were behind a lot of the bond market’s sell off to higher rates into the peak in Oct’23 at 5.02% on the 10-year treasury note

- US economy is in a flux…on the one hand US consumers are having an excess savings of $ 1trillion..on the other hand…. US headline GDP is hitting 5% on a regular basis….we need to look through the numbers….

Corporate India: Good Times Galore

ASCB Non-Food credit grew @ 20.6%, 16.2% ex HDFC, seems sustainable for the remaining year too.

ASCB credit, as of 17th Nov’23, grew at credit grew by 20.6% (ex HDFC: 16.2%, compared to last year growth of 16.0%)

- Personal, Services, Agriculture, MSME reported excellent credit growth YoY as per sectoral credit data as of Oct’2023

- Housing, Commercial Real Estate grew more than 35% yoy

- Aviation reported growth of 67%, suggest further growth opportunity in the sector

- Credit to NBFC sector reported 22% growth YoY to reach around 15 trillion as of Oct’2023

- Overall, Industry credit reported growth of 6%. However, sector such as Chemicals, Metals, Textile, Glass, Food Processing etc. reported double digit growth

- In Infrastructure Road reported 9% growth while Telecommunication and Railway reported growth of 7% each.

CPI Food: Weightage Problem

CSO had revised the base year of the CPI to 2012 (from 2010=100) in Jan’2015, following the weighting pattern based on the CES of 2011-12. A number of methodological improvements have been undertaken by the CSO in the new series, which include, weighting diagrams use the modified mixed reference period data of CES 2011-12 as against a uniform reference period (URP) of 30 days used in the earlier series

- If we look at the weight matrix, there is a significant difference between the share of food and beverages (30%) in the Private Final Consumption Expenditure (PFCE), published by the National Account Statistics (NAS), and the weights derived from the CES (45.86%) used in CPI. Subsequently, the episodic spikes in CPI inflation, which is largely contributed by rise in food and vegetable prices (as in the current situation), makes the RBI decision difficult

- The NAS and CES estimates have difference in coverage, estimation methods and databases, and, therefore, the inflation derived from weights under both the methodology, would be different. However, the present policy decisions are based on the headline CPI inflation where the weights matrix plays an important role that derived from the consumption pattern of eight years back data, so the level of true inflation in the economy remain a matter to investigate

- In NAS, the share of food expenditure shows a clear definitive declining trend which shows the most recent trend in consumption pattern. In contrast, the CES survey also shows a clear downward trend in expenditure on food, but data is not available beyond FY12, and latest CPI data based on such CES survey may be misleading and overstated

CES is a directly observed stand-alone estimate relating to a given survey period (usually a year, as noted above) – while PFCE from NAS is an indirect, residual macro-level estimate of aggregate PFCE derived from GDP estimate. The residual nature of PFCE arises from its use of the commodity-flow method at the disaggregated level of a commodity or service. This method employs an ex-post aggregate commodity-flow balance in which economy wide domestic production is equated to its various uses

- Taking into account the structural changes, which takes place in the economy and to depict a true picture of the economy through macro aggregates, there is a need to change the base year periodically with a revised methodology and basket of commodities. So, there is an urgent need to rationalize the weights of CPI to have clear view of the current economic situation, which can be used for the policy making decisions, say RBI monetary policy.

Need to rationalize Price Discovery Mechanism amongst MSP, e-NAM & Mandis

The deficit in wheat sowing narrowed down to 5% for the week 24 Nov’23 as farmers brought more area under the cereal and wheat

- Sowing of major wheat, pulses and some oilseeds are also slightly delayed this year due to late harvest of kharif-grown paddy in a few States due to ill-effect of El Nino

- Further, the election bound states like MP, Rajasthan and Telangana reports low as staffs engaged in in election duty

- There is a need to cover at least 60% of the normal area under wheat by November-end, which is usually done. We think the area sowing will increase by December end, however, with the rise in prices accentuated by the decline in sowing will have around 30 bps impact on overall CPI.

- Despite Government’s efforts to increase MSP, Mandi prices remain low in Ragi, Moong and Cotton. However, interestingly, price of Cotton at e-NAM is higher than MSP

- In many State elections, parties promised to pay higher MSP on paddy to farmers. However, the eNAM price on Paddy is much higher than the MSP…this indicates there is an incentivization at play at markets that could aid in price discovery….we therefore need to be watchful of food inflation…

MPC to maintain status quo

- India's annual retail inflation eased to four-month low of 4.87% in October from 5.02% the previous month

- Food inflation, which accounts for nearly half of the overall consumer price basket, rose 6.61% in October as compared with 6.56% in September ? CPI is expected to come around 5.4-5.5% by March 2023, though Nov and December inflation could overshoot 6%

- With inflation expected to come down further, MPC is likely to maintain status quo this fiscal.

