Credit demand, auto sales, GST collections turning a bit more tepid after a small jump in the year end

Rahul Bajoria,

Head of India and ASEAN economic research,

BofAS India

Mumbai, March 4, 2025: In the latest GDP data, we saw material upward revisions to historical data for FY23 and

FY24, but GDP growth remains on a path of gradual slowdown, with growth for FY25

expected now at 6.3%, likely recovering to 6.5% only in FY26 (see note: India Watch: Q4

24 GDP Review: Shallow recovery, GDP forecasts downgraded). With fiscal spending

coming off in FY26, and monetary indicators likely to work with a lag, the growth

improvement is likely to be seen in the light of trends normalizing around 6.5-7.0%

growth, which is close to trend growth in India. The budget and RBI’s actions may

stabilize household sentiment, but we see signs of growth stabilizing around 6.5% GDP

growth as the baseline. (see note: India Watch: Budget 2025-26 and RBI February MPC

review).

Supply side indicators continue to hold up

The gap between demand and supply side indicators continues to remain intact, with

supply indicators like cement production, freight traffic, fuel consumption holding up,

while credit demand, auto sales, GST collections turning a bit more tepid after a small

jump in the year end. One bright spot remains rural indicators, which buoyed by

agriculture and allied services growth, continues to display solid momentum.

India’s GDP growth forecasts downgraded

Last week, Q4 2024 (Q3FY25) GDP came in at 6.2% yoy, slightly higher than the revised

5.6% in Q3 24. GVA growth also broadly aligned with the GDP print at 6.2% yoy as well.

However, the highlight of the data release was more in its revisions, than in the actual

information itself. The data saw upward revisions to both near term and historical data

for DP growth, pushing up FY24 GDP growth to 9.2% (from 8.2% previously) and FY23

GDP growth to 7.6% (from 7.0% previously). It also maintained H1 GDP growth for FY25

at 6.0%, while FYTD, growth is around 6.1%, providing a slightly more stable base for

GDP growth data. Still, to incorporate incoming information, we believe incoming data

does not indicate a sharp recovery from here. As such, we downgrade our FY25 GDP

growth forecast to 6.3% (from 6.5% earlier), and lower FY26 GDP forecast to 6.5% from

7.0% earlier (see note: India Watch: Q4 24 GDP Review: Shallow recovery, GDP forecasts

downgraded).

.... but risks are now evenly balanced for FY26

While prima facie we have downgraded growth forecasts, we also do not see any further

downside to our projections, as we have done in last few months. Indeed, the incoming

data for January – February shows that the recovery, which began slowly in November,

has persisted, and growth is now comfortably perched above 6% on our various trackers,

and high frequency indicators. This does not even consider the spate of monetary

measures that the RBI has taken in last eight weeks or so, which will start feeding

through the activity in the coming months. As such, we are comfortable that growth is

likely to recover from 6.3% in FY25, to 6.5% in FY26, and see risks being evenly

balanced for our GDP projections.

January-February activity starts off moving sideways

In January and some early data from February, growth appears to have broadly been at

similar rates to the pace seen in December, which appears to be a modest recovery

relative to previous two years, but still better than the growth pace set six months back

(see note: India Watch: India growth meter – Emerging fault lines) In several high

frequency indicators, there are signs of ongoing weakness, but several show a recovery

as well, partly driven by temporary factors such as the organization of the Maha Kumbh

festival, which takes place once every twelve years in Prayag Raj, a town in Uttar

Pradesh. Overall, the growth momentum is consistent with our latest growth projections

and see room for growth to improve further in Q4 FY25 (Q1 CY25), as things stand.

PMI manufacturing and Services improves

PMI manufacturing showed a mild deceleration in February to 56.3, with weakness

seen in output and new orders and stock of purchases. Both input and output prices

remained flat from previous month with output prices looking slightly stronger than

input prices. Flash PMI services however recovered strongly to 61.1, the best print

recorded in almost 11 months, which could partly reflect one off factors such as

significant travel demand due to the festive event of Kumbh, but also some

improvement in sentiment given change in credit policy measures and interest rate

reduction by the RBI in February. In terms of prices, output and input prices were broadly

stable in services.

Agriculture indicators support rural demand recovery

Agriculture sector continues to do well, with Rabi (winter) sowing also progressing well.

