RBI has further alerted these banks that high attrition and employee turnover rate pose significant risks, including disruption in customer services, besides leading to loss of institutional knowledge and increased recruitment costs

FinTech BizNews Service

Mumbai, 27 December, 2024: The Reserve Bank of India has released its “Report on Trend and Progress of Banking in India 2023-24” on 26 Dec, 2024.

Higher Employee Attrition

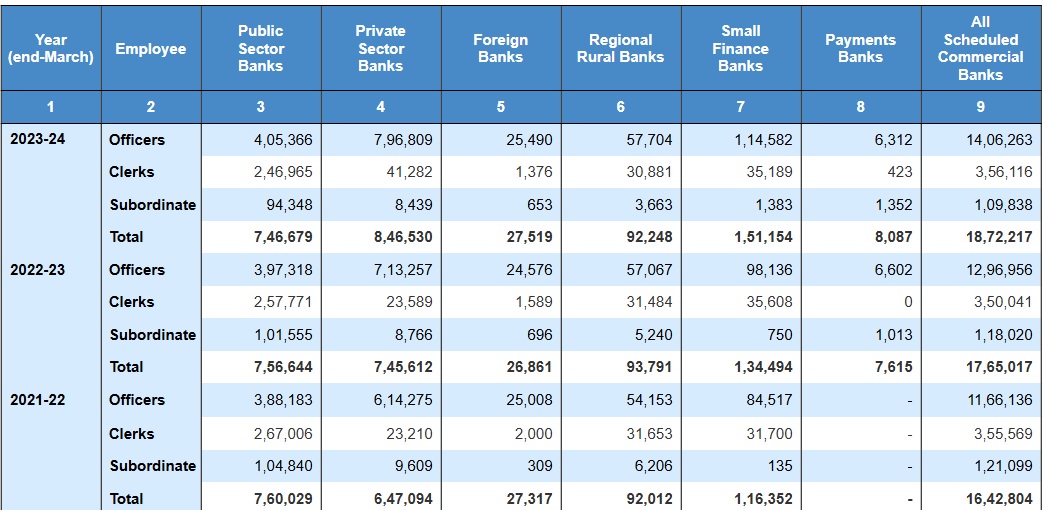

Employee attrition rates are high across select private sector banks (PVBs) and small finance banks (SFBs). The total number of employees of PVBs surpassed that of public sector banks (PSBs) during 2023-24, but their attrition has increased sharply over the last three years, with average attrition rate of around 25 per cent, according to the Reserve Bank of India’s Report on Trend and Progress of Banking in India 2023-24, released on Thursday.

RBI has further alerted these banks that high attrition and employee turnover rate pose significant operational risks, including disruption in customer services, besides leading to loss of institutional knowledge and increased recruitment costs.

In various interactions with banks, the Reserve Bank has stressed that reducing attrition is not just a human resource function but a strategic imperative. Banks need to implement strategies like improved onboarding processes, providing extensive training and career development opportunities, mentorship programmes, competitive benefits, and a supportive workplace culture to build long-term employee engagement.

What is the Employee turnover rate