Liquidity management: managing temporary frictional mismatch

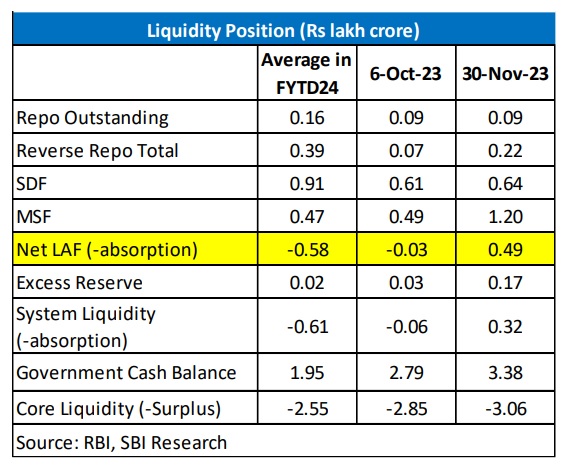

Current Liquidity Update shows Rs 3.1 trillion surplus….but… Liquidity as indicated by the Net LAF has remained in the deficit mode since mid-Sep’23, with the current system liquidity deficit at Rs 0.5 lakh crore and average of Rs 0.7 lakh crore in Nov’23

- However, Government surplus cash balances have increased to an average of Rs 3.7 lakh crore in Nov’23

- With Government surplus cash balances increasing, durable/core liquidity surplus has increased to Rs 3.0 lakh crore.

Liquidity forecasting is becoming difficult!

- Liquidity depends on a number of factors, autonomous factors including forex intervention by RBI, Government surplus cash balances and excess reserves maintained by banks with RBI, and discretionary factors or policy driven factors including OMOs by RBI, CRR requirements and net LAF operations of RBI

- Demand for liquidity is on-tap and supply of liquidity is adhoc

- Currency in circulation declined during the Diwali week for the second straight time in 20 years, indicating that currency leakage is becoming structurally weaker. This is due to increased use of UPI which increased (mom) by 853 million transactions of Rs 1366 billion in value terms in the festive month of Oct’23

- Additionally, just-in-time mechanism will lead to temporary frictional mismatch between the sources and uses of fund by impacting the Government surplus cash balances, resulting in operational conduct of monetary policy being subject to vagaries of liquidity conundrum

Structural change in Liquidity

- The 24*7 payment systems is posing an issue for banks, leading them to park some money in SDF even in situations of deficit liquidity. This can be termed as liquidity for precautionary motive. The average amount parked by banks in SDF since mid-Sep’23 comes at Rs 0.5 lakh crore

- There is a structural shift in liquidity preference in uncertain times which is causing disproportionate increase in precautionary demand for liquidity. This post-GFC world needs a substantially higher liquidity (and assurance on supply of liquidity)

- But at the same time, banks are increasingly resorting to MSF pointing to liquidity deficit. Amount borrowed by banks through MSF rose sharply with an average of Rs 1.2 lakh crore in Nov’23 from Rs 0.9 lakh crore each in Oct’23 and Sep’23

- As the liquidity falls, change in HQLA maintenance gives a true idea of change in liquidity preference of banks. In India, we have not seen a decline in HQLA levels over last 2 years in sharply falling liquidity scenario, indicating preference for liquidity (precautionary demand) is, likely, structural

Some measures to address the issues…make CRR & LCR norms attuned to liquidity mismatches

There are couple of things that we can do to address these issues:

- Ensure that liquidity supply keeps pace with transaction demand. Nominal GDP or bank deposits can be taken as proxy

- Under the changed circumstances, liquidity needs to be, at least, marginally surplus

- To address the precautionary demand, following measures may be taken

- Clear articulation that CRR and LCR can fall below mandated levels in case of emergency and that should be automated…..

- Published set of rules/guidelines that define emergency and facilitate auto-implementation of (a) without any prior approval

- Allowing money market and settlement system to be contemporaneous

- Actively destigmatize use of market or central bank mechanism to avail liquidity

Gold again glitters amidst rising tension between major powers in East and West…

Price of gold has reached all time high, hovering comfortably above $2000 per troy ounce with forecast of its steep rise in years to continue as the asset class in enjoying tailwinds from a mélange of factors

- Central Banks in 2022, increased their purchases of gold by 152%, to over 1,136 tons. In 2023, central banks have bought a net 800t of gold so far this year. The Monetary policy conduct, against the backdrop of enhanced gold purchase taken as a serious sign of de-dollarization, needs some recalibration from markets sure

- Geopolitical factors, de-dollarization, inflation hedging has increased its demand and hence price

Opportune time to revisit the gold policy since last major intervention in 2015….

