Some of the high frequency indicators have been signaling resilience in domestic demand as has been reflected by pickup in digital payments, power demand and even in electronic imports

Dipanwita Mazumdar,

Sonal Badhan,

Aditi Gupta,

Jahnavi Prabhakar,

India Economics: Monthly Chartbook,

Economic Research Department

Bank of Baroda

Mumbai, November 10, 2023: On the domestic front, growth indicators are showing resilience in activity.

Growth holding ground

With the onset of festive season, demand has picked up pace, as seen through increased digital payments and electronic imports. Within services, credit growth still remains robust and GST collections are maintaining pace.

Airline passenger traffic has surpassed pre-pandemic levels and pick up in rail freight also suggests growth in domestic trade. On the global front, risks of Fed hiking rate one more time persists, as economy is holding ground.

This will have an impact on India’s 10Y yield as well. Further, expectation of OMO sale calendar and tight liquidity conditions have added to the pressure on yields across tenors. Volatility in the global markets suggests continued RBI intervention to keep INR range bound. Going forward, we expect INR in the range of 83.25-83.5$ in the near-term.

Steady growth for domestic demand:

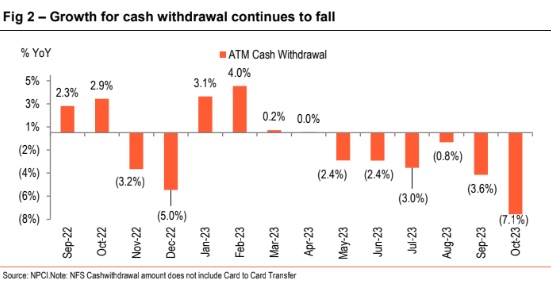

Some of the high frequency indicators have been signalling resilience in domestic demand as has been reflected by pickup in digital payments, power demand and even in electronic imports.

However, non-oil and non-gold imports have registered some moderation. On the other hand, auto sales have recorded improvement on a monthly basis and is expected to improve further on the back of festive demand. Steady pickup has also been noticed in the output of consumer goods. Services indicators such as railway freight, air passenger and robust GST collections are also exhibiting strong growth.

Health of centre’s finances:

Fiscal deficit ratio (% of GDP, 12MMA basis) of the central government settled at 6.3% as of H1FY24 compared with 6.5% last year (H1FY23), on account of better net revenue collections. In H1FY24 (Apr- Sep’23), centre’s net revenue receipts rose by 19.5%, compared with 8.2% growth seen in H1FY23. This was driven by improvement in direct tax collections (25.4% versus 23.5%) and jump in non-tax receipts (50.2 versus - 1.7%). On the other hand, indirect tax collections eased (6.6% versus 11.8%).

On the spending front, momentum was maintained with overall growth at 16.2% versus 12.2% last year, led by revenue expenditure (10% versus 6%). Capex growth, despite some moderation in H1 this year, has managed to maintain momentum as it was up by 43.1% versus 49.5% last year. We expect spending momentum to pick up in H2 as government has utilized only 47% of its budgeted target.

India’s 10Y yield exhibited some volatility:

In line with global yields, India’s 10Y yield witnessed some sell off pressure in Oct’23. This along with anticipation of publication of OMO sales calendar by RBI as well as underlying deficit liquidity conditions, have exerted pressure on India’s yield. The entire curve across all spectrums has shifted upwards. In Nov’23, buying resumed on expectation of peaking of US Fed rate and also on account of risk- off sentiment surrounding geopolitical tensions. However, Fed Chair in his recent speech has highlighted to be watchful of the inflation trajectory as economic conditions have remained fairly buoyant. Going forward, we expect Fed’s guidance will hold cue for evolution of domestic rates.

INR at a record low:

INR has touched a fresh historic low in the last session as comments from Fed Chair have reignited fears of another rate hike in the US.

Pressure on INR has remained, with the currency pair continuing to trade in a narrow range. Volatility has remained low indicating that RBI has been actively managing the exchange rate. We believe that the trend is likely to continue. We expect INR in the range of 83.25-83.5$ in the near-term.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)