Rs 3,700 crore revenue loss is expected in GST, which is 1 bps impact on Fiscal Deficit; GST rate rationalisation has had a largely positive impact on the banking sector; CPI inflation may be moderated in the range of 65-75 bps over FY26-27

FinTech BizNews Service

Mumbai, September 5, 2025: The State Bank of India’s Economic Research Department has come out with a special Research Report after the announcement of GST 2.0. The 56th meeting of the GST Council was held in New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The GST Council inter-alia made the recommendations relating to changes in GST tax rates. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

The Good and Simple (Tax) unleashed....

The simpler GST 2.0 unleash plethora of benefits in the form of consumption boost primarily from the middle class, low inflation, ease of business and ease of living

Dawn of GST 2.0

❑ The 56th meeting of the GST Council has rationalised the current 4-tiered tax rate structure into a citizen-friendly ‘Simple Tax’ - a 2 rate structure with a Standard Rate of 18% and a Merit Rate of 5%; a special de-merit rate of 40% for a select few goods and services. The changes in GST rates of all goods/services except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be implemented with effect from 22nd September 2025

❑ The decision represent a strategic, principled, and citizen-centric evolution of a landmark tax framework, which will enhance the quality of life of every last citizen

❑ GST Council recommends operationalisation of Goods and Services Tax Appellate Tribunal (GSTAT) for accepting appeals before end of September and to commence hearing before end of December 2025

❑ The rationalisation of rates by the GST Council has brought down the effective weighted average GST rate from 14.4% at the time of inception to 11.6% in Sep’19; enhanced buoyancy has been achieved by widening the tax base and removing distortions. Given the current rationalization of rates, we believe that effective weighted average GST rate may come down to 9.5%

Number of Items with old and new rates

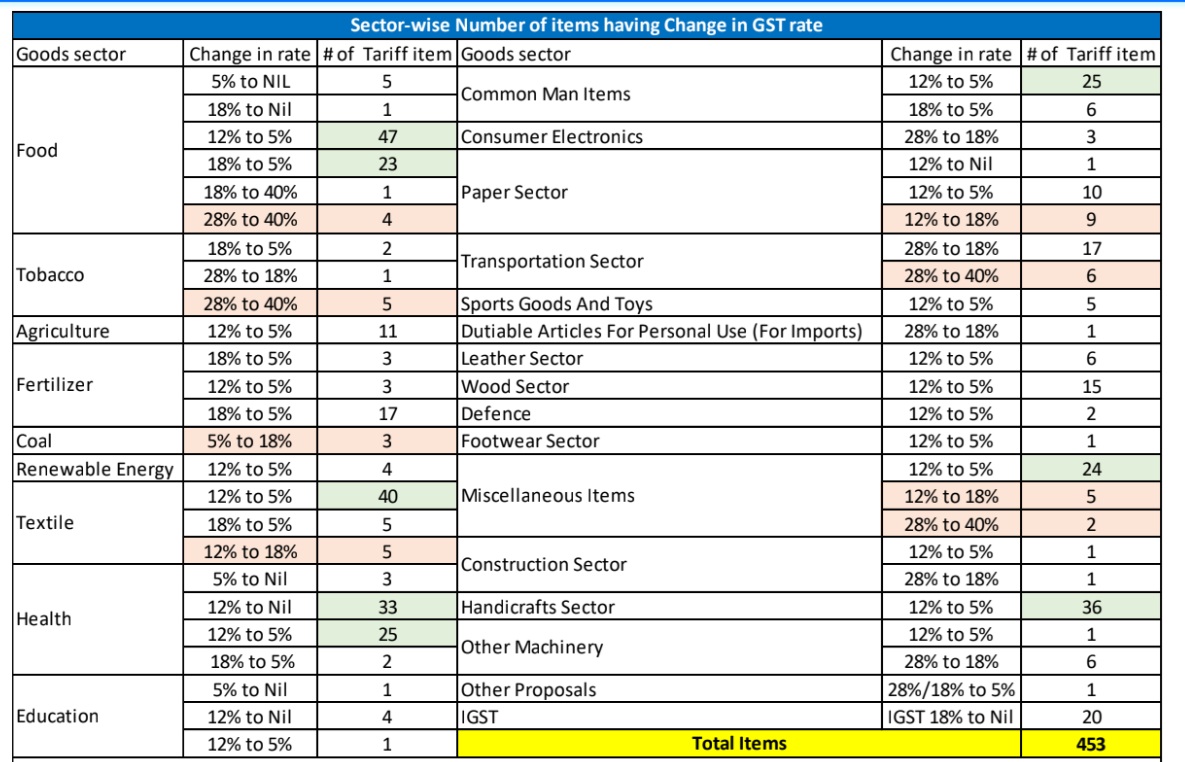

❑ Of the 453 goods where GST rate has changed, 413 goods exhibited decrease in rates while only 40 goods exhibited increase in rates