- Government of India launched the Revamped Gold deposit scheme 2015 but it did not see much retail participation. Even the continuous issues of Sovereign Gold Bonds since 2015 have not met the desired success (total mop up at 122 Ton a fraction of our annual imports) despite delivering stellar returns to investors since first tranche of 2015 redeemed (~150% return with interest credit)

- India launched its first bullion exchange in 2022 at GIFT city, positioning the country as a market maker in precious metal price discovery and offering suitable hedging products to shield from volatility

- To capitalise on India’s enormous gold market opportunities, several fintech startups have entered the gold segment in recent years, disrupting the conventional gold buying and investing behaviour. From purchasing digital gold to getting loans against gold in a hasslefree, paperless manner, constant innovations are upending the traditional ways of doing business

- Also, more and more banks are looking at launching their own gold loan products and also forging partnerships with fin-techs. The collaboration can be harnessed for a frictionless onboarding and dispensation system to attract people holding substantial physical gold as means of consumption related credit that also strengthens the banking system (collateral backed credit)

- Gold recycling needs focussed attention. In India, recycled gold comprises about 11% of the supply. Gold sold back for cash is usually linked to consumer sentiment and the economic backdrop. However, over the years the share of gold sold for cash has remained broadly steady, despite the economic slowdown of 2012-2014 and the pandemic. This is due to the vibrant gold loan industry in India, which makes it straightforward to borrow funds against gold rather than selling it. Old jewellery scrap represents the largest source of recycling in India, with an approximate 85% share of the total. The other key component is old bars and coins that people either sell or exchange for jewellery; these Metals Focus estimate to make up about 10% to 12% of scrap gold supply

- ESG concerns, from sourcing to making of jewellery is gaining a foothold in mainstream as niche groups of influential buyers are increasingly focussing on ESG commitments of ecosystem, impacting consumer cost and financing factors in days ahead

The fragmented nature of the industry, largely unorganised and with considerable gaps across value chain, besieged with market infrastructure as also financial constraints, especially for the small and medium players in the ecosystem even though the industry is having footprint throughout the vast latitude of the country, necessitate readjustments as buyers’ preferences change constantly and regulatory requirements evolve, necessitating setting up of a Self-Regulatory Organisation (SRO) for industry

- SRO, the ‘First level of Defence’ that builds trust and credibility through transparency, sustainability, governance and accountability, aligning with global benchmarks and eventually transforming into a beacon in setting best global practices for all while ensuring constant monitoring while adopting better compliance measures, professionalism, capability and capacity development, standards setting/certifications and harnessing market opportunities to serve consumers/customers across geographies is need of the hour

- Positioning India as the jeweller to the world that hinges on, as also leverages our proven craftsmanship, rich cultural heritage’s imprint on the design philosophy and the impeccable brand equity India has been able to accrue of late, makes the challenging task of positioning India as the ‘Jeweller to the World’, quite possible if we can connect the dots and move forward in unison…through leveraging our strong Indian diaspora abroad

- The second largest gold-jewellery market globally, the fastest growing large economy of ours fostering an unmatched financialization and formalisation drive for a billion-plus populace can truly benefit from gold centric measures, for both consumers as also financial stakeholders

Final Thought

- So, what will be the RBI’s policy look like:

Repo rate: We expect the RBI to continue pause stance in upcoming policy

- Downward revisions in US non-farm payroll, higher GDP growth expectations, decline in inflation, excess savings still to the tune of $ 1 trillion seem to have pushed back on market expectations for a quick pivot to rate cuts

- Domestically, we believe at 6.50%, we are in for a prolonged pause, no rate reversal cycle till Jun’24

Stance

- We believe the stance should continue to be withdrawal of accommodation as inflation is unlikely to tread below 5% in rest of FY24; as amidst the structural change in liquidity is making its forecasting difficult, it should be looked at with a completely different prism

Risks for growth/inflation

- Risk for growth mostly from outside home sources…Growth continues to remain resilient. Higher oil prices pushing up inflation and/or tighter global financial conditions are the key risks weighing on the currency, inflation and growth dynamics

Forward Guidance

- It is not advisable to give a forward guidance yet…..

Any Other

- Gold is now the new multi bagger….

Disclaimer: The opinion expressed is of Research Team and not necessarily reflect those of the Bank or its subsidiaries. The contents can be reproduced with proper acknowledgement. The writeup on Economic & Financial Developments is based on information & data procured from various sources and no responsibility is accepted for the accuracy of facts and figures. The Bank or the Research Team assumes no liability if any person or entity relies on views, opinion or facts & figures finding in this Report.