As of 04 Feb 2025, Rabi sowing is up 1.5% yoy and 4% over the normal area average

of last five years. Fertilizer sales continued to remain healthy in January carrying

forward the strong recovery seen in December to post 7.4% yoy growth. Tractor sales

data also shows a stable January on the back of the strong yoy growth seen in

December. Thus, good crop cash flows with the prospects of two strong crop cycles

augur well for rural sector performance.

Industry indicators mixed given lack of the leap day effect

Most industrial indicators remained resilient in February, especially considering the lack

of 1 extra day February had last year in 2024. Despite a return to warm weather in mid-

February, power consumption is recovering only slowly, but may show a sharper

recovery, as March begins. As per the national power portal, grew by almost 1.5% yoy in

February, after contracting 1.3% yoy in January. Fuel consumption is holding up well,

and gasoline consumption has continued to remain strong, growing 4.6% yoy in February

flash estimates, while diesel fell by 1.5% yoy despite heightened activity in Kumbh Mela.

Airline fuel consumption also was down to only 3.7% yoy growth. Steel production in

January decelerated to 3.7% yoy but cement production jumped back up to post double

digit growth at 14.5% yoy. Coal production as per estimates seems to have slowed

further in February. On the autos front, estimates from our auto analysts suggest

passenger vehicle and 2-wheeler dispatches fared decently in February posting a

growth of 2% and 3% yoy, respectively. We expect the fiscal initiatives as well as the

renewed focus on growth from the monetary front to stimulate industrial growth going

forward.

Services indicators remain healthy

Within services, Railway freight data has not been reported since October, but we

assume it would be on the weaker side, tracking low coal offtake. Aviation turbine fuel

consumption data moderated sharply to 3.7% yoy on the back of moderation in demand

and lower working days in February. International air traffic turned back up and posted a

high yoy growth at 19.1%. Toll collections data from NPCI showed a strong yoy

performance in January growing at 19% yoy up from 13% yoy in December.

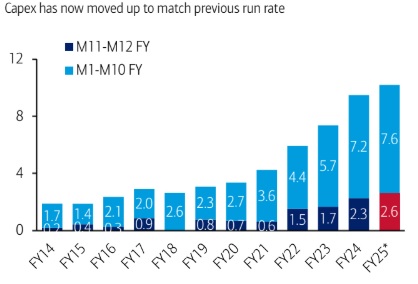

Public capex now in line with previous run rate

Post the December booster shot in capex spending, January continued to see a strong

growth rate at 51.4%. FYTD Capex spending at INR7.6trn is now higher than FY24 by

5%. As of January, the government has reached 74% of its revised estimate in line with

the amount achieved in FY24. For FY26, the government has budgeted capital spending

at INR11.2trn, which is constant in % of GDP terms at 3.1% but is still slower than

historical run rates seen previously. Given recent experience, the government could

consider frontloading capex in H1FY26 to ensure better planning. On the revenue front,

revenue growth saw a slowdown in January de-growing 54% yoy, but this in our view is

more of a timing mismatch, than a material issue. GST collections for February was in

high-single digits at 9% yoy at INR1.8trn.

Monetary indicators may revive with a lag

While monetary conditions continue to remain weak, we believe the RBI has started to

take actions which will spur some strength in these indicators looking ahead. Non-food

credit growth has steadily weakened further to 12% yoy in line with the deposit growth

of 12% yoy. The RBI however has become a lot more pro-active in providing liquidity and

has started to purchase bonds in open market operations, while also giving liquidity

through FX swaps and long-term repo operations. On a sectoral basis, marginal

improvement in yoy growth is seen in industry and services credit growth but broadly

the growth remains flat, and recovery has not been seen yet. RBI has also started to do

material liquidity injections, alongside relaxing macro prudential norms, alongside

relaxing risk weights for credit deployed towards other financial companies, which can

further help in distributive aspect of credit availability. Still, we expect credit growth to

revive only with a lag and start gaining some strength in next 3-6 months. (see note:

India Viewpoint: RBI policy playbook: Not in Kansas anymore).

Trade balance settles down in January

After the material improvement in trade balance seen in December trade data, January

trade data appears to have sustained the gains made in December, posting a trade

balance of USD22.9bn, in line with the USD21.9bn seen in December. While export

growth weakened at -2.4% yoy, import growth accelerated 10.3% yoy, while on a

sequential basis, import growth de-grew by 1% mom. Gold imports stayed low in January

at USD2.7bn, while oil related imports weakened marginally to USD13.4bn. On services,

exports have risen 13.3% to USD320bn in the same period, while imports are up 13.8%

to grow to USD167bn, for a surplus of USD153.2bn from April-January of this fiscal year.