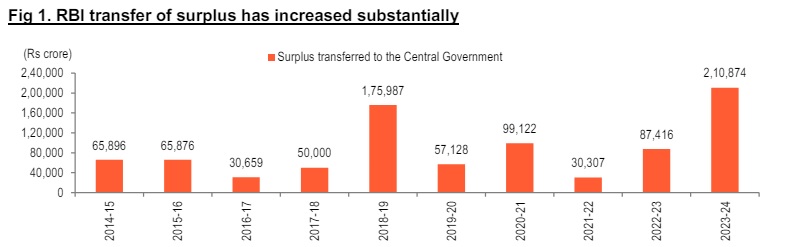

RBI dividend at record high

FinTech BizNews Service

Mumbai, May 24, 2024: RBI declared a record Rs. 2.11 lakh crores surplus transfer to the government in FY25, compared with Rs. 87,416 crores in FY24. This was also much higher than both the budgeted (Rs. 1.02 lakh crores, including dividend from banks and FIs) and street estimates of ~Rs. 1 lakh crores surplus. The higher than anticipated surplus can be attributed to higher interest income led by an increase in both global as well as domestic yields. There were also revaluation gains on forex reserves unlike in 2022. The higher surplus will have a positive impact on government finances. This is positive in terms of maintaining the targeted fiscal deficit. Thus, the additional Rs 1 lakh crore gives government the headroom to either cut back on its gross borrowing from the market, putting lesser pressure on domestic yields, or to increase its thrust towards capex. The main budget post elections will throw better light on the same. Overall, this is likely to have a positive impact on government yields. We expect 10Y yield to go below 7% in the coming months. Frontloading by FPIs due to inclusion in the global bond index will further lend support. What has led to record high surplus: conjectures? RBI has transferred a record high dividend to the government for accounting year 2023-24. This is far higher than budgeted amount of Rs 1.02 lakh crore for FY25. This Rs 1.02 lakh crore is also inclusive of Dividend transfer of Nationalised Banks & Financial Institutions. Thus, from RBI itself a windfall gain has been received. This level of high transfer of surplus was last witnessed in 2018-19. A result of such unexpected increase could be higher interest income from foreign securities, exchange gain/loss from foreign exchange transactions. The other part of in “other income” may be due to some rebalancing of provisions no longer required due to write-back of excess risk provision from Contingency Fund.

Impact

The higher than budgeted dividend transfer by RBI bodes well for India’s fiscal dynamics and will provide a boost to the government’s effort towards fiscal consolidation. It must be noted the in the interim budget the government had set a target of bringing down fiscal deficit target to 5.1% of GDP in FY25 from 5.8% of GDP in FY24. 2. Government can hence reduce its dependence on market borrowings which are currently budgeted at Rs. 14.13 lakh crores (gross) and help lower borrowing costs. Lower than expected borrowings by the government will have a softening impact on yields. The impact has already been felt in the G-sec market with yield on the new benchmark 10Y yield to below 7%, falling by ~ 5bps and we expect a softening momentum in yields going forward. With bond-index related FPI inflows also expected to surge in Q2 FY25, we may see benchmark 10Y yield falling to as low as 6.75% assuming RBI invokes rate cuts in the second half. 3. The government can also choose to deploy the additional resources for higher spending, preferably for capital expenditure. Incidentally, the government had already increased its capital expenditure to Rs. 11.1 lakh crores or 3.4% of GDP in FY25. 4. Apart from this, the bumper dividend payout is also likely to ease reliance on government’s disinvestment program, on which the progress has been slow in the last few years.