❑ Almost 295 goods now have new GST rate of 5%/NIL from earlier 12%

Sector-wise New Rates: Number of Items in Food, Health and Textiles have seen the largest cuts

Impact on Revenue is positive

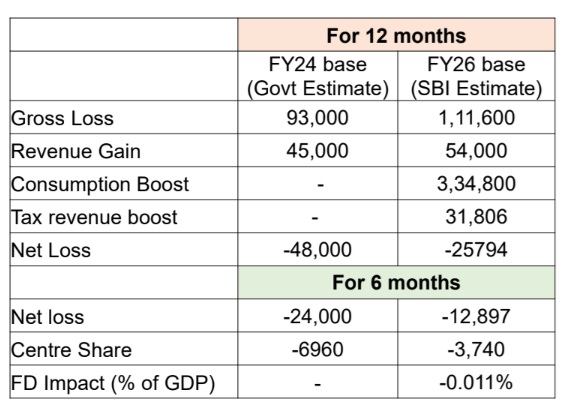

The government estimates the net fiscal impact of this rationalisation at Rs48,000 crore in FY26 on FY24 consumption base

❑ However, based on the trend growth and consumption boost, we expect Rs 3,700 crore revenue loss in GST, which is 1 bps impact on Fiscal Deficit

❑ However, in the past episodes, rate cut has translated into additional revenues of nearly Rs1 trillion. Importantly, rationalisation should be seen less as a short-lived stimulus to demand and more as a structural measure that simplifies the tax system, reduces compliance burdens, and enhances voluntary compliance, thereby widening the tax base. In this broader sense, the Hon’ble PM’s vision of a streamlined GST framework is best understood as a step towards long-term revenue buoyancy and greater efficiency in the economy

Impact on Inflation could be at least 65-75 basis points on headline inflation numbers

Since the GST rate of essential items (around 295 items) has declined from 12% to 5%/NIL, the CPI inflation in this category may also come down by 25- 30 bps in FY26 after considering a 60% pass through effect on food items

❑ Apart from this, the rationalization of GST rates of services also leads to another 40-45 bps reduction in CPI inflation on other goods and service items, considering a 50% pass through effect

❑ Overall, we believe CPI inflation may be moderated in the range of 65-75 bps over FY26-27

Impact on Banking

❑ GST rate rationalisation has had a largely positive impact on the banking sector, with important implications for the operating metrics of banks

❑ For the banking sector in particular, the reform translates into meaningful cost efficiencies as most of the relevant rates have been brought down. For example, the exemption of GST on health and life insurance premiums directly reduces the cost burden on banks, especially for employee-related insurance where the earlier levy of 18% is now fully removed

❑ Hotel accommodation is another important area, the rate cut from 12% to 5% means the effective cost to banks falls by 3.5%. Likewise, office infrastructure items such as air-conditioners and monitors, as well as medical essentials have become cheaper, further reducing expenses

❑ This rationalisation therefore improves operating efficiency, strengthens profitability, and creates space for banks to channel resources into growth and customer-centric innovation.

Impact on Insurance Sector

❑ GST on individual health and life insurance premiums (including reinsurance) has been reduced to zero in the 56th GST Council meeting, which will come into effect starting September 22, 2025. Additionally, GST on other medical items like glucometers, test-strips etc, has reduced to 5%

❑ At current GST regime, life insurance products are subjected to GST of 4.5% on first year premium, 2.5% on renewal premium and 1.8% on single premiums on saving products. While protection products and funds management charges on ULIP attracted a GST of 18%

❑ As per the latest available data, in FY24, GST collected from health and life insurance companies amounted to Rs 16,398 crore (Health: Rs 8263 crore and Life insurance: Rs 8135 crore). Additionally, Rs 2045 crore was raised as GST from reinsurance on life (Rs 1484 crore) and health insurance (Rs 561 crore)

❑ Removal of GST would bring down the overall premium and improve affordability.

This may help in 2 ways:

-------------------