For PVBs the increase on fresh deposits was lower 195 bps and that on loans was 154 bps

Dipanwita Mazumdar,

Economist

Bank of Baroda

FinTech BizNews Service

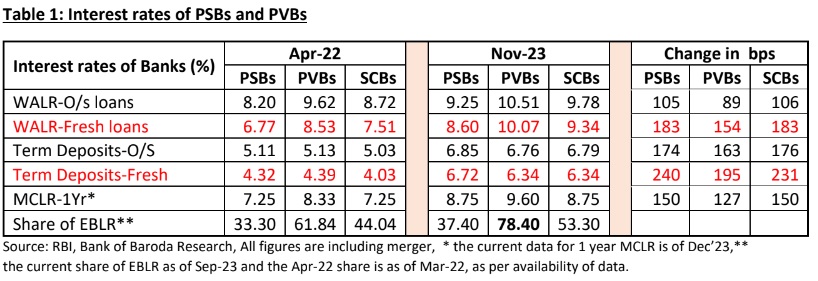

Mumbai, January 1, 2024: A closer look at the table reveals how transmission of

interest rates across different spectrum have fared. The change is taken from Apr-22

just before RBI embarked on the journey of rate hikes, to control inflation.

? The transmission of interest rates was better for PSBs relative to PVBs. In case of

PSBs the transmission on fresh term deposits was almost complete with an increase

of 240 bps. On the lending side, WALR rose by 183 bps.

? For PVBs the increase on fresh deposits was lower 195 bps and that on loans was

154 bps.

? The increase in MCLR on 1 year loans was again higher for PSBs relative to PVBs

with the difference being 23 bps for this period.

? PVBs had a higher share of loans under EBLR at 78% compared with PSBs with

37%. Yet the transmission of rate increase was swifter for PSBs.

? In the same period the accretion to deposits have been Rs 31.7 lakh crore

(outstanding deposits as of Apr’22: Rs 166.2 lakh crore, outstanding deposits as of

15 Nov 2023: Rs 197.9 lakh crore). For credit, there has been accretion of Rs 38

lakh crore during the same period (outstanding credit as of Apr’22: Rs 119.6 lakh

crore, outstanding credit as of 15 Nov 2023: Rs 158.1 lakh crore). (All figures are

including the impact of merger)

? Looking at the movement of other interest rates, it is clear that the transmission has

been pretty fast on short term rates (TBill rates). This is also contingent on the

evolving liquidity conditions. The entire movement of repo was priced in to OIS to

some extent. 10Year sovereign yield on the other hand, remained broadly stable,

reflecting robust demand conditions on the back of resilience of Indian economy.

? Tighter liquidity conditions in the wake of restrictive policy has resulted in WALR

going above repo in the current cycle.

(Disclaimer The views expressed in this research note are personal views of the author(s) and do not

necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be

deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of

any entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the

accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby

disclaim any liability with regard to the same. Bank of Baroda Group or its officers, employees, personnel,

directors may be associated in a commercial or personal capacity or may have a commercial interest

including as proprietarytraders in or with the securities and/ or companies or issues or matters as contained

in this publication and such commercial capacity or interest whether or not differing with or conflicting with

this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever &

Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss,

damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information

that may be displayed in this publication from time to time.)